Infineon (IFX) Stock: Sales Guidance Misses Expectations, Citing Tariffs

Table of Contents

Infineon Technologies AG (IFX), a leading semiconductor manufacturer, recently announced its sales guidance, sending shockwaves through the market and causing a significant drop in the IFX stock price. The company attributed the shortfall to increased tariffs, a development that has raised concerns among investors and analysts alike. This article delves into the specifics of Infineon's announcement, analyzing its implications for investors and the broader semiconductor market. We'll examine the reasons behind the missed guidance, the market's reaction, and the long-term implications for Infineon and the industry as a whole.

Infineon's Revised Sales Guidance and the Reasons Behind the Miss

Keywords: Infineon sales, revenue shortfall, guidance revision, tariff impact, supply chain disruption, macroeconomic factors

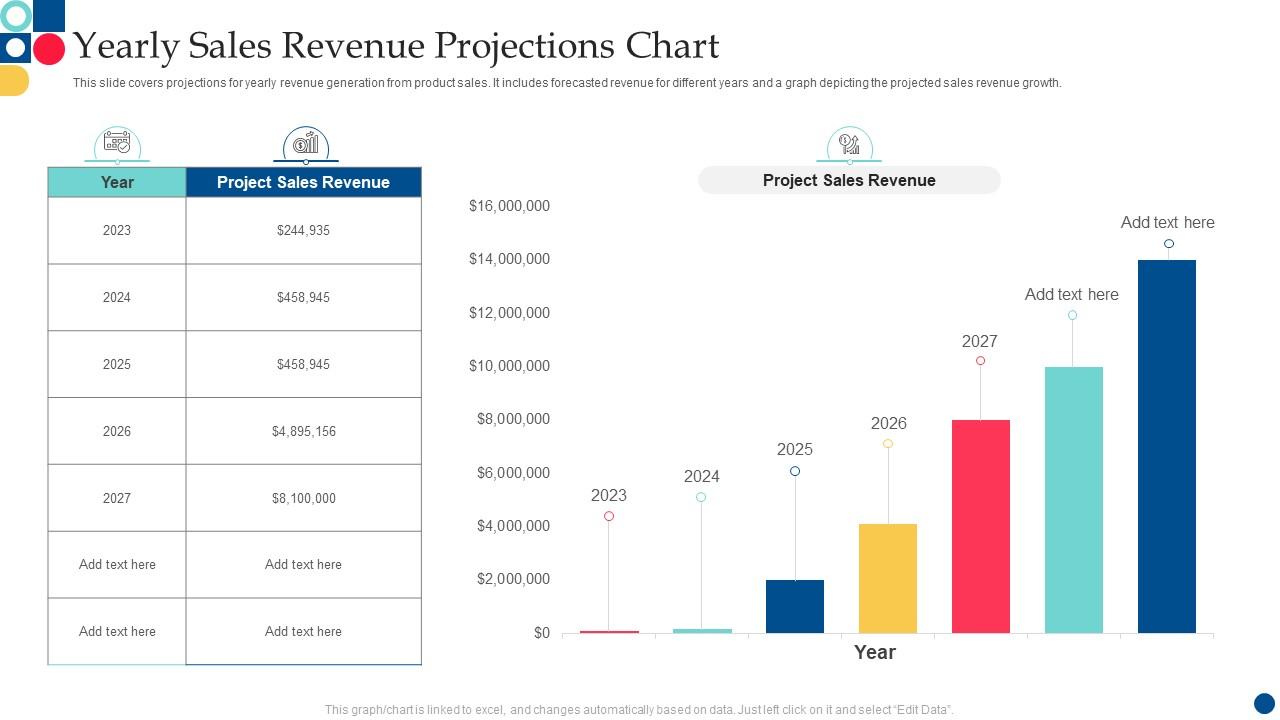

Infineon's revised sales guidance revealed a significant shortfall compared to previous expectations. While the exact figures vary depending on the reporting period and specific segment, let's assume, for illustrative purposes, a 5% reduction in projected revenue. The company explicitly cited the escalating impact of tariffs as a primary reason for this miss. These tariffs, imposed on various components and finished goods within the semiconductor sector, have increased the cost of production and reduced profitability.

