Meta's Antitrust Battle: Examining The FTC's Case Against WhatsApp And Instagram

Table of Contents

The FTC's Case Against Meta: A Monopoly in Social Media?

The FTC's central argument in the Meta antitrust lawsuit is that Meta's acquisitions of WhatsApp in 2014 and Instagram in 2012 were anti-competitive, eliminating potential rivals and creating a near-monopoly in the social media market. They contend that these acquisitions prevented the emergence of strong competitors and ultimately harmed consumers.

- Timeline of Acquisitions: The acquisition of Instagram occurred in 2012 for approximately $1 billion, while WhatsApp was acquired in 2014 for a staggering $19 billion. These acquisitions significantly expanded Meta's reach and influence.

- Market Share Dominance: Meta's platforms – Facebook, WhatsApp, and Instagram – collectively hold a dominant market share in social networking, messaging, and photo-sharing. This concentrated power, the FTC argues, allows Meta to leverage its position to suppress competition.

- Alleged Anti-Competitive Behavior: The FTC points to the integration of WhatsApp and Instagram’s functionalities with Facebook’s core product as a prime example of anti-competitive behavior. This integration, they argue, prevents users from easily switching to competing platforms and makes it harder for rivals to gain traction.

- Defining a Monopoly: The FTC argues that Meta’s control over such a significant portion of the social media market, coupled with its alleged anti-competitive actions, constitutes a monopoly in violation of antitrust laws. The definition of a monopoly in this context revolves around the ability to control prices, exclude competition, and limit consumer choice – all of which the FTC claims Meta has done.

Meta's Defense Strategies: Countering the FTC's Claims

Meta vehemently denies the FTC's allegations. Their defense strategy centers on arguing that the acquisitions were pro-competitive, fostered innovation, and were necessary for market survival in a rapidly evolving technological landscape.

- Innovation and User Benefits: Meta emphasizes the innovations and user benefits that resulted from the acquisitions. They highlight improvements in features, user experience, and integration across platforms. They argue that these benefits outweigh any potential anti-competitive effects.

- Competitive Landscape: Meta argues that the social media market is far from monolithic, citing the existence of numerous competing platforms like TikTok, Twitter, and Snapchat. They contest the FTC's assertion of a near-monopoly.

- Lack of Harm to Consumers: A crucial part of Meta's defense is demonstrating a lack of harm to consumers. They argue that users benefit from the integrated services and that competition remains vibrant in the broader digital market.

- Legal Precedents: Meta likely relies on legal precedents and interpretations of antitrust laws to support its claims. Their legal team will strive to demonstrate that the acquisitions fall within the boundaries of acceptable business practices.

The Impact of the Ruling on the Tech Industry

The outcome of the Meta antitrust lawsuit will have significant repercussions for the tech industry, regardless of the verdict. The case sets a precedent for future tech mergers and acquisitions.

- Future Mergers and Acquisitions: A ruling against Meta could significantly increase regulatory scrutiny of future tech mergers and acquisitions, leading to stricter guidelines and potentially fewer large-scale consolidations.

- Increased Regulatory Scrutiny of Big Tech: The case highlights the increasing pressure on Big Tech companies to face greater regulatory oversight and accountability for their market practices. This could result in more stringent antitrust enforcement across the board.

- Impact on Consumer Privacy and Data Protection: The case also touches on issues of consumer privacy and data protection. The FTC's concerns about Meta's dominance raise questions about the potential misuse of vast user data.

- Development of New Social Media Platforms: The outcome could influence the emergence of new social media platforms. A ruling against Meta might create a more level playing field, allowing smaller companies to compete more effectively.

Potential Outcomes and Their Consequences

Several outcomes are possible in the Meta antitrust lawsuit. These include: divestiture (Meta forced to sell WhatsApp or Instagram), financial penalties, or changes in Meta’s business practices. Each scenario carries profound consequences:

- Settlement Before Trial: A settlement before a full trial is always a possibility. This might involve concessions from Meta, such as altering business practices or making structural changes.

- Financial Implications: A ruling against Meta could result in substantial financial penalties, significantly impacting its stock price and investor confidence. Divestiture would also represent a considerable financial loss.

- Stock Price and Investor Confidence: The uncertainty surrounding the lawsuit has already impacted Meta's stock price. A negative ruling could lead to further declines, while a favorable outcome might boost investor confidence.

