Is Ethereum Poised For Further Gains? Analyzing Current Market Trends

Table of Contents

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a rollercoaster ride of price fluctuations. This article analyzes current market trends and explores whether Ethereum is poised for further gains, examining the factors influencing its future price movement. We'll delve into key metrics and potential catalysts to help you understand the current state of ETH and its investment potential. Understanding these dynamics is crucial for anyone considering an Ethereum investment or already holding ETH.

Ethereum's Technological Advancements and Their Impact

The ongoing evolution of Ethereum's technology plays a significant role in its potential for future price appreciation. Key advancements are driving increased adoption and efficiency, addressing previous scalability limitations.

Ethereum 2.0 and its Role in Scalability

The transition to Ethereum 2.0 is a multi-stage upgrade designed to drastically improve the network's scalability, security, and efficiency. This upgrade is crucial for handling the increasing transaction volume and demand for ETH.

- Improved scalability: Ethereum 2.0's sharding mechanism significantly enhances transaction throughput, allowing the network to process many more transactions per second. This addresses the past bottleneck that resulted in high gas fees.

- Reduced transaction fees (gas fees): Increased scalability directly translates to lower transaction costs for users, making it more accessible and attractive for various applications. Lower gas fees encourage broader participation in the Ethereum ecosystem.

- Proof-of-Stake consensus mechanism: The shift from Proof-of-Work to Proof-of-Stake improves energy efficiency and enhances the network's security by requiring validators to stake ETH, incentivizing honest behavior.

- Increased security: The Proof-of-Stake mechanism and sharding contribute to a more robust and resilient network, reducing vulnerabilities to attacks.

The Growing DeFi Ecosystem on Ethereum

Ethereum's prominence as the leading platform for Decentralized Finance (DeFi) applications is a major factor contributing to its value. The explosive growth of DeFi protocols built on Ethereum has created significant demand for ETH.

- Increased demand for ETH for DeFi activities: Many DeFi protocols require users to lock up ETH to participate in various activities like lending, borrowing, and yield farming. This "locking" reduces the circulating supply of ETH, potentially driving up its price.

- Locking of ETH in DeFi protocols: The Total Value Locked (TVL) in Ethereum-based DeFi protocols is a key indicator of the ecosystem's health and growth. A rising TVL generally correlates with increased demand for ETH.

- Impact of DeFi innovations on ETH price: Continuous innovation in the DeFi space, such as new lending protocols, decentralized exchanges (DEXs), and yield farming strategies, further fuels demand and usage of ETH.

Macroeconomic Factors Influencing Ethereum's Price

External factors beyond Ethereum's technical improvements also significantly impact its price. These include the performance of other cryptocurrencies and the regulatory landscape.

Bitcoin's Performance and Correlation with Ethereum

Bitcoin (BTC), the largest cryptocurrency, often influences the price movements of other cryptocurrencies, including Ethereum. While a degree of decoupling has been observed, correlation still exists.

- Historical price correlation between BTC and ETH: Historically, ETH price has shown a significant correlation with BTC's price, often moving in tandem. Positive movements in BTC usually lead to positive movements in ETH and vice versa.

- Impact of Bitcoin's price volatility on ETH: Significant price swings in BTC often result in similar volatility in ETH, although the magnitude of the price change can differ.

- Potential decoupling scenarios: As Ethereum's ecosystem matures and its utility expands beyond simply being a cryptocurrency, the correlation with BTC may lessen over time, leading to more independent price movements.

Regulatory Landscape and its Effect on Crypto Markets

The regulatory environment surrounding cryptocurrencies remains dynamic and uncertain. Regulatory clarity or lack thereof can significantly impact market sentiment and investor confidence.

- Impact of regulatory uncertainty: Uncertainty regarding regulations can lead to market volatility and price fluctuations as investors react to potential changes in legal frameworks.

- Potential for increased regulation: Governments worldwide are increasingly focusing on regulating the cryptocurrency space, which may introduce stricter rules about trading, taxation, and compliance.

- Influence of government policies on cryptocurrency markets: Government policies and pronouncements can influence investor confidence and ultimately drive the price up or down, depending on their nature.

Market Sentiment and Investor Behavior Towards Ethereum

Analyzing market sentiment and investor behavior provides valuable insights into potential price movements.

