Extreme Price Increase: Broadcom's VMware Deal Faces AT&T Backlash

Table of Contents

The Broadcom-VMware Merger: A Deep Dive

Broadcom's acquisition of VMware represents a monumental shift in the enterprise software landscape. The sheer size of the acquisition cost, $61 billion, underlines the strategic importance Broadcom places on integrating VMware's virtualization and cloud technologies into its existing portfolio. This move signifies Broadcom's ambition to become a dominant player in the enterprise infrastructure market, potentially leading to significant market consolidation.

- Acquisition cost and financial implications: The $61 billion price tag is a testament to VMware's value, but it also raises questions about the financial burden on Broadcom and its potential impact on future investments.

- Broadcom's plans for VMware's integration and future product roadmap: Broadcom aims to leverage VMware's leading virtualization technologies to expand its offerings and potentially increase prices for existing and new products. The long-term implications of this integration for product innovation and development remain to be seen.

- Potential synergies and market consolidation: The merger has the potential to create significant synergies by combining Broadcom's semiconductor expertise with VMware's software capabilities. However, concerns remain regarding the potential for reduced competition and stifled innovation due to market consolidation.

AT&T's Concerns and the Backlash

AT&T's opposition to the Broadcom-VMware merger centers on the anticipated extreme price increase for essential services and infrastructure. They fear that the deal will give Broadcom undue leverage, leading to significantly higher costs for their network operations and impacting their competitiveness.

- Increased costs for AT&T's network infrastructure: AT&T relies heavily on VMware's virtualization technologies. A price hike following the acquisition could significantly strain their operational budgets.

- Potential impact on AT&T's competitiveness: Increased costs could force AT&T to raise prices for consumers or reduce services, potentially losing market share to competitors.

- AT&T's lobbying efforts and regulatory challenges: AT&T is actively lobbying regulators to scrutinize the deal closely, citing potential antitrust concerns and the negative impact on competition.

The Impact of the Extreme Price Increase on the Broader Market

The potential for an extreme price increase resulting from Broadcom's VMware deal extends far beyond AT&T. The merger could lead to higher prices for cloud services, software licenses, and other related technologies, affecting businesses and consumers alike.

- Potential for higher prices for cloud services and software licenses: Businesses that rely on VMware's virtualization solutions may face significantly increased costs, potentially impacting their profitability and competitiveness.

- Impact on competition within the technology sector: Market consolidation could stifle innovation and lead to reduced competition, potentially benefiting Broadcom at the expense of consumers and smaller technology companies.

- Long-term implications for innovation and technological development: The extreme price increase could hamper technological progress by increasing the cost of innovation and limiting access to essential tools and platforms.

Regulatory Scrutiny and Future Outlook

Broadcom's VMware deal is facing intense regulatory scrutiny, with antitrust concerns at the forefront. Several government bodies are conducting reviews to determine whether the merger violates antitrust laws and harms competition.

- Current status of regulatory reviews: Regulatory bodies in various jurisdictions are actively assessing the deal's potential impact.

- Potential outcomes of regulatory investigations: The outcome could range from unconditional approval to a requirement for divestitures or other conditions to mitigate anti-competitive concerns.

- Predictions for the future of the Broadcom-VMware deal: The ultimate fate of the deal hinges on the results of these regulatory investigations. The possibility of the deal being blocked or significantly altered remains real.

Conclusion: Navigating the Aftermath of Broadcom's VMware Deal's Extreme Price Increase

Broadcom's acquisition of VMware carries significant implications for the tech industry, primarily concerning the potential for an extreme price increase and the subsequent backlash, particularly from AT&T. The merger's impact on the broader market, including higher costs for businesses and consumers, and the ongoing regulatory scrutiny, highlights the far-reaching consequences of this deal. Stay tuned for updates on Broadcom's VMware deal and its extreme price increase implications. Learn more about the impact of this extreme price increase from Broadcom's VMware deal on your business.

