Analysis: How The Luxury Goods Recession Affects Paris

Table of Contents

The Decline in Luxury Tourism and its Ripple Effect on Paris

The luxury goods recession is profoundly impacting Paris's vibrant tourism sector. The decline is directly linked to reduced spending by high-net-worth individuals (HNWIs) and shifting tourist preferences.

Reduced Spending by High-Net-Worth Individuals (HNWIs)

- High-end hotels, renowned restaurants, and exclusive boutiques are experiencing a noticeable drop in revenue. The usual throngs of HNWIs, accustomed to lavish spending on designer goods and bespoke experiences, are spending more cautiously.

- Demand for private tours, chauffeured services, and luxury transportation has plummeted. These services, integral to the Parisian luxury experience, are suffering greatly.

- While precise statistical data requires further research, anecdotal evidence from industry insiders points towards a significant decrease in tourist spending, particularly among the high-spending demographic.

Shifting Tourist Preferences and Emerging Markets

- The rise of sustainable and experiential tourism is impacting the traditional luxury travel model. Tourists are increasingly seeking authentic experiences rather than simply accumulating luxury goods.

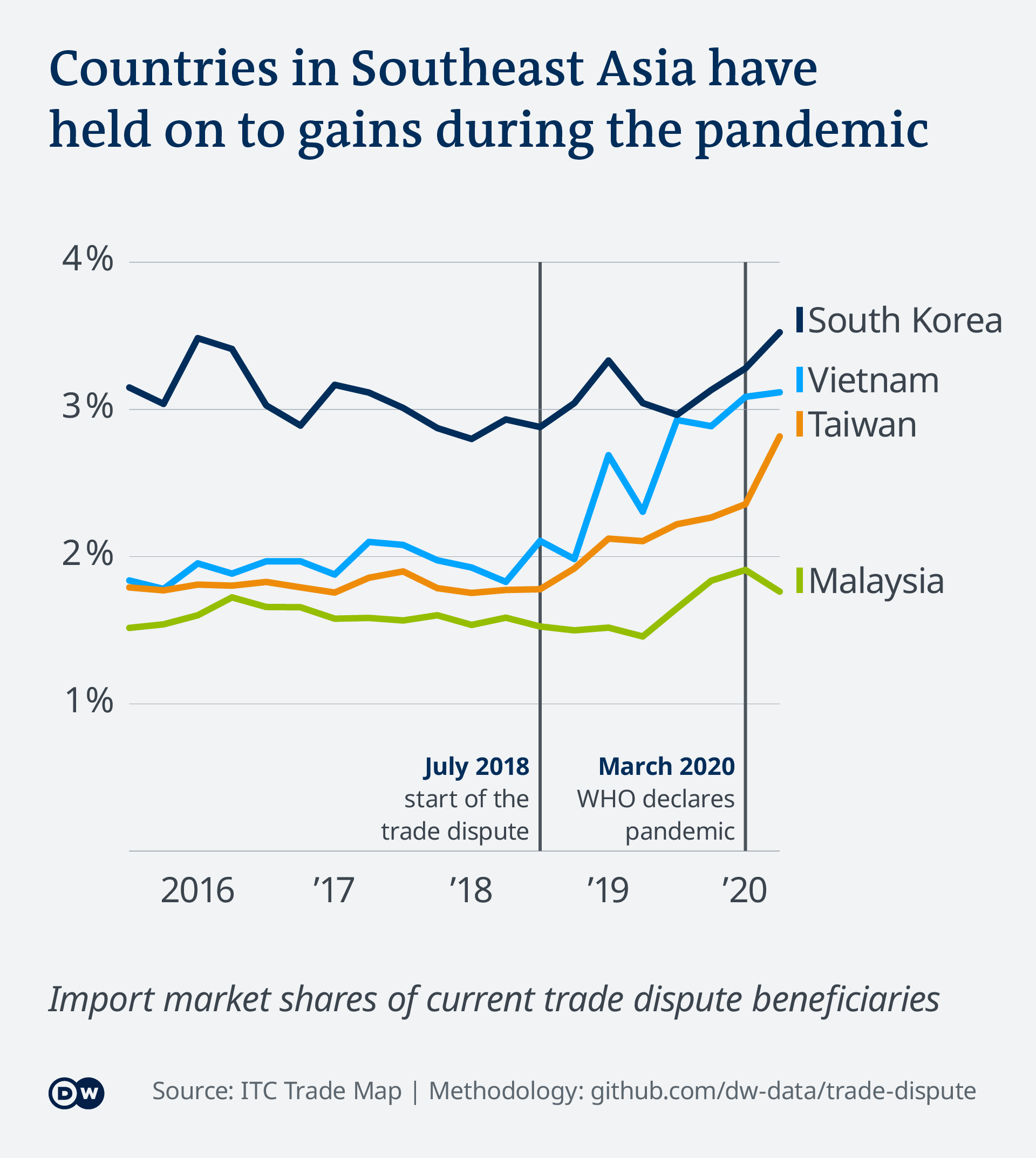

- Paris faces stiff competition from other luxury destinations globally, each vying for the attention of discerning travelers. Emerging markets are also changing the dynamics of luxury tourism, with preferences and spending habits evolving.

- Global events, such as geopolitical instability and economic uncertainty, have further contributed to the slowdown in luxury tourism.

The Impact on Small Businesses and Local Artisans

Small luxury boutiques and artisan workshops, heavily reliant on tourist spending, are particularly vulnerable.

- Many are struggling to maintain profitability, facing potential closures if the recession persists.

- Adaptation strategies, such as embracing online sales channels and diversifying product offerings, are crucial for survival.

- Examples of businesses affected include independent perfume makers, bespoke tailors, and small luxury goods retailers in the Marais district.

Job Losses and Economic Uncertainty in the Parisian Luxury Sector

The luxury goods recession is leading to job losses and economic uncertainty within the Parisian luxury sector.

Impact on Employment in Luxury Retail and Hospitality

- Job losses are evident across various luxury sectors, including retail, hospitality, and related services.