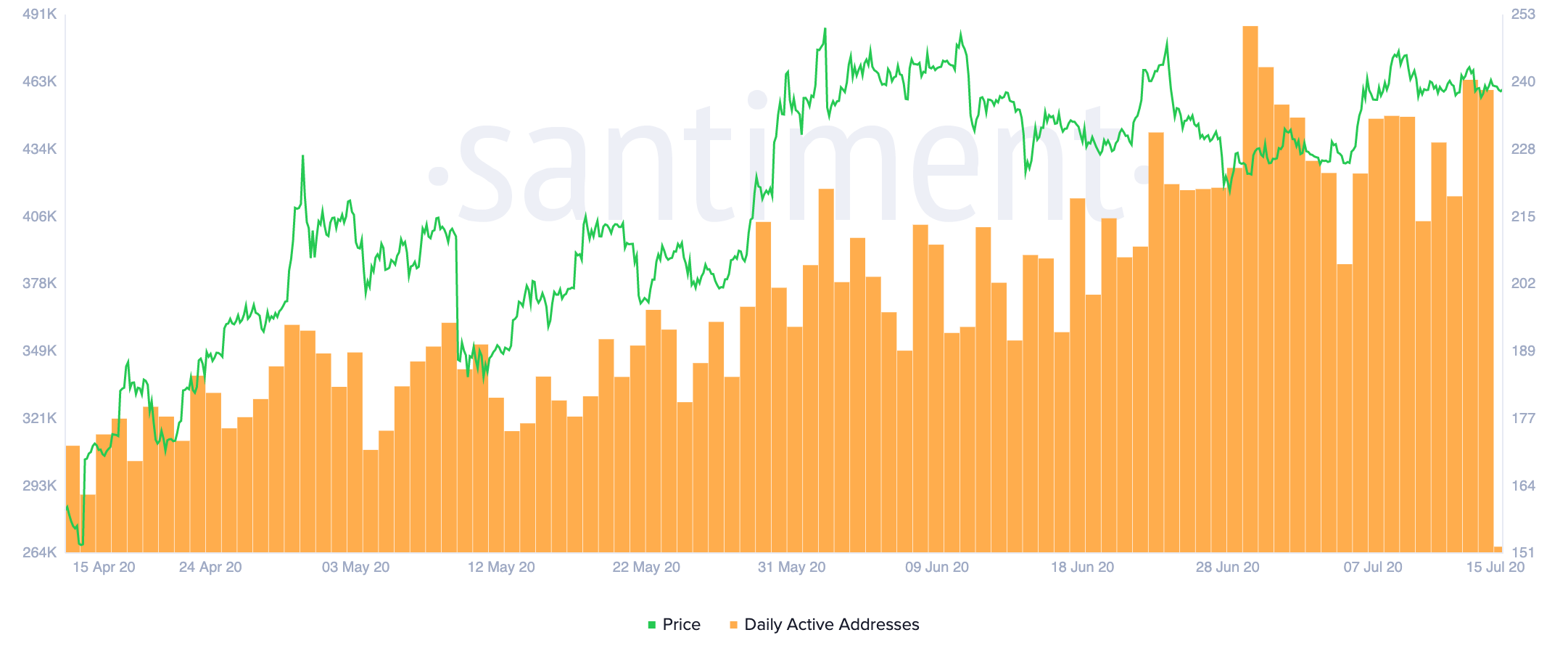

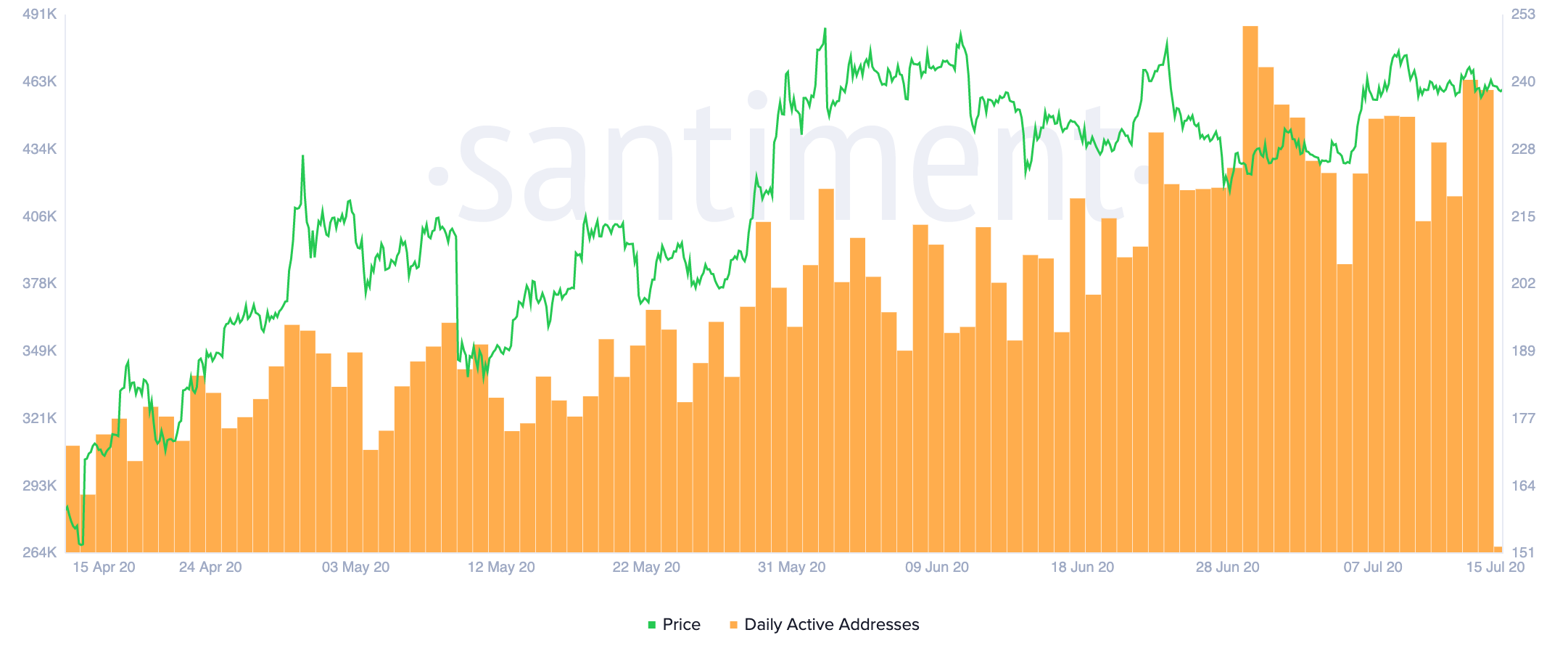

Analyzing on-chain metrics

On-chain data offers objective measurements of network activity and user engagement.

- Increased network activity as a bullish indicator: High transaction volumes, active addresses, and increasing gas usage can signal strong demand and positive market sentiment.

- Decreasing transaction volume as a bearish indicator: Reduced network activity might suggest waning interest and could potentially foreshadow a price correction.

- Analysis of whale activity and its influence: The actions of large holders ("whales") can influence price movements, with significant buying or selling potentially triggering market reactions.

Social Media Sentiment and News Coverage

Social media and news coverage play a significant role in shaping public perception and influencing investor decisions.

- Analysis of social media sentiment towards ETH: Monitoring social media platforms can provide insights into overall sentiment, although it's crucial to distinguish between genuine sentiment and manipulated narratives.

- Impact of positive/negative news on price: Positive news, such as technological advancements or partnerships, often leads to price increases, while negative news can trigger price drops.

- Identifying potential misinformation: It's important to be critical of information found online and to verify it through reputable sources before making investment decisions.

Conclusion

