Interpreting Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

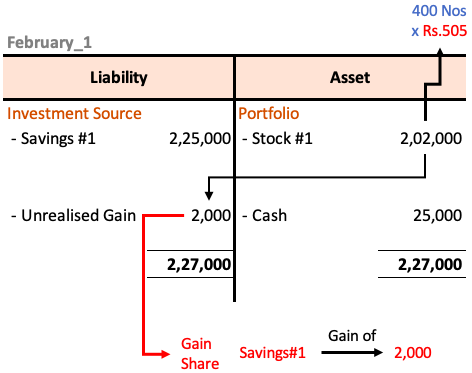

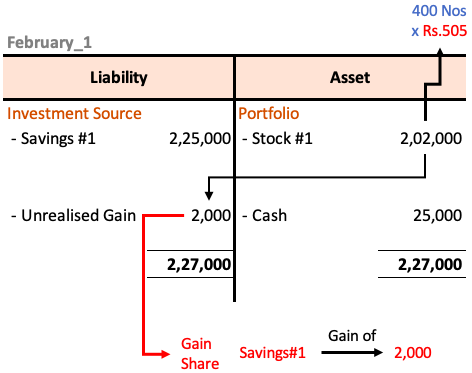

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation involves determining the total market value of all the underlying Dow Jones Industrial Average stocks held in the ETF's portfolio. This market value is then adjusted for any liabilities, such as management fees and expenses.

-

Components of NAV Calculation:

- Market Value of Holdings: The current market price of each stock in the ETF's portfolio, multiplied by the number of shares held.

- Liabilities: Expenses incurred in managing the ETF, including management fees, administrative costs, and other operational expenses.

-

Frequency of NAV Calculation: The Amundi Dow Jones Industrial Average UCITS ETF's NAV is typically calculated and published daily, reflecting the closing prices of the underlying assets. This daily NAV provides a snapshot of the ETF's value at the end of each trading day. Keywords: NAV calculation, ETF valuation, asset value, liabilities, market value, daily NAV, Amundi ETF NAV.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

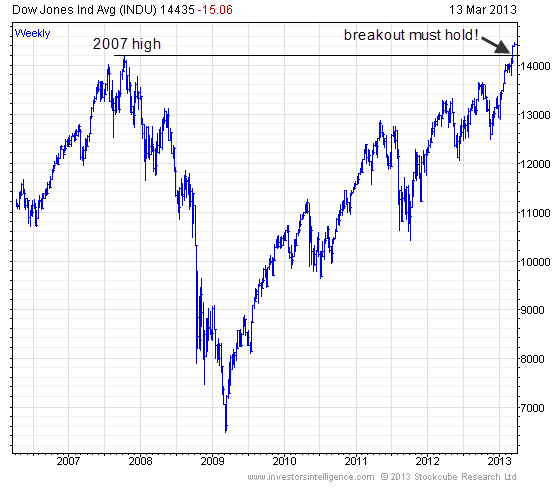

- Market Fluctuations: Changes in the prices of the underlying Dow Jones Industrial Average stocks directly impact the ETF's NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

- Currency Exchange Rates: Since the ETF invests in US-based companies, currency fluctuations between the US dollar and the euro (or other relevant currencies) can affect the NAV if the ETF is denominated in a currency other than the US dollar.

- Dividends and Distributions: Dividend payments from the underlying companies are usually passed on to ETF investors. When dividends are distributed, the NAV of the ETF will typically decrease by the amount of the distribution. Keywords: market volatility, currency risk, dividend impact, NAV fluctuation, Dow Jones Industrial Average.

How to Interpret NAV Changes in the Amundi Dow Jones Industrial Average UCITS ETF

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is closely related to, but not always identical to, its share price. Differences can arise due to factors like bid-ask spreads and trading volume.

-

Relationship between NAV and Share Price: Ideally, the ETF's share price should closely track its NAV. However, a small tracking error may exist.

-

Significance of Tracking Error: Tracking error represents the difference between the ETF's performance and the performance of its underlying index (the Dow Jones Industrial Average). A higher tracking error suggests that the ETF is not perfectly replicating the index.

-

Interpreting NAV Changes:

- Positive NAV Change: Indicates that the value of the underlying assets has increased, reflecting positive performance.

- Negative NAV Change: Suggests that the value of the underlying assets has decreased, indicating negative performance. Keywords: NAV changes, ETF share price, tracking error, investment performance, Amundi ETF performance.

Using NAV to Compare ETFs

NAV can be a useful tool for comparing the Amundi Dow Jones Industrial Average UCITS ETF with other similar ETFs that track the same or similar indices. However, it's crucial to remember that NAV is not the only metric to consider.

- Comparing ETFs Using NAV: By comparing the NAVs of different ETFs, investors can assess relative value. However, this should be considered alongside other factors.

- Limitations of Using NAV Alone: NAV alone doesn't fully capture the ETF's performance. Consider factors like expense ratios and historical performance.

- Other Relevant Metrics: Expense ratios, historical performance data, and the ETF's trading volume are important aspects to consider when comparing ETFs. Keywords: ETF comparison, benchmarking, investment strategy, competitive analysis.

Accessing and Utilizing Amundi Dow Jones Industrial Average UCITS ETF NAV Data

The daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is readily accessible through various sources:

-

Amundi Website: The official Amundi website typically provides daily NAV updates for its ETFs.

-

Financial News Sources: Many reputable financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) publish daily NAV data for ETFs.

-

Utilizing NAV Data:

- Investment Performance Monitoring: Track your investment's growth or decline by comparing your purchase price with the current NAV.

- Tax Reporting: NAV data is often used to calculate capital gains or losses for tax purposes. Keywords: NAV data, Amundi website, financial news, investment tracking, tax reporting, performance monitoring.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for informed investment decisions. By regularly monitoring the NAV, investors can track their investment performance, compare it with similar ETFs, and make adjustments to their portfolio as needed. Remember that NAV is just one piece of the puzzle; consider other factors for a holistic investment strategy. Regularly monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV and use this information for effective investment management. For more detailed information, visit the and consult with a financial advisor. Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV, investment decision, risk management, portfolio management.

Featured Posts

-

Eurovision 2025 Concert Conchita Wurst And Jj In The Village

May 24, 2025

Eurovision 2025 Concert Conchita Wurst And Jj In The Village

May 24, 2025 -

Demna Gvasalia The Future Of Gucci Design

May 24, 2025

Demna Gvasalia The Future Of Gucci Design

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Analysis

May 24, 2025 -

Sterke Aex Prestaties Ondanks Onrust Op Wall Street

May 24, 2025

Sterke Aex Prestaties Ondanks Onrust Op Wall Street

May 24, 2025 -

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Lineup Revealed

May 24, 2025

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Lineup Revealed

May 24, 2025

Latest Posts

-

Trade War Uncertainty Causes 7 Fall In Amsterdam Stock Market

May 24, 2025

Trade War Uncertainty Causes 7 Fall In Amsterdam Stock Market

May 24, 2025 -

Euro Sterker Dan 1 08 Analyse Van De Stijgende Rentes

May 24, 2025

Euro Sterker Dan 1 08 Analyse Van De Stijgende Rentes

May 24, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Significant Drop In Amsterdam Stock Market Trade War Fallout

May 24, 2025

Significant Drop In Amsterdam Stock Market Trade War Fallout

May 24, 2025 -

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025