- Reduced working hours and potential wage reductions are also impacting employees in the luxury industry.

- Government support measures, such as unemployment benefits and retraining programs, are playing a crucial role in mitigating the impact on affected individuals.

The Knock-on Effect on Related Industries

- The decline in luxury tourism is impacting related service sectors, including transportation, security, and event management.

- Increased competition for jobs in other sectors is a concern for those losing their positions in the luxury industry.

- The long-term implications for economic growth in Paris are a significant concern for policymakers and industry leaders.

The Real Estate Market and Luxury Property Values in Paris

The luxury goods recession is also impacting the Parisian real estate market, specifically the high-end segment.

Decreased Demand for High-End Properties

- Demand for luxury properties has decreased, leading to adjustments in property prices and rental rates in prime areas.

- Luxury real estate developers and agents are facing challenges in securing sales and maintaining profitability.

- Market corrections and price adjustments are likely to continue in the near term.

The Impact on Related Businesses

- Businesses associated with luxury properties, such as high-end interior design firms and property management companies, are experiencing reduced demand.

- Related luxury service providers, like art consultants and bespoke furniture makers, are also feeling the pinch.

Investment Strategies in the Luxury Real Estate Market

Investors are re-evaluating their strategies, with a focus on longer-term investment horizons and a more cautious approach to luxury property acquisitions.

Paris's Response and Strategies for Mitigating the Impact

Paris is actively responding to the challenges posed by the luxury goods recession.

Government Initiatives and Support Programs

- The French government is implementing measures to support businesses in the luxury sector, including tax breaks and financial aid packages.

- Initiatives to attract new investment and boost tourism are underway, focusing on promoting Paris as a destination for high-value visitors.

- Long-term economic recovery plans are being developed, aiming to diversify the city's economy and reduce its reliance on the luxury sector alone.

Adaptation Strategies for Luxury Businesses

- Luxury businesses are focusing on innovation and diversification to appeal to a broader range of consumers.

