Is Apple Stock Headed To $254? Analyst Prediction & Buying Opportunities

Table of Contents

Analyst Predictions Fueling the $254 Target

Review of Key Analyst Forecasts

Several prominent analysts have issued bullish forecasts for Apple stock, predicting it could reach or even surpass $254. These predictions are based on a confluence of factors suggesting strong future growth for the tech giant.

- Morgan Stanley: Projects Apple stock to reach $250 by [Date], citing strong iPhone 15 sales and continued growth in the services sector. [Link to Morgan Stanley report]

- Goldman Sachs: Predicts a target price of $260 for Apple stock, highlighting the potential of the upcoming AR/VR headset and expansion into new markets. [Link to Goldman Sachs report]

- Bank of America: Forecasts Apple stock to reach $240, emphasizing the resilience of the company's ecosystem and its consistent revenue generation. [Link to Bank of America report]

These forecasts represent a significant upside potential for Apple stock, but it's crucial to remember that these are predictions, not guarantees.

Factors Contributing to the Positive Outlook

The bullish sentiment surrounding Apple stock stems from a number of positive factors:

- Strong iPhone Sales: The iPhone remains Apple's flagship product, generating a significant portion of its revenue. Continued strong sales, particularly of the latest iPhone models, are expected to fuel growth.

- Growth in Services Revenue: Apple's services segment, encompassing Apple Music, iCloud, Apple TV+, and more, is experiencing robust growth and boasts high margins. This recurring revenue stream provides stability and predictability.

- Success of Wearables and Accessories: The Apple Watch, AirPods, and other wearables have become highly popular, contributing significantly to Apple's overall revenue and demonstrating the strength of its ecosystem.

- Expansion in Emerging Markets: Apple continues to expand its presence in emerging markets, presenting significant growth opportunities in regions with large populations and increasing purchasing power.

- Potential for New Product Launches: Anticipated new product launches, such as the rumored AR/VR headset, could further boost Apple's revenue and attract new customers, driving up the Apple stock price.

- Overall Tech Sector Health: The relative strength of the tech sector also contributes to positive sentiment surrounding Apple, a sector leader.

Evaluating the Risks and Potential Downsides

While the outlook for Apple stock is largely positive, several risks could impact its performance and prevent it from reaching $254.

Global Economic Uncertainty and its Impact

Global economic headwinds pose a significant threat to Apple's performance:

- Inflation: High inflation can reduce consumer spending, impacting demand for Apple's products, particularly in price-sensitive markets.

- Recession: A potential recession could significantly dampen consumer demand for discretionary items like iPhones and other Apple products, leading to lower sales and impacting the Apple stock price forecast.

- Supply Chain Disruptions: Geopolitical instability and other factors could disrupt Apple's supply chain, impacting production and potentially leading to shortages.

- Geopolitical Instability: International conflicts and trade tensions can create uncertainty and negatively impact Apple's global operations.

Diversification within a larger investment portfolio is a crucial strategy to mitigate these risks.

Competition and Market Saturation

Apple faces intense competition from other tech giants:

- Samsung: Samsung remains a significant competitor in the smartphone market, offering comparable products at often lower price points.

- Google: Google's Android operating system holds a dominant market share globally, posing a consistent challenge to Apple's iOS ecosystem.

Market saturation for certain products, particularly iPhones, is also a potential concern. Apple needs to continue innovating and offering compelling new features to maintain its market leadership and drive future growth. However, Apple's strong brand loyalty and innovation capabilities mitigate these risks to some extent.

Identifying Potential Buying Opportunities and Investment Strategies

Analyzing Apple's Financial Performance

Analyzing key financial metrics is crucial before investing in Apple stock:

- Revenue: Apple consistently demonstrates strong revenue growth, driven by a diverse range of products and services. [Insert relevant data and chart]

- Earnings Per Share (EPS): Apple's EPS has generally shown consistent growth, indicating strong profitability. [Insert relevant data and chart]

- Debt-to-Equity Ratio: Apple maintains a relatively low debt-to-equity ratio, suggesting a healthy financial position. [Insert relevant data and chart]

Comparing these metrics to industry benchmarks and competitors provides a clearer picture of Apple's financial health.

Considering Different Investment Approaches

Investors should consider various investment approaches when evaluating Apple stock:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. It reduces the risk of investing a large sum at a market peak.

- Buy-and-Hold: This long-term strategy involves purchasing and holding the stock for an extended period, aiming to benefit from long-term growth.

The choice of investment strategy depends on individual investor risk tolerance and financial goals.

Conclusion

Analyst predictions suggest Apple stock could reach $254, fueled by strong iPhone sales, growth in services, and potential new product launches. However, global economic uncertainty and competition present significant risks. Analyzing Apple's financial performance and considering various investment strategies, such as dollar-cost averaging or buy-and-hold, are crucial for informed decision-making. Remember that any prediction, including reaching $254, is subject to market fluctuations.

Is Apple stock right for your portfolio? Do your due diligence and decide if this potential surge to $254 is an opportunity you want to explore. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions regarding Apple stock or any other investment.

Featured Posts

-

News Corps Undervalued Assets A Potential Investment Opportunity

May 25, 2025

News Corps Undervalued Assets A Potential Investment Opportunity

May 25, 2025 -

Porsche Indonesia Menyambut Classic Art Week 2025

May 25, 2025

Porsche Indonesia Menyambut Classic Art Week 2025

May 25, 2025 -

Record Global Forest Loss Driven By Devastating Wildfires

May 25, 2025

Record Global Forest Loss Driven By Devastating Wildfires

May 25, 2025 -

From Distant Shores To Dc Hearts A Story Of Love And Loss

May 25, 2025

From Distant Shores To Dc Hearts A Story Of Love And Loss

May 25, 2025 -

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025

Latest Posts

-

Alternative Delivery Services Capitalize On Canada Post Shortcomings

May 25, 2025

Alternative Delivery Services Capitalize On Canada Post Shortcomings

May 25, 2025 -

The Impact Of Canada Posts Performance On The Alternative Delivery Market

May 25, 2025

The Impact Of Canada Posts Performance On The Alternative Delivery Market

May 25, 2025 -

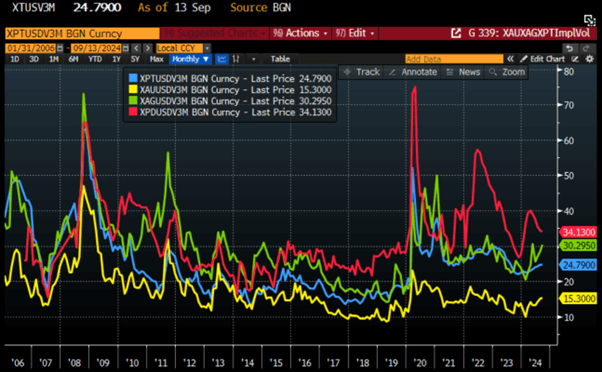

Gold Prices Rise Amidst Trumps Escalating Trade Dispute With Eu

May 25, 2025

Gold Prices Rise Amidst Trumps Escalating Trade Dispute With Eu

May 25, 2025 -

Trumps Trade Threats Gold Prices Climb On Renewed Uncertainty

May 25, 2025

Trumps Trade Threats Gold Prices Climb On Renewed Uncertainty

May 25, 2025 -

How Canada Posts Problems Are Benefiting The Competition In Delivery Services

May 25, 2025

How Canada Posts Problems Are Benefiting The Competition In Delivery Services

May 25, 2025