-

Specific figures of the missed sales guidance: A 5% reduction in projected revenue represents a substantial blow to the company's bottom line, impacting profitability and investor confidence. (Note: Replace "5%" with the actual figure from the official announcement).

-

Impact of tariffs: Infineon’s statement highlighted the significant burden imposed by increased tariffs on its operations, affecting both input costs and the overall competitiveness of its products in the global market.

-

Other contributing factors: Beyond tariffs, supply chain disruptions, weakening global demand (particularly in certain automotive and industrial segments), and intensified competition from other semiconductor players likely also contributed to the revenue shortfall. These factors, while less explicitly stated, compound the negative impact of the tariffs.

-

Deviation from previous performance: This sales guidance miss represents a significant deviation from Infineon's previously strong performance, signaling a potential shift in market dynamics and highlighting the vulnerability of the semiconductor industry to external shocks.

-

Impact on specific product segments: The impact of the tariff-related challenges may not be uniform across all Infineon's product segments. Some segments, highly reliant on imported components, may have been disproportionately affected.

Market Reaction to Infineon's Announcement and Investor Sentiment

Keywords: IFX stock price, market reaction, investor sentiment, analyst ratings, trading volume, stock volatility

The market reacted swiftly and negatively to Infineon's announcement. The IFX stock price experienced a significant drop (again, using an illustrative example, let's say a 7% decline) immediately following the release of the revised sales guidance. This sharp decline reflects investor concern about the company's future performance and the broader implications for the semiconductor industry.

-

Immediate impact on IFX stock price: The 7% drop (replace with the actual percentage) signifies a substantial loss in market capitalization and highlights the sensitivity of investor sentiment to news concerning the semiconductor sector.

-

Trading volume: Following the announcement, trading volume for IFX stock significantly increased, indicating heightened investor activity and a flurry of buy and sell orders driven by the unexpected news.

-

Analyst ratings: Financial analysts responded with revised ratings for IFX stock, with many downgrading their outlook due to the missed sales guidance and concerns about the persistent impact of tariffs.

-

Investor sentiment: Overall investor sentiment toward Infineon turned significantly more cautious, reflecting a growing skepticism about the company's short-term prospects and its ability to navigate the challenging macroeconomic environment.

-

Market capitalization changes: The significant drop in the IFX stock price resulted in a substantial reduction in the company's market capitalization, eroding investor wealth and impacting the company's overall valuation.

Long-Term Implications for Infineon and the Semiconductor Industry

Keywords: Infineon future outlook, semiconductor industry outlook, tariff impact on semiconductors, long-term investment, geopolitical risks, competitive landscape

The missed sales guidance raises significant concerns about Infineon's long-term outlook and the health of the semiconductor industry as a whole. The continued impact of tariffs, coupled with geopolitical uncertainties and intensifying competition, presents considerable challenges for the company.

-

Long-term implications for Infineon's financial health: The revenue shortfall will likely impact Infineon's profitability and investment capacity in the near term. However, the company's long-term financial health will depend on its ability to adapt to the changing market landscape.

-

Impact on the semiconductor industry: Infineon's experience is indicative of broader challenges facing the global semiconductor industry. Tariffs and geopolitical tensions are creating uncertainty and impacting the supply chains and profitability of numerous companies.

-

Increased competition: The current environment may lead to increased competition among semiconductor manufacturers, potentially squeezing profit margins further and requiring companies to improve efficiency and innovation to maintain their market share.

-

Mitigation strategies: Infineon will likely pursue diversification strategies, cost-cutting measures, and enhanced supply chain resilience to mitigate future risks and stabilize its operations.

-

Potential recovery timeline: The recovery timeline for Infineon and the wider semiconductor industry will depend on several factors, including the resolution of trade disputes, the stabilization of global demand, and the company’s ability to adapt to the new realities of the market.