Featured Posts

-

Warriors Vs Opponent Jimmy Butler Game Status Update

May 15, 2025

Warriors Vs Opponent Jimmy Butler Game Status Update

May 15, 2025 -

Trump Vs Canadian Imports Fact Checking The Us Dependence Debate

May 15, 2025

Trump Vs Canadian Imports Fact Checking The Us Dependence Debate

May 15, 2025 -

Presiden Prabowo Dan Dpr Sepakat Pembangunan Giant Sea Wall

May 15, 2025

Presiden Prabowo Dan Dpr Sepakat Pembangunan Giant Sea Wall

May 15, 2025 -

The Nhl Draft Lottery Why Fans Are Upset

May 15, 2025

The Nhl Draft Lottery Why Fans Are Upset

May 15, 2025 -

What If A Speculative Conversation Between Two Max Muncys

May 15, 2025

What If A Speculative Conversation Between Two Max Muncys

May 15, 2025

Latest Posts

-

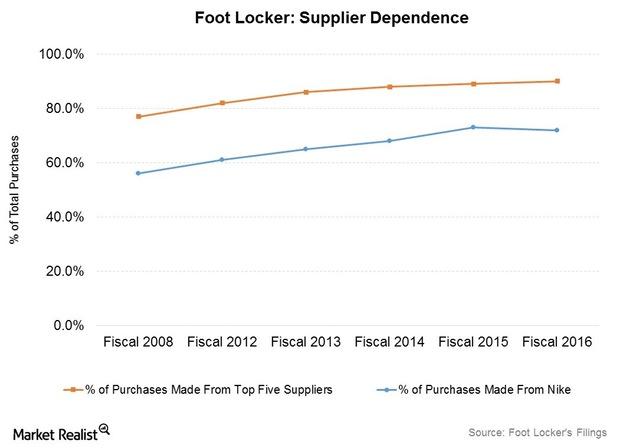

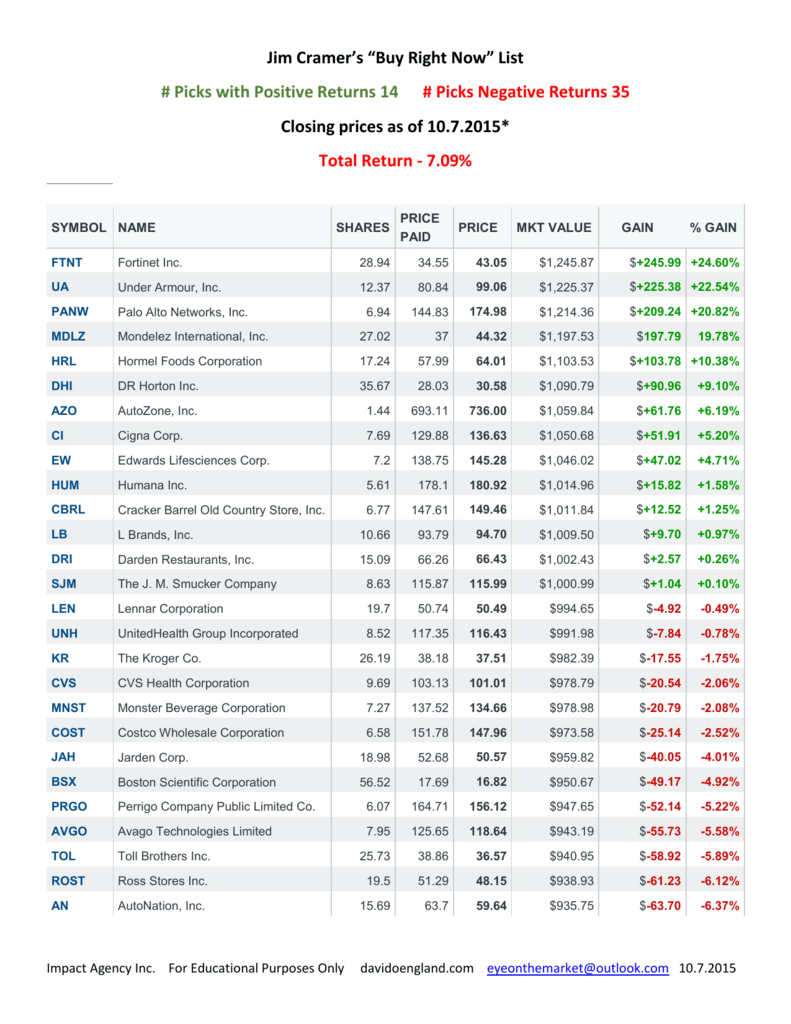