- Investment in sustainable practices and responsible luxury is increasing, aligning with evolving consumer preferences.

- Emphasis on delivering exceptional customer experiences and personalized service is crucial for attracting and retaining high-value clients.

Conclusion: The Future of Luxury in Paris

The luxury goods recession is significantly impacting Paris's tourism, employment, and real estate sectors. The city faces considerable challenges, but also opportunities for adaptation and innovation. Key takeaways include the need for diversification, a focus on sustainable luxury, and proactive government support. Stay informed about the evolving landscape of the Parisian luxury market and how this luxury goods recession shapes the future of the City of Lights. Understanding these trends is critical for businesses, investors, and policymakers alike.

Featured Posts

-

Sustainable Growth Bangladesh And Europes Collaborative Partnership

May 24, 2025

Sustainable Growth Bangladesh And Europes Collaborative Partnership

May 24, 2025 -

Dutch Stock Market Suffers Further Losses In Us Trade Dispute

May 24, 2025

Dutch Stock Market Suffers Further Losses In Us Trade Dispute

May 24, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni And Otomotif Berkolaborasi

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni And Otomotif Berkolaborasi

May 24, 2025 -

Everything For Expats Housing Finance Fun And Kids At The Iam Expat Fair

May 24, 2025

Everything For Expats Housing Finance Fun And Kids At The Iam Expat Fair

May 24, 2025 -

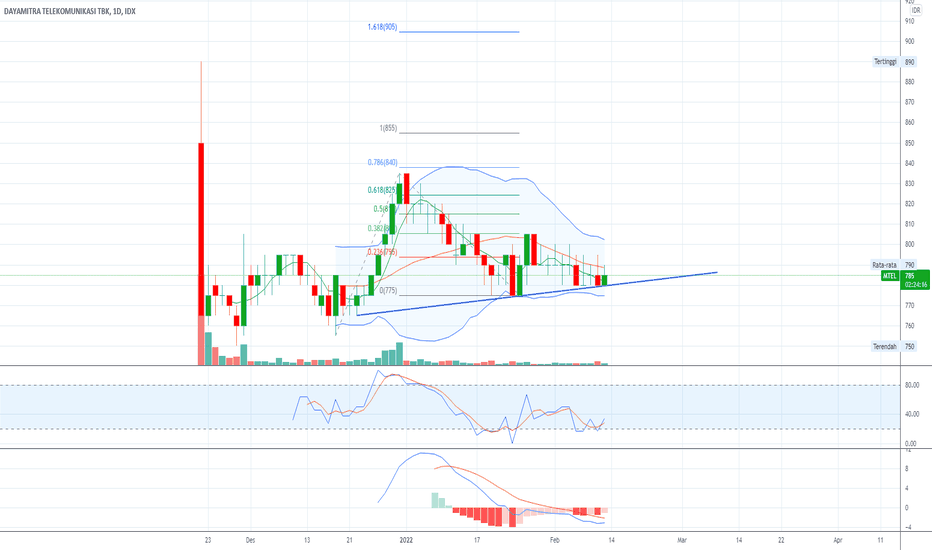

Analisis Investasi Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 24, 2025

Analisis Investasi Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 24, 2025

Latest Posts

-

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

Apple Price Target Lowered But Wedbush Stays Positive Long Term Investment Potential

May 24, 2025

Apple Price Target Lowered But Wedbush Stays Positive Long Term Investment Potential

May 24, 2025 -

Apple Stock Analysis I Phone Success Fuels Q2 Growth

May 24, 2025

Apple Stock Analysis I Phone Success Fuels Q2 Growth

May 24, 2025 -

Should You Buy Apple Stock Now Wedbushs Long Term Bullish Prediction After Price Target Cut

May 24, 2025

Should You Buy Apple Stock Now Wedbushs Long Term Bullish Prediction After Price Target Cut

May 24, 2025 -

Apple Stock Q2 Earnings And Price Predictions

May 24, 2025

Apple Stock Q2 Earnings And Price Predictions

May 24, 2025