Escape To The Country: Nicki Chapman's £700,000 Property Investment Strategy

Table of Contents

Understanding Nicki Chapman's Investment Philosophy

Nicki Chapman's property investment success likely stems from a long-term, strategic approach focused on capital appreciation and consistent rental income. Instead of quick flips, her strategy probably prioritizes properties with strong potential for growth over several years. This suggests a sophisticated understanding of the property market and a commitment to diligent research.

- Focus on strong rental yields: A key element of her strategy is likely maximizing rental income. This provides a steady cash flow to cover mortgage payments, maintenance, and other expenses, while also contributing to the overall return on investment.

- Targeting areas with high demand and potential for future growth: Smart property investors identify up-and-coming areas with projected population growth, improved infrastructure, or regeneration projects. These factors significantly influence property value appreciation.

- Prioritizing property condition and potential for renovation/improvement: Nicki likely assesses properties not just for their current condition, but also their potential for renovation or refurbishment to increase value and rental appeal.

- Long-term investment outlook rather than quick flips: Rather than focusing on short-term profits, Nicki likely favors long-term investment, allowing for substantial capital appreciation over time. This patient approach minimizes risk and maximizes returns in the long run. This is a hallmark of successful Nicki Chapman Property Investment strategies.

Key Location Strategies in Nicki Chapman's Portfolio

Nicki's "Escape to the Country" experience undoubtedly influences her location choices. While specific details of her portfolio remain private, we can infer some key location strategies:

- Exploring the appeal of rural properties for consistent rental income: Rural properties often command strong rental yields due to high demand from those seeking a peaceful lifestyle. This is consistent with the show's focus and likely reflects a part of Nicki's investment strategy.

- Analyzing the potential for growth in specific towns and villages: Strategic selection of towns and villages with growth potential – perhaps due to improved transport links, regeneration initiatives, or proximity to larger cities – is key. Smart Nicki Chapman Property Investment isn't just about the present, but about future value.

- The importance of access to transport links for tenant appeal: Good transport links are crucial for attracting tenants. Properties conveniently located near major roads, train stations, or bus routes will always be more desirable and easier to let.

- Considering the influence of local amenities and schools on property value: The presence of good schools, local shops, and recreational facilities significantly impacts property values and rental demand. This is a factor likely considered heavily in Nicki's investment decisions.

Managing Risk in Property Investment: Lessons from Nicki Chapman

Successful property investment involves effective risk mitigation. Nicki Chapman, with her experience, likely employs several strategies:

- Importance of professional surveys and legal advice: Thorough due diligence, including professional surveys and expert legal counsel, is paramount to avoid costly mistakes and potential legal issues. This is fundamental in any successful Nicki Chapman Property Investment strategy.

- Careful tenant selection and robust tenancy agreements: Selecting reliable tenants and having legally sound tenancy agreements significantly minimizes the risk of rental arrears or property damage.

- Diversification across different property types and locations: Spreading investments across various property types and geographical locations reduces the impact of market fluctuations in any single area.

- Building an emergency fund to cover unexpected repairs: Unexpected repairs are inevitable. Having a dedicated fund readily available for maintenance and emergencies prevents financial strain and ensures smooth property management.

The Power of Renovation and Refurbishment

Renovation and refurbishment are powerful tools for enhancing property value and rental income. Nicki likely utilizes this strategy:

- Adding value through strategic renovations and improvements: Smart renovations, focusing on high-impact areas like kitchens and bathrooms, can significantly increase property value and attract higher rental payments.

- Balancing renovation costs with potential return on investment: Carefully calculating renovation costs against the expected return on investment is essential to ensure profitability.

- Understanding local planning regulations: Adhering to local planning regulations is crucial to avoid complications and potential fines during renovation projects.

- Working with reputable contractors: Selecting skilled and trustworthy contractors is vital to ensure quality workmanship and timely project completion.

