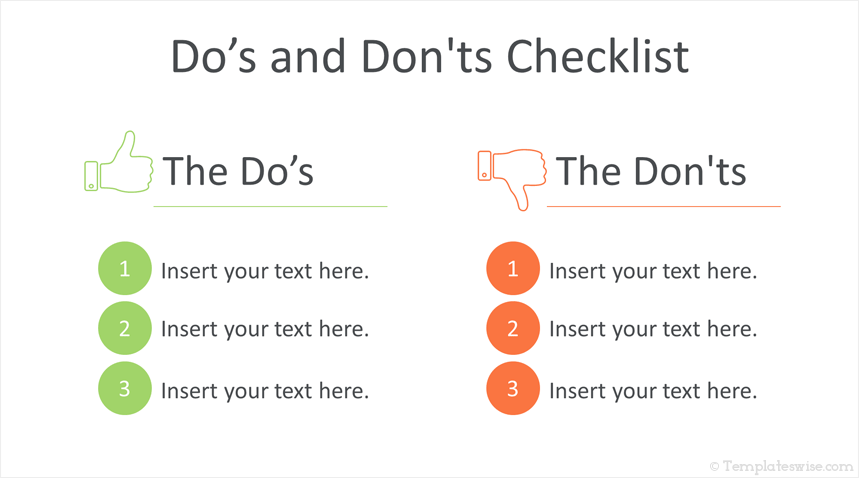

Land Your Dream Private Credit Job: 5 Do's & Don'ts

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do #1: Network Strategically

Building a strong network is paramount in securing a private credit job. The private credit industry thrives on relationships. Don't underestimate the power of networking!

- LinkedIn: Optimize your LinkedIn profile with relevant keywords like "private credit analyst," "direct lending," or "mezzanine financing." Actively engage with posts and connect with professionals in the field.

- Industry Events: Attend private equity and credit-focused conferences and workshops. These events offer unparalleled networking opportunities to meet potential employers and learn about industry trends. Look for events focusing on private credit networking and private credit industry events.

- Informational Interviews: Reach out to people working in private credit firms for informational interviews. This allows you to learn about their roles, gain insights into the industry, and potentially make a valuable connection.

- Alumni Networks: Leverage your alumni network if you attended a university with a strong finance program. Many alumni work in the private credit sector and are happy to help fellow graduates.

Do #2: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They need to highlight your qualifications and demonstrate your understanding of the private credit industry.

- Keyword Optimization: Incorporate relevant keywords from job descriptions, such as "debt financing," "leveraged buyouts," "credit analysis," "underwriting experience," and "financial modeling." Your private credit resume and private credit cover letter should be targeted.

- Quantifiable Achievements: Instead of simply stating your responsibilities, quantify your achievements. For example, instead of saying "managed a portfolio," say "managed a portfolio of $X million, resulting in a Y% return."

- Tailored Approach: Don't use a generic resume and cover letter. Tailor each application to the specific requirements and responsibilities outlined in the job description.

Do #3: Master the Interview Process

The interview is your chance to showcase your personality, skills, and knowledge. Preparation is key.

- Behavioral Questions: Practice answering behavioral interview questions, focusing on situations demonstrating problem-solving skills, teamwork, and your ability to handle pressure.

- Insightful Questions: Prepare insightful questions to ask the interviewer, showcasing your genuine interest in the private credit role and the firm. Research their investment strategy and recent transactions.

- Professionalism: Dress professionally, arrive on time, and maintain confident and positive body language throughout the private credit interview. Thorough research of the private credit firm is crucial.

Do #4: Showcase Your Financial Modeling Skills

Proficiency in financial modeling is essential for a private credit job.

- Software Proficiency: Demonstrate expertise in financial modeling software such as Excel, Bloomberg Terminal, and potentially more specialized platforms.

- Portfolio of Work: Prepare examples of your financial modeling work to share with potential employers. Be ready to discuss your methodologies and assumptions. Highlight experience with LBO modeling, discounted cash flow (DCF) analysis, and other relevant techniques. Emphasize your financial modeling skills, including DCF analysis and LBO modeling. This is key for a private credit analyst role.

Do #5: Highlight Your Industry Knowledge

Demonstrate a deep understanding of the private credit market.

- Stay Updated: Stay abreast of current trends and news in the private credit market. Read industry publications, follow key influencers, and understand the impact of economic indicators.

- Strategic Awareness: Show familiarity with different private credit strategies such as direct lending, mezzanine financing, and other investment approaches. Highlight your understanding of private credit market trends, direct lending, and mezzanine financing. Show you understand private credit investment strategies.

5 Don'ts to Avoid When Seeking a Private Credit Job

Don't #1: Neglect Networking

Avoid relying solely on online job applications. Active networking significantly increases your chances of finding a private credit job.

Don't #2: Submit Generic Applications

Avoid submitting the same resume and cover letter for every job application. Tailoring your application demonstrates genuine interest and attention to detail.

Don't #3: Underprepare for Interviews

Avoid going into an interview without thoroughly researching the firm and practicing your answers to common interview questions. This shows a lack of seriousness.

Don't #4: Overlook Technical Skills

Avoid downplaying the importance of strong financial modeling and analytical skills. These are critical for success in the private credit industry.

Don't #5: Lack Industry Awareness

Avoid demonstrating a lack of knowledge about current events and trends within private credit. Staying informed is crucial.

Conclusion

Securing your dream private credit job requires a strategic and diligent approach. By following these five "dos" and avoiding the five "don'ts," you significantly improve your chances of success. Remember to network effectively, tailor your application materials, master the interview process, showcase your financial modeling skills, and demonstrate your in-depth knowledge of the private credit industry. Start implementing these strategies today and take a significant step towards landing your dream private credit job.

Featured Posts

-

Hout Bay Fcs Success The Klopp Connection

May 22, 2025

Hout Bay Fcs Success The Klopp Connection

May 22, 2025 -

Googles Ai A Deep Dive Into Investor Expectations And Performance

May 22, 2025

Googles Ai A Deep Dive Into Investor Expectations And Performance

May 22, 2025 -

Tikkie En Nederlandse Bankrekeningen Een Praktische Gids

May 22, 2025

Tikkie En Nederlandse Bankrekeningen Een Praktische Gids

May 22, 2025 -

The Goldbergs Why The Show Resonates With Audiences

May 22, 2025

The Goldbergs Why The Show Resonates With Audiences

May 22, 2025 -

Bwtshytynw Ystdey Thlathy Mmyz Lmntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ystdey Thlathy Mmyz Lmntkhb Alwlayat Almthdt

May 22, 2025

Latest Posts

-

Understanding The Sharp Increase In Core Weave Crwv Stock On Thursday

May 22, 2025

Understanding The Sharp Increase In Core Weave Crwv Stock On Thursday

May 22, 2025 -

Core Weave Crwv Stock Soars Analyzing Thursdays Market Performance

May 22, 2025

Core Weave Crwv Stock Soars Analyzing Thursdays Market Performance

May 22, 2025 -

Why Did Core Weave Inc Crwv Stock Price Soar On Thursday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Price Soar On Thursday

May 22, 2025 -

The Status Of Blake Lively And Taylor Swifts Friendship Post Lawsuit

May 22, 2025

The Status Of Blake Lively And Taylor Swifts Friendship Post Lawsuit

May 22, 2025 -

Core Weave Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025

Core Weave Crwv Stock Surge Understanding Thursdays Jump

May 22, 2025