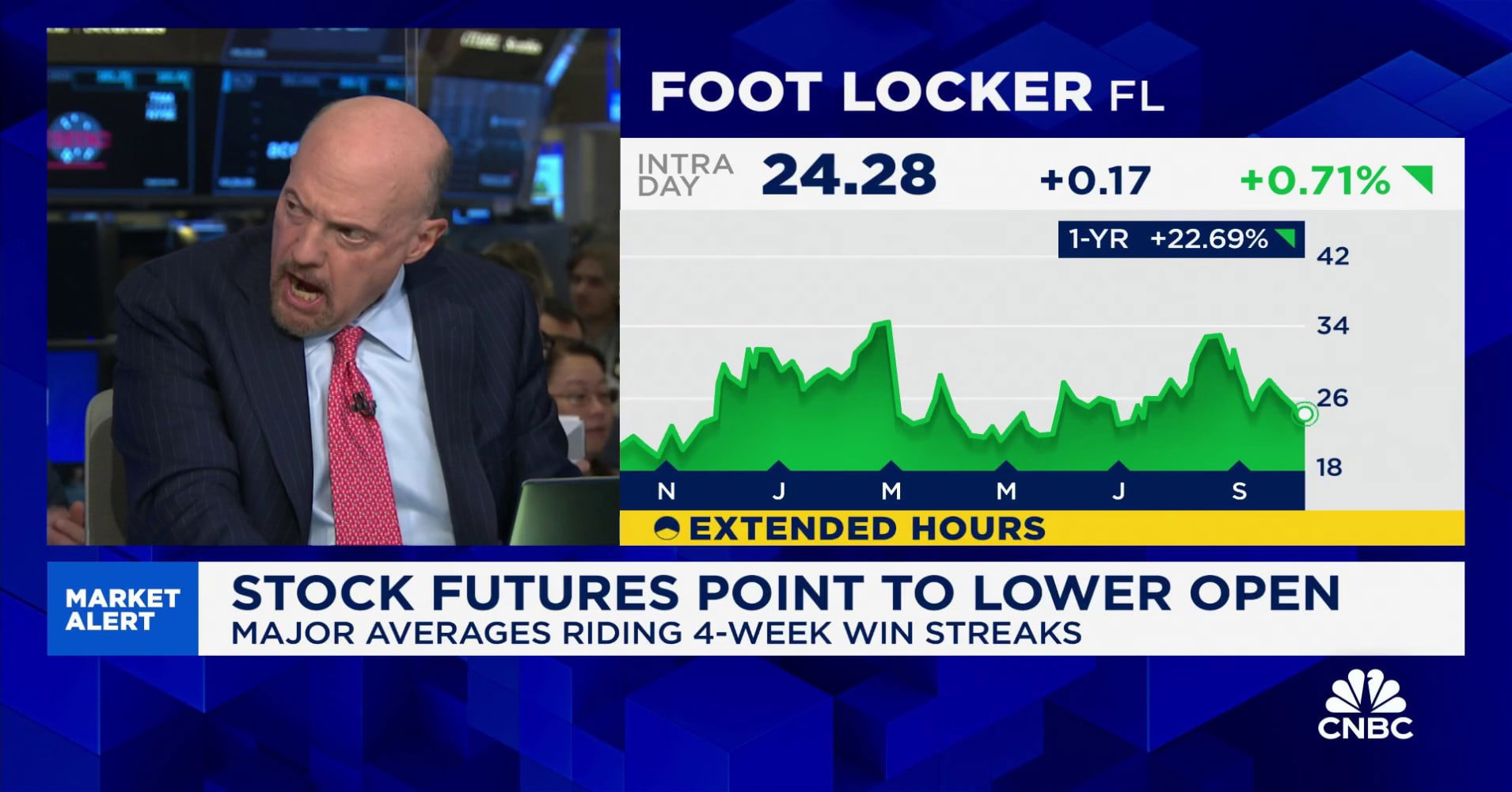

Analyzing Foot Locker Fl Does Jim Cramers Genuine Winner Claim Hold Up

May 15, 2025

Analyzing Foot Locker Fl Does Jim Cramers Genuine Winner Claim Hold Up

May 15, 2025 -

Foot Locker Fl Jim Cramers Analysis And Investment Recommendation

May 15, 2025

Foot Locker Fl Jim Cramers Analysis And Investment Recommendation

May 15, 2025 -

Jim Cramer On Foot Locker Fl Is It A Solid Investment

May 15, 2025

Jim Cramer On Foot Locker Fl Is It A Solid Investment

May 15, 2025 -

Is Foot Locker Fl A Genuine Winner According To Jim Cramer

May 15, 2025

Is Foot Locker Fl A Genuine Winner According To Jim Cramer

May 15, 2025 -

Unlocking Revenue A Practical Guide To Becoming An Amazon Locker Host

May 15, 2025

Unlocking Revenue A Practical Guide To Becoming An Amazon Locker Host

May 15, 2025