Conclusion

Nicki Chapman's reported property investment success demonstrates the importance of a long-term vision, meticulous research, and effective risk mitigation. Her strategy likely emphasizes strategic location selection, focusing on areas with growth potential and strong rental yields. Furthermore, smart renovation and refurbishment add significant value, maximizing returns. The power of consistent rental income combined with capital appreciation is a key takeaway from understanding her approach to Nicki Chapman Property Investment.

Inspired by Nicki Chapman's success? Start your own journey towards a profitable property portfolio. Learn more about smart property investment strategies and find your perfect investment today! Search "Nicki Chapman Property Investment" for more expert advice.

Featured Posts

-

Carmen Joy Crookes New Single

May 24, 2025

Carmen Joy Crookes New Single

May 24, 2025 -

Is She Still Waiting By The Phone A Personal Account

May 24, 2025

Is She Still Waiting By The Phone A Personal Account

May 24, 2025 -

Escape To The Country Finding Your Perfect Country Home

May 24, 2025

Escape To The Country Finding Your Perfect Country Home

May 24, 2025 -

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 24, 2025

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 24, 2025 -

Access Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup And Info

May 24, 2025

Access Bbc Radio 1 Big Weekend 2025 Tickets Confirmed Lineup And Info

May 24, 2025

Latest Posts

-

18 Brazilian Nationals Charged 100 Firearms Seized In Mass Gun Trafficking Crackdown

May 24, 2025

18 Brazilian Nationals Charged 100 Firearms Seized In Mass Gun Trafficking Crackdown

May 24, 2025 -

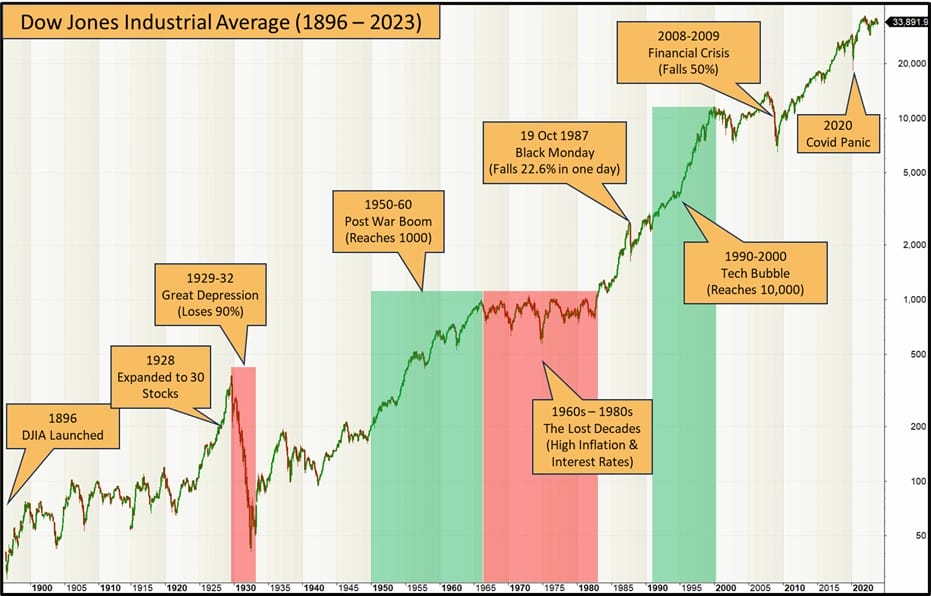

Dow Joness Continued Ascent Analysis Of The Recent Pmi Data

May 24, 2025

Dow Joness Continued Ascent Analysis Of The Recent Pmi Data

May 24, 2025 -

Is News Corps Stock Price Misrepresenting Its True Worth

May 24, 2025

Is News Corps Stock Price Misrepresenting Its True Worth

May 24, 2025 -

Dow Jones Rallies On Positive Pmi Report A Cautious Ascent

May 24, 2025

Dow Jones Rallies On Positive Pmi Report A Cautious Ascent

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025