Freepoint Eco-Systems And ING Partner On Project Finance

Table of Contents

Freepoint Eco-Systems' Expertise in Sustainable Projects

Freepoint Eco-Systems is a pioneer in developing and managing sustainable and environmentally friendly projects. Their core focus lies in creating impactful initiatives that minimize environmental footprints and foster positive social change. With a proven track record in various sectors, Freepoint Eco-Systems brings invaluable experience in navigating the complexities of sustainable project development. Their expertise spans crucial areas such as renewable energy finance, sustainable infrastructure finance, and impactful ESG investing.

- Past Successes: Freepoint Eco-Systems has successfully completed numerous projects, demonstrating their proficiency in delivering tangible results. For example, their involvement in a large-scale solar farm project resulted in a 30% reduction in carbon emissions in the region, showcasing their commitment to renewable energy finance. Another project in sustainable agriculture led to a 15% increase in crop yield while minimizing water usage.

- Certifications and Recognitions: Freepoint Eco-Systems has earned several prestigious certifications, including ISO 14001 for environmental management systems, underscoring their commitment to environmental, social, and governance (ESG) principles and their dedication to impact investing.

- ESG Commitment: At the heart of Freepoint Eco-Systems' operations lies a deep commitment to ESG principles. This commitment is reflected in their meticulous project selection process, transparent reporting, and unwavering dedication to ethical practices.

ING's Role in Providing Project Finance Solutions

ING, a global leader in banking and financial services, brings decades of experience in providing comprehensive project finance solutions worldwide. Their extensive network and deep understanding of the financial landscape are crucial in supporting complex sustainable projects. ING is actively committed to sustainable finance, actively participating in various green initiatives and promoting environmental finance.

ING offers a diverse range of financing options tailored to the specific needs of sustainable projects. These include debt financing, equity financing, and other structured finance solutions, including green bonds and sustainable debt instruments. Their expertise extends to complex financial structuring, risk assessment, and management for sustainable initiatives.

- Successful Sustainable Project Finance Deals: ING has a strong portfolio of successful project finance deals in renewable energy, sustainable transportation, and green building, demonstrating their commitment to environmental finance.

- Sustainability Targets and Commitments: ING has ambitious sustainability targets, aligning its financing activities with global climate goals and the sustainable development goals (SDGs).

- Risk Assessment Expertise: ING’s deep understanding of risk assessment and management for sustainable projects provides crucial support to project developers, ensuring the long-term viability of projects.

Synergies and Benefits of the Partnership

The partnership between Freepoint Eco-Systems and ING creates a powerful synergy. Freepoint Eco-Systems' expertise in developing and managing sustainable projects, combined with ING's extensive project finance capabilities and commitment to sustainable finance, creates an unmatched force in the market. The benefits are significant for both organizations and for the environment.

- Increased Access to Capital: This collaboration will significantly increase access to capital for sustainable projects, unlocking funding for initiatives that might otherwise struggle to attract investment.

- Improved Risk Management: ING’s expertise in risk assessment and management will enhance the overall risk profile of sustainable projects, attracting more investors and ensuring project success.

- Greater Impact and Scalability: The partnership will enable the development and scaling of sustainable projects, accelerating the transition to a greener economy and creating more positive societal impact.

Impact on Sustainable Development and the Environment

This collaboration will have a profound impact on sustainable development and the environment. By facilitating the funding of environmentally friendly projects, the partnership directly contributes to a greener future.

- Quantifiable Environmental Benefits: The projects supported by this partnership are expected to result in significant carbon footprint reduction – potentially millions of tons of CO2 reduced annually – and improved resource management.

- Positive Societal Impacts: The initiative will create jobs in green sectors, fostering economic growth while promoting sustainable development goals.

- Long-Term Sustainability: The projects will be designed for long-term sustainability, ensuring lasting environmental and social benefits.

The Future of Freepoint Eco-Systems and ING in Project Finance

The partnership between Freepoint Eco-Systems and ING marks a pivotal moment in the evolution of project finance. By combining their respective strengths, they are poised to become a leading force in driving sustainable project finance and accelerating the global transition to a green economy. This initiative showcases a powerful model for collaboration, demonstrating how the private sector can effectively contribute to achieving climate goals and fostering sustainable development. Learn more about Freepoint Eco-Systems' innovative projects [link to Freepoint Eco-Systems website] and ING's commitment to sustainable finance [link to ING sustainable finance website]. Explore the exciting opportunities in project finance within the sustainable sector and contribute to a greener future!

