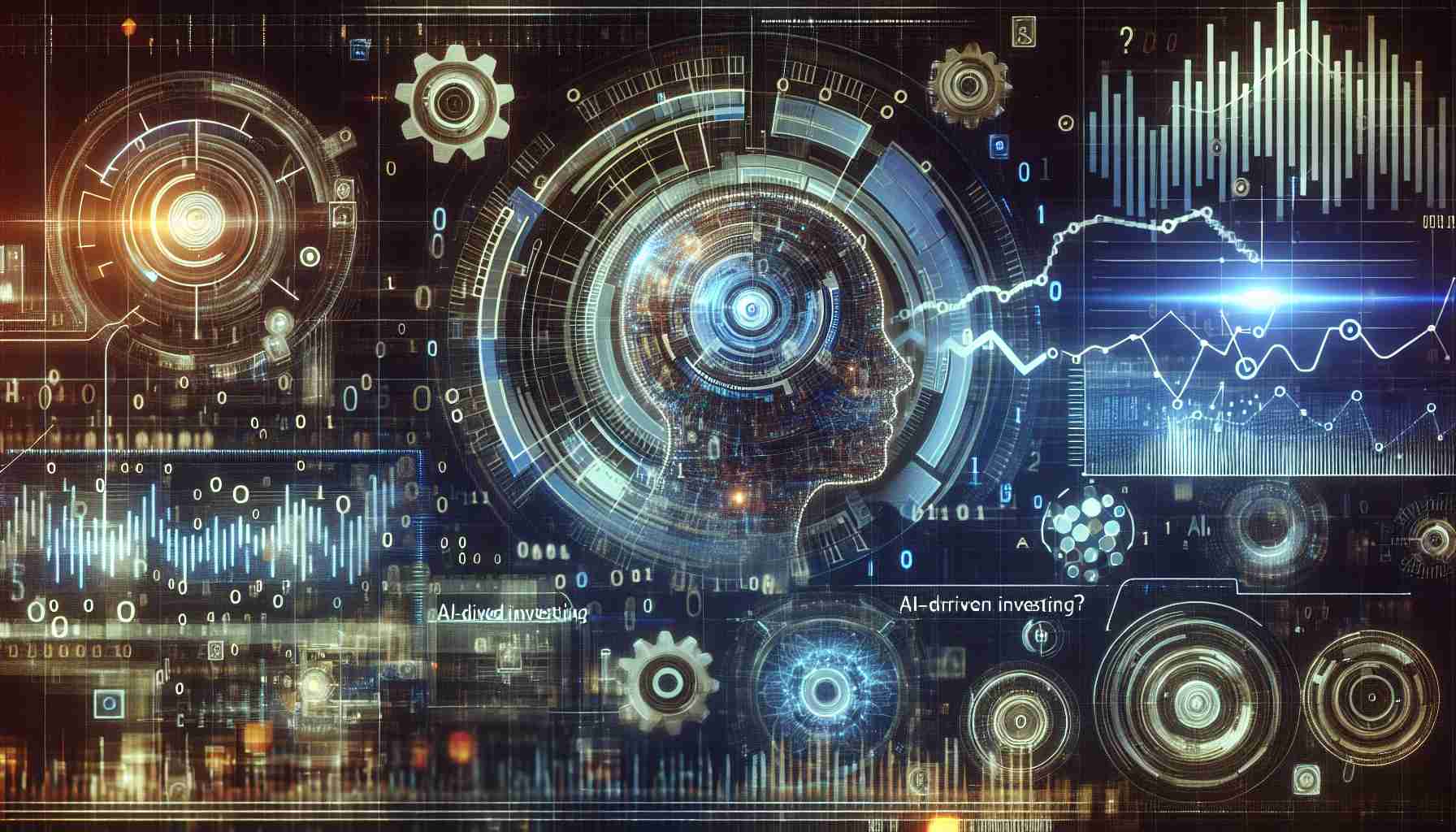

Investing In Palantir Stock: A Pre-May 5th Earnings Perspective

Table of Contents

Palantir's Recent Performance and Growth Trajectory

Palantir's recent performance and future growth trajectory are key factors influencing investor decisions. Analyzing its revenue growth, key contracts, and the performance of its core platforms – Foundry and AIP – provides crucial insights.

Revenue Growth and Key Contracts

Examining Palantir revenue growth is vital. Recent quarterly reports reveal significant progress, fueled by substantial contract wins. Keywords like "Palantir revenue," "PLTR growth," and "contract wins" help understand this progress.

- Significant Contract Wins: Palantir has secured several large contracts in recent quarters, demonstrating strong demand for its data analytics and AI-powered platforms. Specific examples of these contracts and their values (where publicly available) should be highlighted.

- Revenue Growth Percentage: Compare the percentage growth in revenue quarter-over-quarter and year-over-year. This provides a clear picture of Palantir's growth trajectory. Highlight any acceleration or deceleration in growth rates.

- Government vs. Commercial Contracts: Analyze the proportion of revenue generated from government contracts versus commercial contracts. This provides insight into the diversification of Palantir's revenue streams and its reliance on specific sectors. The balance between these two revenue streams greatly impacts the overall risk profile of PLTR stock.

Focus on Foundry and AIP Platforms

Palantir's Foundry and Artificial Intelligence Platform (AIP) are its core offerings. Their performance directly impacts the company's overall financial health and future prospects. Keywords like "Palantir Foundry," "AIP platform," "data integration," and "AI-powered platform" are critical here.

- Platform Improvements: Highlight recent updates and improvements to both Foundry and AIP, focusing on features, functionalities, and ease of use.