Analyzing Ethereum's technological advancements, macroeconomic influences, and market sentiment reveals a complex interplay of factors that determine its price. While the transition to Ethereum 2.0 and the growth of DeFi are promising long-term catalysts, the influence of Bitcoin's price and the evolving regulatory environment introduce uncertainty. Monitoring on-chain data and assessing market sentiment is crucial. While current trends suggest potential for further gains, market volatility remains a significant factor.

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem and continue to analyze the factors influencing Ethereum price to make well-informed investment decisions. Is Ethereum right for your portfolio? Thorough research is vital before investing in any cryptocurrency.

Featured Posts

-

Ethereum Price Breaks Resistance 2 000 Target In Sight

May 08, 2025

Ethereum Price Breaks Resistance 2 000 Target In Sight

May 08, 2025 -

Lahwr Ke Askwlwn Ka Py Ays Ayl Ke Baeth Awqat Kar Tbdyl

May 08, 2025

Lahwr Ke Askwlwn Ka Py Ays Ayl Ke Baeth Awqat Kar Tbdyl

May 08, 2025 -

Universal Credit And The Dwp Navigating The Upcoming Changes

May 08, 2025

Universal Credit And The Dwp Navigating The Upcoming Changes

May 08, 2025 -

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025

Wall Street Kurumlari Kripto Paraya Nasil Yaklasiyor

May 08, 2025 -

Saglik Bakanligi 37 Bin Personel Alimi Basvuru Sartlari Tarihleri Ve Detaylar

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Basvuru Sartlari Tarihleri Ve Detaylar

May 08, 2025