Featured Posts

-

Vybz Kartel Faces Movement Restrictions In Trinidad And Tobago

May 21, 2025

Vybz Kartel Faces Movement Restrictions In Trinidad And Tobago

May 21, 2025 -

Is The Trans Australia Run World Record About To Fall

May 21, 2025

Is The Trans Australia Run World Record About To Fall

May 21, 2025 -

A Provencal Walking Adventure From Mountains To The Sea

May 21, 2025

A Provencal Walking Adventure From Mountains To The Sea

May 21, 2025 -

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 21, 2025

Thlatht Njwm Jdd Yndmwn Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 21, 2025 -

Klopp Un Yeni Takimi Geri Doenues Ve Gelecek Planlari

May 21, 2025

Klopp Un Yeni Takimi Geri Doenues Ve Gelecek Planlari

May 21, 2025

Latest Posts

-

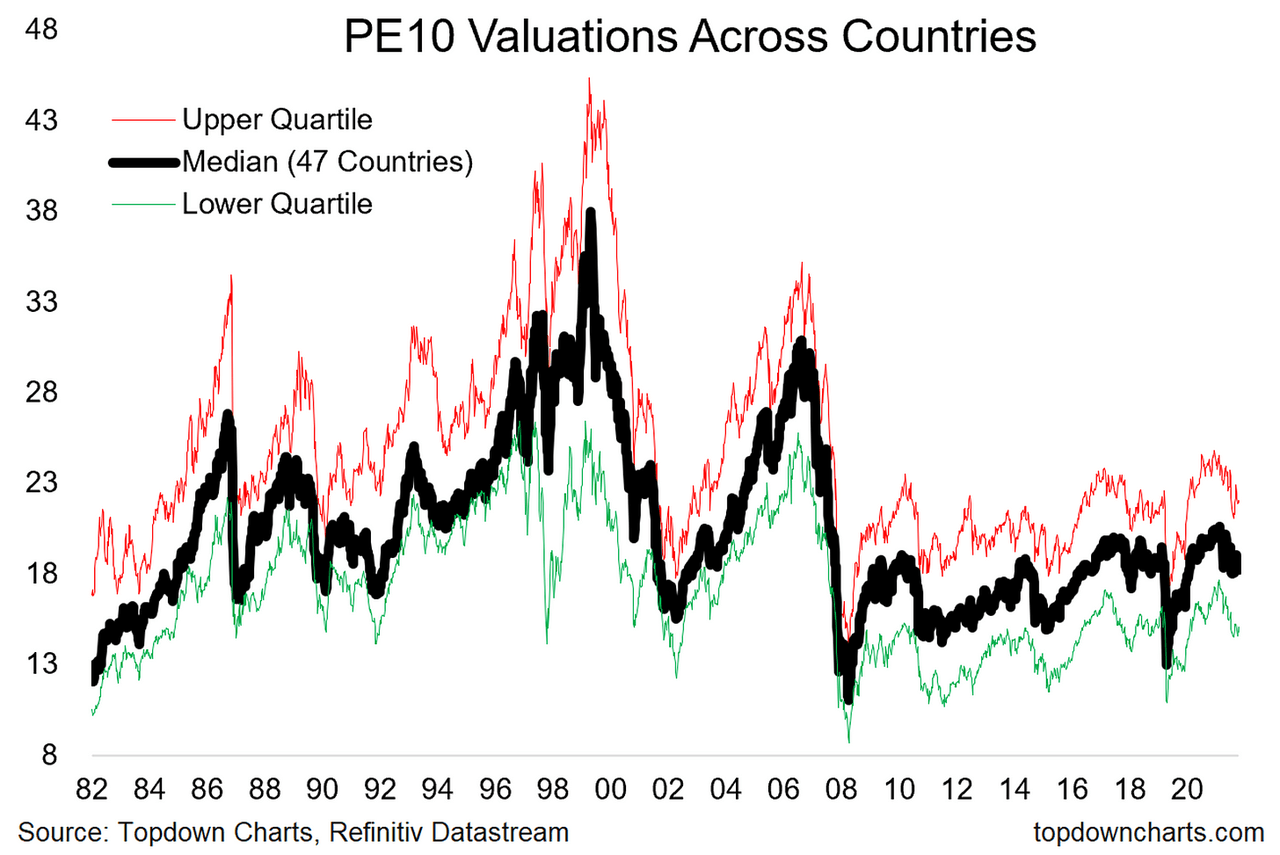

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 21, 2025

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 21, 2025 -

Uk Luxury Brands Navigating Brexits Challenges In The Eu Market

May 21, 2025

Uk Luxury Brands Navigating Brexits Challenges In The Eu Market

May 21, 2025 -

Investor Concerns About High Stock Market Valuations Bof As Response

May 21, 2025

Investor Concerns About High Stock Market Valuations Bof As Response

May 21, 2025 -

Analysis Brexit And The Decline Of Uk Luxury Exports To The Eu

May 21, 2025

Analysis Brexit And The Decline Of Uk Luxury Exports To The Eu

May 21, 2025 -

Why Current Stock Market Valuations Are Not A Threat Bof As View

May 21, 2025

Why Current Stock Market Valuations Are Not A Threat Bof As View

May 21, 2025