- Successful Customer Implementations: Showcase successful customer implementations and case studies that demonstrate the value proposition of these platforms. Quantifiable results from these implementations (e.g., efficiency gains, cost savings) add further weight.

- Market Penetration and Competition: Assess Palantir's market penetration and competitive landscape. Understanding its competitive advantage against other big data and AI solutions is vital. This will include an analysis of the market size, projected growth, and Palantir's current market share.

Analyzing the Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries inherent risks. Understanding these risks is essential for informed decision-making.

Volatility and Market Sentiment

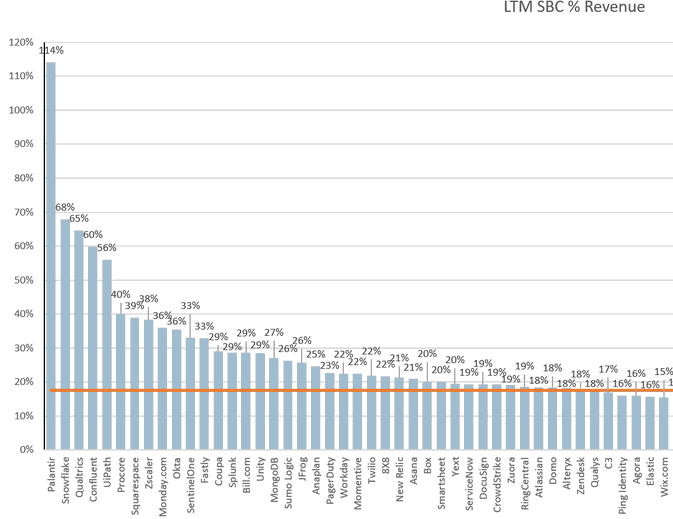

Palantir stock is known for its volatility. Market sentiment plays a significant role in its price fluctuations. Keywords such as "PLTR stock volatility," "market sentiment," and "investment risk" capture this aspect.

- Price Swings: Provide examples of significant price swings in the past and the events that triggered them. This helps contextualize the volatility and potential for rapid price changes.

- News Impact: Discuss how recent news (positive or negative) has influenced investor sentiment and stock price. This emphasizes the importance of staying informed about company developments and market trends.

- Correlation with Market Trends: Analyze the correlation between Palantir's stock price and broader market trends. Understanding how macroeconomic factors and overall market performance affect PLTR is crucial.

Competition and Market Share

Palantir operates in a competitive market. Analyzing its competitive landscape and market share is vital for assessing its long-term prospects. Keywords such as "Palantir competitors," "market share," "competitive advantage," and "big data analytics" are important here.

- Key Competitors: Identify and analyze key competitors, highlighting their strengths and weaknesses. This assessment will help understand Palantir's relative position in the market.

- Competitive Advantages: Discuss Palantir's unique selling propositions and competitive advantages, such as its strong government relationships, its focus on complex data problems, or its advanced AI capabilities.

- Potential for Increased Competition: Explore the potential for increased competition and its impact on Palantir's future growth and market share. This includes analyzing the entry of new players and the evolving dynamics of the big data analytics market.

Predicting Palantir's Q1 2024 Earnings and Their Impact on Stock Price

Analyzing analyst expectations and considering potential scenarios for Q1 2024 earnings is critical.

Analyst Expectations and Consensus Forecasts

Understanding the range of analyst predictions for Palantir's Q1 2024 earnings provides valuable context. Keywords like "Palantir earnings forecast," "analyst expectations," and "Q1 2024 earnings" are essential.

- Summary of Predictions: Present a summary of various analyst predictions, including the range of estimates and the consensus forecast.

- Influencing Factors: Analyze the factors influencing these forecasts, such as projected revenue growth, operating margins, and potential one-time events (e.g., large contract wins or losses).

Potential Scenarios and Their Impact on the Stock Price

Considering various scenarios for the Q1 2024 earnings report helps prepare for different outcomes. Keywords such as "stock price reaction," "earnings beat," "earnings miss," and "market response" are important.

- Earnings Beat, Meet, or Miss: Outline the likely market reaction to scenarios where Palantir beats, meets, or misses analyst expectations.

- Guidance Impact: Explain how the company's guidance for future quarters will influence investor sentiment and the stock price reaction.

Conclusion

Investing in Palantir stock before the May 5th earnings release presents both significant opportunities and considerable risks. A thorough understanding of Palantir's growth trajectory, its competitive landscape, and the potential volatility surrounding its earnings report is crucial for informed decision-making. While the potential for substantial returns exists, investors should carefully weigh the risks before committing capital. Before making any investment decisions regarding Palantir stock, conduct thorough due diligence and consider seeking advice from a qualified financial advisor. Remember to carefully assess the risks and rewards associated with Palantir stock before investing.

Featured Posts

-

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025

Edmonton Oilers Leon Draisaitl Expected Return Before Playoffs

May 09, 2025 -

Analyzing Palantir Stock Before Its May 5th Earnings Report

May 09, 2025

Analyzing Palantir Stock Before Its May 5th Earnings Report

May 09, 2025 -

Palantir Plunges 30 Should You Buy The Dip

May 09, 2025

Palantir Plunges 30 Should You Buy The Dip

May 09, 2025 -

Community Colleges Get 56 M To Combat Nursing Crisis

May 09, 2025

Community Colleges Get 56 M To Combat Nursing Crisis

May 09, 2025 -

Live Tv Malfunction Exposes Franco Colapinto Sponsors F1 Plans

May 09, 2025

Live Tv Malfunction Exposes Franco Colapinto Sponsors F1 Plans

May 09, 2025