Dow Jones Rallies On Positive PMI Report: A Cautious Ascent

Table of Contents

Understanding the PMI Report and its Influence on the Dow Jones

The Purchasing Managers' Index (PMI) is a leading economic indicator that measures the activity level of purchasing managers in the manufacturing and services sectors. It provides valuable insight into the health of the economy and is closely followed by investors and economists alike. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction.

The latest PMI report revealed several positive aspects that contributed significantly to the Dow Jones rally:

- Stronger-than-expected manufacturing PMI: The manufacturing PMI surged to 55.2, exceeding analysts' expectations and signaling robust growth in the industrial sector. This positive data point boosted investor confidence in the overall economic outlook.

- Growth in services sector PMI: The services sector PMI also showed healthy growth, indicating strong demand and sustained economic activity. A rising services PMI often translates to increased consumer spending and business investment.

- Positive implications for future economic growth: The combined strength of the manufacturing and services PMIs suggests a positive trajectory for future economic growth, leading to increased investment in the stock market, driving the Dow Jones rally.

However, it's crucial to remember that the PMI is not a perfect predictor of future economic performance. It's just one piece of the puzzle, and relying solely on the PMI for market analysis can be misleading. Other factors, such as inflation, geopolitical events, and consumer sentiment, must also be considered.

Sector-Specific Performance within the Dow Jones Rally

The Dow Jones rally wasn't uniform across all sectors. Some sectors experienced more significant gains than others:

- Technology sector performance: The tech sector saw substantial gains, driven by positive investor sentiment towards growth stocks. This is often a leading indicator of broader market confidence.

- Financials sector performance: The financials sector also performed well, benefiting from rising interest rates and increased lending activity. This sector's performance reflects confidence in the overall economic outlook.

- Consumer discretionary sector performance: The consumer discretionary sector showed moderate gains, reflecting increased consumer spending and confidence. This suggests that consumers are optimistic about the future and are willing to spend more.

Conversely, some sectors underperformed despite the overall market rally. This disparity highlights the complexity of market dynamics and underscores the need for diversified investment strategies. Understanding the nuances of sector-specific performance is vital for informed investment decisions.

Cautious Optimism: Factors Tempering the Dow Jones Rally

While the positive PMI report is encouraging, several factors could temper the ongoing Dow Jones rally:

- Inflationary pressures: Persistent inflation remains a significant concern, as it can erode consumer purchasing power and increase borrowing costs for businesses. High inflation can lead to interest rate hikes, negatively impacting the stock market.

- Geopolitical uncertainties: Ongoing geopolitical tensions and conflicts can introduce uncertainty into the market, potentially leading to increased market volatility. Geopolitical risk is a significant factor to consider when assessing the market.

- Interest rate hikes: Central banks may continue to raise interest rates to combat inflation, potentially slowing economic growth and dampening investor enthusiasm. Rising interest rates can significantly impact stock valuations.

These factors highlight the need for a cautious approach, even with the positive PMI data. Simply relying on one economic indicator to make investment decisions is risky. A comprehensive analysis of multiple economic and geopolitical factors is crucial for effective market navigation.

Dow Jones Future Predictions and Investor Strategies

Predicting the future performance of the Dow Jones is challenging, even with positive indicators like the PMI report. While the positive PMI signals potential for continued growth, the headwinds mentioned above could significantly impact the market's trajectory.

Investors should consider the following strategies based on the current market conditions:

- Diversification strategies: Diversifying investments across different asset classes and sectors reduces overall risk. Diversification is crucial in volatile market environments.

- Risk management techniques: Implementing robust risk management strategies, such as stop-loss orders, is essential to protect investments from potential losses. Risk management is critical for long-term success in the market.

- Long-term versus short-term investment horizons: Investors with long-term investment horizons can often weather short-term market fluctuations more effectively than those with shorter horizons. Choosing an investment horizon that suits your risk tolerance is vital.

It is imperative to consult with a qualified financial advisor before making any investment decisions. They can provide personalized advice based on your individual financial situation and risk tolerance.

Conclusion: Dow Jones Rallies on Positive PMI Report: A Cautious Ascent – What's Next?

The Dow Jones rally, fueled by a positive PMI report, presents a picture of cautious optimism. While the robust PMI suggests positive economic momentum, factors like inflation, geopolitical risks, and potential interest rate hikes must be carefully considered. The sector-specific performance within the Dow Jones further emphasizes the need for diversified investment strategies and robust risk management. Understanding the nuances of economic indicators such as the PMI, alongside a comprehensive market analysis, is vital for navigating the complexities of the stock market.

Stay tuned for further updates on the Dow Jones and the impact of future PMI reports. Understanding these economic indicators is crucial for navigating the complexities of the stock market and making informed investment decisions. Regularly monitoring the Dow Jones and related economic data will help you understand future market movements.

Featured Posts

-

Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street En Toekomstverwachtingen

May 24, 2025

Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street En Toekomstverwachtingen

May 24, 2025 -

Bbc Radio 1s Big Weekend 2025 Your Guide To Getting Sefton Park Tickets

May 24, 2025

Bbc Radio 1s Big Weekend 2025 Your Guide To Getting Sefton Park Tickets

May 24, 2025 -

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025

A Relaxing Escape To The Country Choosing The Right Location

May 24, 2025 -

40 Svadeb Na Kharkovschine Kakaya Data Stala Rekordnoy Foto

May 24, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Rekordnoy Foto

May 24, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Performers And How To Buy Tickets

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Performers And How To Buy Tickets

May 24, 2025

Latest Posts

-

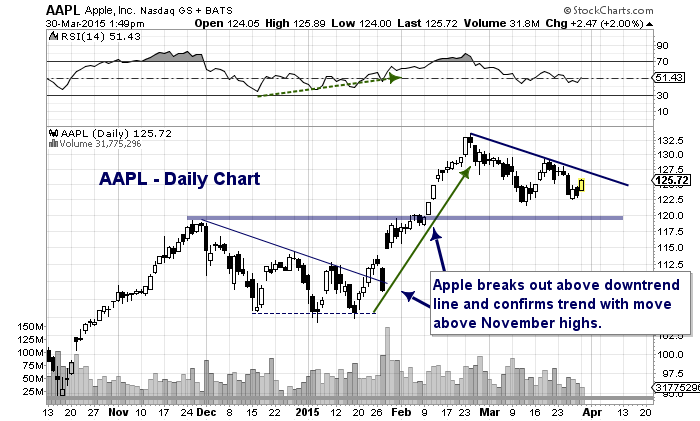

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025 -

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 24, 2025

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025 -

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025 -

Growth And Innovation Bangladesh And Europes Collaborative Future

May 24, 2025

Growth And Innovation Bangladesh And Europes Collaborative Future

May 24, 2025