Is BigBear.ai Holdings, Inc. (NYSE: BBAI) A Top Penny Stock To Watch?

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai offers AI-powered solutions and big data analytics to government and commercial clients. Its services range from cybersecurity and intelligence analysis to predictive maintenance and supply chain optimization. Understanding its business model is crucial for any BBAI stock analysis. However, BigBear.ai, like many penny stocks, faces challenges in terms of profitability.

Analyzing recent financial performance reveals a mixed picture. While BBAI revenue has shown some growth, profitability remains elusive. High debt levels also present a considerable risk for investors. Examining key financial metrics is essential:

- BBAI Revenue: While recent quarters might show increases, sustained, significant revenue growth is vital for long-term success.

- Net Income: Currently, BigBear.ai likely operates at a net loss, a common characteristic of many growth-oriented companies, especially within the penny stock sector.

- EPS (Earnings Per Share): Negative EPS further underscores the company's current lack of profitability.

- BBAI Debt-to-Equity Ratio: A high debt-to-equity ratio indicates a significant level of financial risk.

[Insert Chart/Graph visualizing BBAI revenue, net income, and debt-to-equity ratio over time]

Market Analysis and Growth Potential

The market for AI and big data analytics is booming, presenting significant growth opportunities for companies like BigBear.ai. The increasing demand for advanced analytical capabilities across various sectors fuels this expansion. However, the AI market growth is fiercely competitive. BigBear.ai faces competition from established tech giants and smaller, agile startups. Its competitive advantages lie in its specialized expertise in government and defense sectors and its unique AI solutions.

- AI Market Growth: The market is projected to experience substantial growth in the coming years, offering potential for BBAI.

- Big Data Analytics Market: This closely related market is also exhibiting strong growth, creating further opportunities.

- BBAI Competitors: BigBear.ai competes with both large multinational corporations and smaller, specialized firms in the AI and big data analytics space.

- Recent Contracts and Partnerships: Securing large contracts and forming strategic partnerships will be critical to BBAI’s growth trajectory.

Risk Assessment and Investment Considerations

Penny stocks, including BBAI, are inherently risky investments. Their volatility can lead to significant losses in a short period. Liquidity is another key concern; trading volume might be low, making it difficult to buy or sell shares quickly without impacting the price. Specific risks related to BigBear.ai include:

-

Penny Stock Risk: The inherent volatility and lack of liquidity associated with penny stocks necessitate a high risk tolerance.

-

BBAI Investment Risk: Specific risks for BBAI include its dependence on large government contracts, competition in the AI market, and its current financial performance.

-

Dependence on Large Contracts: A reliance on a few key contracts leaves BBAI vulnerable to potential contract losses.

-

Competitive Pressure: The highly competitive landscape requires continuous innovation and adaptation to remain successful.

-

Appropriate Risk Tolerance: Investing in BBAI requires a high tolerance for risk due to its penny stock status and inherent volatility.

Technical Analysis of BBAI Stock

Analyzing the BBAI stock chart reveals fluctuations typical of a volatile penny stock. Observing trading volume, support and resistance levels, and overall chart patterns can provide insights into potential price movements. However, it's essential to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

[Insert Chart illustrating key technical indicators for BBAI stock]

Disclaimer: This section is purely for informational purposes and does not constitute investment advice.

Conclusion: Is BigBear.ai (BBAI) a Penny Stock Worth Your Attention?

BigBear.ai (BBAI) operates in a rapidly growing market with promising potential. However, its current financial performance and the inherent risks associated with penny stock investment require careful consideration. While the company’s AI-powered solutions are potentially valuable, its profitability and stability remain uncertain. Therefore, while BBAI might show promise, it's crucial to acknowledge the substantial risks involved.

This BBAI stock analysis does not offer a definitive yes or no. Whether BBAI is a top penny stock to watch ultimately depends on your individual risk tolerance and investment goals. Before making any investment decision, conduct your own research on BBAI, consider BBAI as part of a diversified portfolio, and learn more about penny stock investment strategies. Remember, thorough due diligence is paramount in the volatile world of penny stock investing.

Featured Posts

-

Juergen Klopp Nereye Gidecek Son Dakika Transfer Haberleri Ve Analizi

May 21, 2025

Juergen Klopp Nereye Gidecek Son Dakika Transfer Haberleri Ve Analizi

May 21, 2025 -

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025 -

Ftc Vs Meta Monopoly Trial Shifts Focus To Metas Defense

May 21, 2025

Ftc Vs Meta Monopoly Trial Shifts Focus To Metas Defense

May 21, 2025 -

Patra Lista Efimerion Iatron Gia To Savvatokyriako

May 21, 2025

Patra Lista Efimerion Iatron Gia To Savvatokyriako

May 21, 2025 -

2025 Money In The Bank Perez And Ripley Officially In The Ladder Match

May 21, 2025

2025 Money In The Bank Perez And Ripley Officially In The Ladder Match

May 21, 2025

Latest Posts

-

The Rise Of Succession Planning In High Net Worth Families

May 22, 2025

The Rise Of Succession Planning In High Net Worth Families

May 22, 2025 -

Succession Planning For The Ultra High Net Worth A Growing Trend

May 22, 2025

Succession Planning For The Ultra High Net Worth A Growing Trend

May 22, 2025 -

Exclusive Open Ais Texas Data Center Receives Massive 11 6 Billion Funding Boost

May 22, 2025

Exclusive Open Ais Texas Data Center Receives Massive 11 6 Billion Funding Boost

May 22, 2025 -

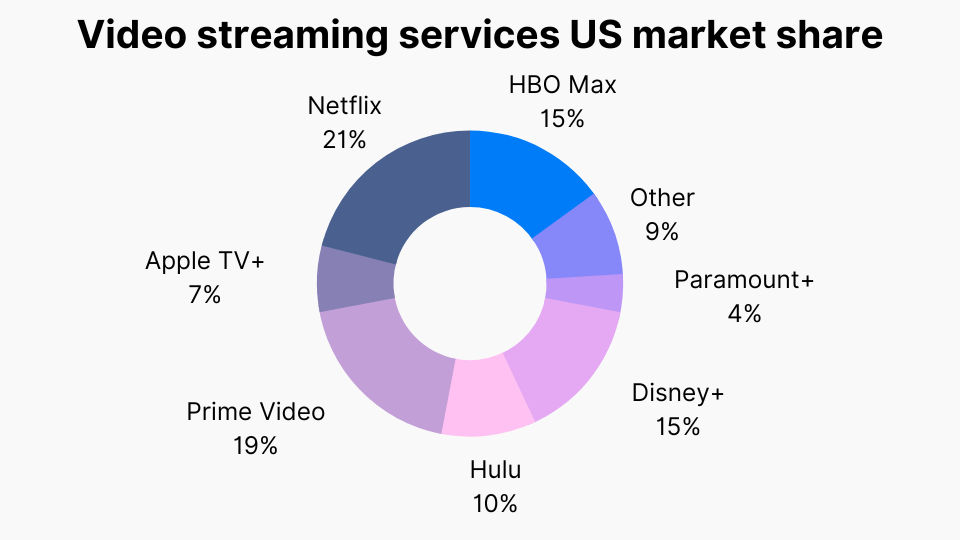

The Rise Of Streaming Revenue Challenges And Changes For Consumers

May 22, 2025

The Rise Of Streaming Revenue Challenges And Changes For Consumers

May 22, 2025 -

Open Ai Texas Data Center Secures 11 6 Billion In Funding

May 22, 2025

Open Ai Texas Data Center Secures 11 6 Billion In Funding

May 22, 2025