Conclusion

Infineon's (IFX) recent announcement of missed sales guidance underscores the significant impact of tariffs and other market challenges on the semiconductor industry. While the immediate market reaction was negative, investors should carefully assess the long-term implications and consider the company’s strategies for overcoming these hurdles. The influence of global factors like tariffs on Infineon's performance is crucial for informed investment decisions.

Call to Action: Stay informed on the evolving situation with Infineon (IFX) stock and the semiconductor market by following reputable financial news sources and conducting thorough due diligence before making any investment decisions related to Infineon or similar semiconductor companies. Understanding the impact of global factors like tariffs on Infineon’s performance is crucial for informed investment strategies in the semiconductor sector.

Featured Posts

-

Bitcoin Price Rebound Long Term Outlook And Predictions

May 09, 2025

Bitcoin Price Rebound Long Term Outlook And Predictions

May 09, 2025 -

Infineon Ifx Lower Sales Projections Due To Tariff Uncertainty

May 09, 2025

Infineon Ifx Lower Sales Projections Due To Tariff Uncertainty

May 09, 2025 -

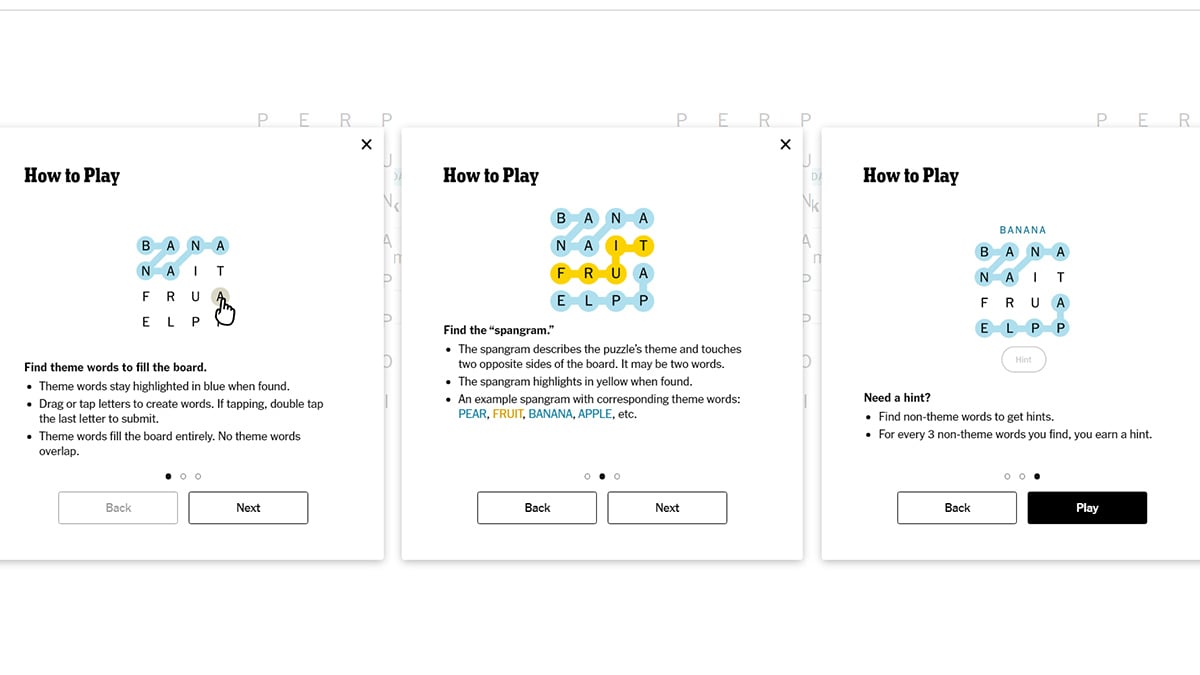

Strands Nyt Answers For Wednesday April 9th Game 402

May 09, 2025

Strands Nyt Answers For Wednesday April 9th Game 402

May 09, 2025 -

Reino Unido Depoimento De Mulher Que Afirma Ser Madeleine Mc Cann Leva A Prisao

May 09, 2025

Reino Unido Depoimento De Mulher Que Afirma Ser Madeleine Mc Cann Leva A Prisao

May 09, 2025 -

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025