Dutch Stock Market Suffers Further Losses In US Trade Dispute

Table of Contents

Impact on Key Sectors of the Dutch Economy

The US Trade Dispute is not impacting all sectors equally. Certain key areas of the Dutch economy are feeling the pressure more acutely than others.

Decline in Technology Stocks

The Dutch tech sector, a significant contributor to the nation's GDP, is facing a considerable downturn. The trade war impact is particularly evident in the semiconductor industry and other export-oriented businesses. Companies heavily reliant on US markets are experiencing sharp declines in their stock prices.

- ASML Holding: Experienced a 5% drop in its share price last week.

- Philips: Saw a 3% decrease, reflecting concerns about reduced US demand for their medical equipment.

- Besi: A leading supplier of semiconductor equipment, reported a 7% decline.

Future projections for these Dutch tech stocks remain uncertain, with analysts predicting further volatility depending on the outcome of trade negotiations. The ongoing uncertainty surrounding the semiconductor industry adds to the market's instability.

Agricultural Sector Under Pressure

The Dutch agricultural sector, renowned for its dairy exports and horticulture, is also under significant pressure. Potential tariffs and market access restrictions imposed by the US threaten to severely impact this vital part of the Dutch economy.

- Dairy exports: Facing potential tariffs of up to 25%.

- Horticulture: Concerns about increased import costs for US consumers impacting demand for Dutch flowers and plants.

- Livestock: Uncertainty about future market access.

While the government has announced some support measures for affected farmers, including export subsidies, the long-term impact of the tariff implications on Dutch agriculture remains a major concern.

Uncertainty in Financial Services

The Dutch banking sector, along with other financial institutions, is experiencing increased investment uncertainty. Decreased investment from US and international sources is leading to a cautious approach to lending and a general slowing of economic activity.

- Decreased investment: Foreign direct investment into the Netherlands is slowing, impacting the financial markets.

- Market volatility: The economic slowdown is increasing market uncertainty.

- Cautious lending: Banks are becoming more selective in their lending practices, impacting business expansion and growth.

Major Dutch banks have reported decreased profits and are closely monitoring the evolving situation. Analysts warn of potential ripple effects across the financial sector if the US Trade Dispute remains unresolved.

Government Response and Mitigation Strategies

The Dutch government is actively working to mitigate the negative effects of the US Trade Dispute on its economy.

Government Initiatives to Support Businesses

The Dutch government has announced several initiatives to support businesses impacted by the trade war.

- Tax breaks: For companies investing in new technologies and expanding into new markets.

- Financial aid: To help struggling businesses maintain employment and avoid layoffs.

- Export promotion: Increased funding for export promotion agencies to help Dutch businesses find new markets.

The effectiveness of these economic stimulus measures remains to be seen, as the full impact of the trade dispute is yet to unfold. The long-term impact of fiscal policy and government support will be crucial in determining the recovery of affected businesses.

Negotiations with the US

The Dutch government is engaging in active trade negotiations with the US, working both bilaterally and through the EU to find a resolution to the trade dispute.

- Bilateral talks: Focus on addressing specific concerns raised by the US.

- EU-level negotiations: Coordinating a unified approach within the EU to counteract US trade policies.

- Dispute resolution mechanisms: Exploring alternative ways to resolve the disagreements and avoid further escalation of the trade war.

The success of these negotiations will be crucial in determining the future trajectory of the Dutch Stock Market and the overall health of the Dutch economy.

Expert Opinions and Future Outlook

The opinions of financial analysts on the future trajectory of the Dutch Stock Market are varied but generally cautious.

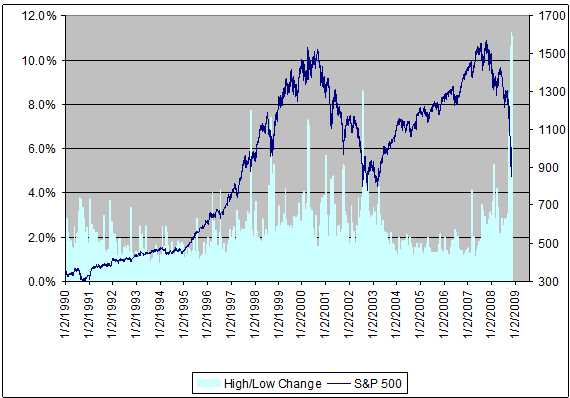

Analyst Predictions for the Dutch Stock Market

- Short-term pessimism: Many analysts predict continued volatility in the short term, with the possibility of further losses.

- Long-term optimism (conditional): However, some analysts express long-term optimism, provided the US Trade Dispute is resolved swiftly.

- Investor sentiment: Overall, investor sentiment remains fragile, and many are adopting a wait-and-see approach.

The overall market forecast suggests a period of uncertainty, with the long-term outlook significantly dependent on the outcome of trade negotiations.

Long-Term Implications of the Trade Dispute

The long-term economic impact of this US Trade Dispute on the Netherlands could be substantial.

- Structural changes: Businesses may be forced to restructure, diversify their supply chains, and explore new markets.

- Global trade relations: The impact of this dispute could have significant implications for future global trade relations.

- Diversification strategies: Investors are urged to consider diversification strategies to mitigate the impact of future trade disputes.

The long-term consequences of the trade war remain uncertain, highlighting the importance of adapting to new economic realities.

Conclusion: Navigating the Challenges in the Dutch Stock Market During US Trade Disputes

The US Trade Dispute is having a significant and multifaceted impact on the Dutch Stock Market, affecting key sectors like technology, agriculture, and financial services. The Dutch government is responding with various support initiatives and engaging in negotiations to resolve the dispute. However, uncertainty persists, and the future outlook remains somewhat clouded. It’s crucial to carefully monitor developments, stay informed through reliable financial news sources, and seek professional advice to navigate the challenges presented by the ongoing US Trade Dispute. Staying updated on the Dutch Stock Market and its response to the evolving situation is paramount for investors and businesses alike. Subscribe to our newsletter for the latest updates on the Dutch Stock Market and the impact of the US Trade Dispute.

Featured Posts

-

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025

Escape To The Country Finding Your Perfect Countryside Home

May 24, 2025 -

Analyzing Jordan Bardellas Chances In The French Election

May 24, 2025

Analyzing Jordan Bardellas Chances In The French Election

May 24, 2025 -

Alterya Joins Chainalysis A Strategic Move In Blockchain And Ai

May 24, 2025

Alterya Joins Chainalysis A Strategic Move In Blockchain And Ai

May 24, 2025 -

Apple Stock Under Pressure Ahead Of Fiscal Q2 Results

May 24, 2025

Apple Stock Under Pressure Ahead Of Fiscal Q2 Results

May 24, 2025 -

Mia Farrow Michael Caine And A Surprising Set Visit During A Sex Scene Filming

May 24, 2025

Mia Farrow Michael Caine And A Surprising Set Visit During A Sex Scene Filming

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025