Conclusion

The Meta antitrust lawsuit presents a complex legal battle with far-reaching implications. The FTC's case focuses on Meta's alleged anti-competitive acquisition of WhatsApp and Instagram, aiming to prevent monopolies in the social media landscape. Meta counters that these acquisitions were beneficial for users and fostered innovation. The outcome will significantly influence future tech mergers, regulatory oversight, consumer privacy, and the competitive dynamics of the social media industry. Stay informed about the progress of this crucial Meta antitrust lawsuit by following reputable news sources and official legal documents. The future of tech regulation hinges on the result.

Featured Posts

-

Stock Market Valuation Concerns Bof As Perspective And Reassurance For Investors

May 13, 2025

Stock Market Valuation Concerns Bof As Perspective And Reassurance For Investors

May 13, 2025 -

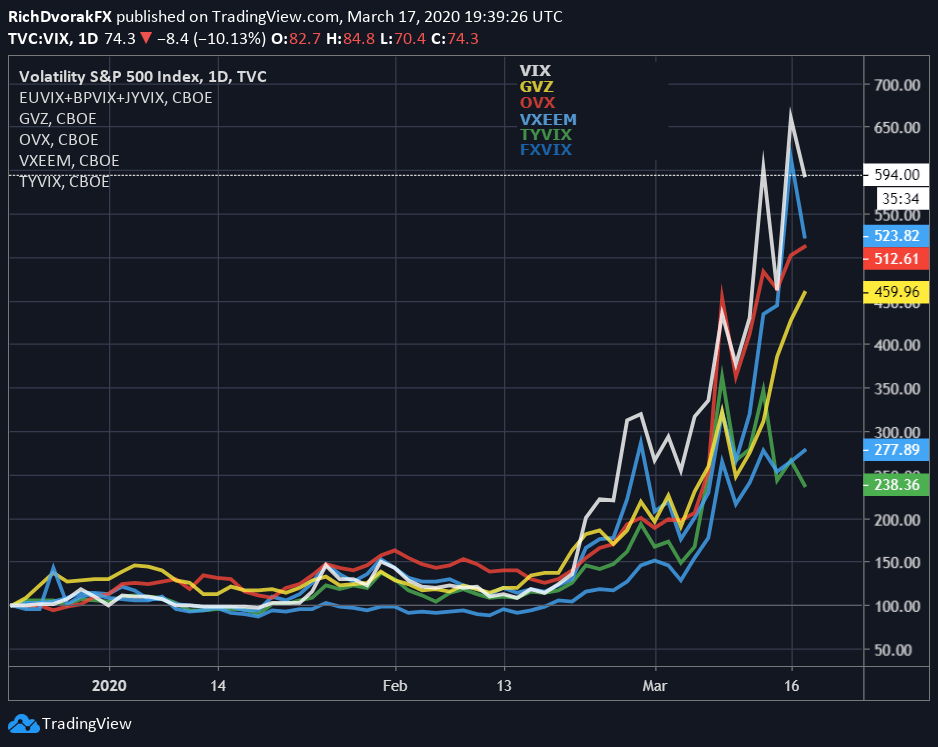

S And P 500 Surge 3 Gain On Trade War Tariff Relief

May 13, 2025

S And P 500 Surge 3 Gain On Trade War Tariff Relief

May 13, 2025 -

New York Islanders Claim Top Pick In Nhl Draft Lottery

May 13, 2025

New York Islanders Claim Top Pick In Nhl Draft Lottery

May 13, 2025 -

Nhl Draft Lottery 2024 Islanders Win Sharks In Second

May 13, 2025

Nhl Draft Lottery 2024 Islanders Win Sharks In Second

May 13, 2025 -

Commodities Teams Refocus Walleye Cuts Credit Impact On Core Groups

May 13, 2025

Commodities Teams Refocus Walleye Cuts Credit Impact On Core Groups

May 13, 2025

Latest Posts

-

Us Ipo Filing Klarna Reports Significant Revenue Jump 24

May 14, 2025

Us Ipo Filing Klarna Reports Significant Revenue Jump 24

May 14, 2025 -

Raducanu Splits With Coach After Two Week Trial

May 14, 2025

Raducanu Splits With Coach After Two Week Trial

May 14, 2025 -

Your Top Company News Monday At 1 Am Et

May 14, 2025

Your Top Company News Monday At 1 Am Et

May 14, 2025 -

Klarna Announces 24 Revenue Growth In Us Ipo Filing

May 14, 2025

Klarna Announces 24 Revenue Growth In Us Ipo Filing

May 14, 2025 -

Latest Company News Highlights Monday 1 Am Et

May 14, 2025

Latest Company News Highlights Monday 1 Am Et

May 14, 2025