Pakistan, Sri Lanka, Bangladesh Pledge Enhanced Capital Market Cooperation

Table of Contents

Specific Commitments to Enhanced Capital Market Cooperation

The pledge for enhanced capital market cooperation encompasses several key agreements designed to foster greater integration and collaboration. These commitments aim to unlock the considerable untapped potential within South Asian capital markets. Specifically, the participating nations have agreed to:

- Increased Information Sharing: Facilitating transparent and timely exchange of market data and regulatory information between Pakistan, Sri Lanka, and Bangladesh capital markets. This will improve investor confidence and understanding of regional investment opportunities.

- Regulatory Harmonization: Working towards aligning regulatory frameworks to minimize inconsistencies and create a more seamless investment environment across borders. This includes streamlining processes for cross-border investment and reducing bureaucratic hurdles.

- Investment Promotion: Jointly promoting investment opportunities within the region to attract both domestic and foreign capital. This will involve targeted marketing campaigns and collaborative initiatives to showcase investment-ready projects.

- Cross-border Investment Initiatives: Development of mechanisms to encourage and facilitate cross-border investments, particularly in areas such as infrastructure development, technology transfer, and renewable energy. Specific projects will be identified and supported through joint funding and technical assistance.

- Establishment of Joint Working Groups: The creation of dedicated working groups and committees composed of representatives from each country's regulatory bodies and capital market stakeholders to oversee implementation and monitor progress. These groups will address challenges and ensure effective cooperation.

These initiatives are designed to provide investors with increased liquidity, reduced risk, and greater opportunities for diversification within the South Asian market.

Benefits for Pakistan, Sri Lanka, and Bangladesh

The enhanced capital market cooperation promises substantial benefits across various sectors for all three participating nations:

Economic Growth and Development

The enhanced cooperation is projected to attract significant Foreign Direct Investment (FDI). Increased FDI will stimulate economic diversification, leading to job creation and sustainable economic growth. By opening up access to wider pools of capital, businesses in all three countries will be better positioned to expand and compete in the global market. This collaborative approach can lead to a substantial increase in GDP growth, potentially exceeding the current regional average.

Financial Inclusion

The initiative aims to improve access to financial services and investment opportunities for a broader segment of the population. By fostering a more inclusive financial ecosystem, the cooperation can help lift people out of poverty and improve overall standards of living. This includes initiatives to promote financial literacy and education, making investing more accessible to the general public.

Regional Stability and Integration

Strengthened financial ties between Pakistan, Sri Lanka, and Bangladesh will contribute to greater regional stability and integration. Improved economic cooperation will foster stronger political relationships, creating a more stable and predictable environment for investment and economic growth. The positive spillover effects could also extend to neighboring countries, promoting wider regional cooperation.

Challenges and Opportunities for Enhanced Capital Market Cooperation

While the potential benefits are significant, several challenges must be addressed to ensure the success of this initiative:

Regulatory Differences

Harmonizing regulations across different jurisdictions is a complex undertaking. Differences in accounting standards, corporate governance practices, and legal frameworks pose significant challenges. Overcoming these hurdles requires a commitment to progressive regulatory reforms and a willingness to adapt best practices.

Political and Economic Instability

Political and economic volatility in the region can hinder investment and create uncertainty for investors. Strategies for mitigating these risks include fostering political stability, strengthening macroeconomic fundamentals, and implementing robust risk management frameworks.

Infrastructure Development

Robust infrastructure, including reliable communication networks and efficient payment systems, is crucial for supporting increased cross-border transactions. Investments in infrastructure development are essential to facilitate the smooth flow of capital and information across the region.

Opportunities for Technological Advancement

Fintech and other technological advancements offer significant opportunities to enhance efficiency and transparency within the South Asian capital markets. Leveraging technologies like blockchain and AI can help streamline processes, reduce costs, and improve overall market functionality.

A New Era of Capital Market Cooperation in South Asia

The pledge for enhanced capital market cooperation marks a significant step towards greater regional economic integration. The agreements focused on information sharing, regulatory harmonization, and investment promotion hold the potential to unlock substantial economic benefits for Pakistan, Sri Lanka, and Bangladesh. This initiative promises to attract more FDI, stimulate job creation, and foster financial inclusion across the region. By addressing the challenges and leveraging opportunities, these nations can create a thriving and integrated South Asian capital market. Stay informed about the development of this crucial initiative for enhanced capital market cooperation in South Asia and explore the numerous investment opportunities emerging from this collaborative effort.

Featured Posts

-

Stock Market Valuations Bof As Reassuring View For Investors

May 10, 2025

Stock Market Valuations Bof As Reassuring View For Investors

May 10, 2025 -

Jesse Watters Faces Backlash Hypocrisy Claims After Wife Cheating Joke

May 10, 2025

Jesse Watters Faces Backlash Hypocrisy Claims After Wife Cheating Joke

May 10, 2025 -

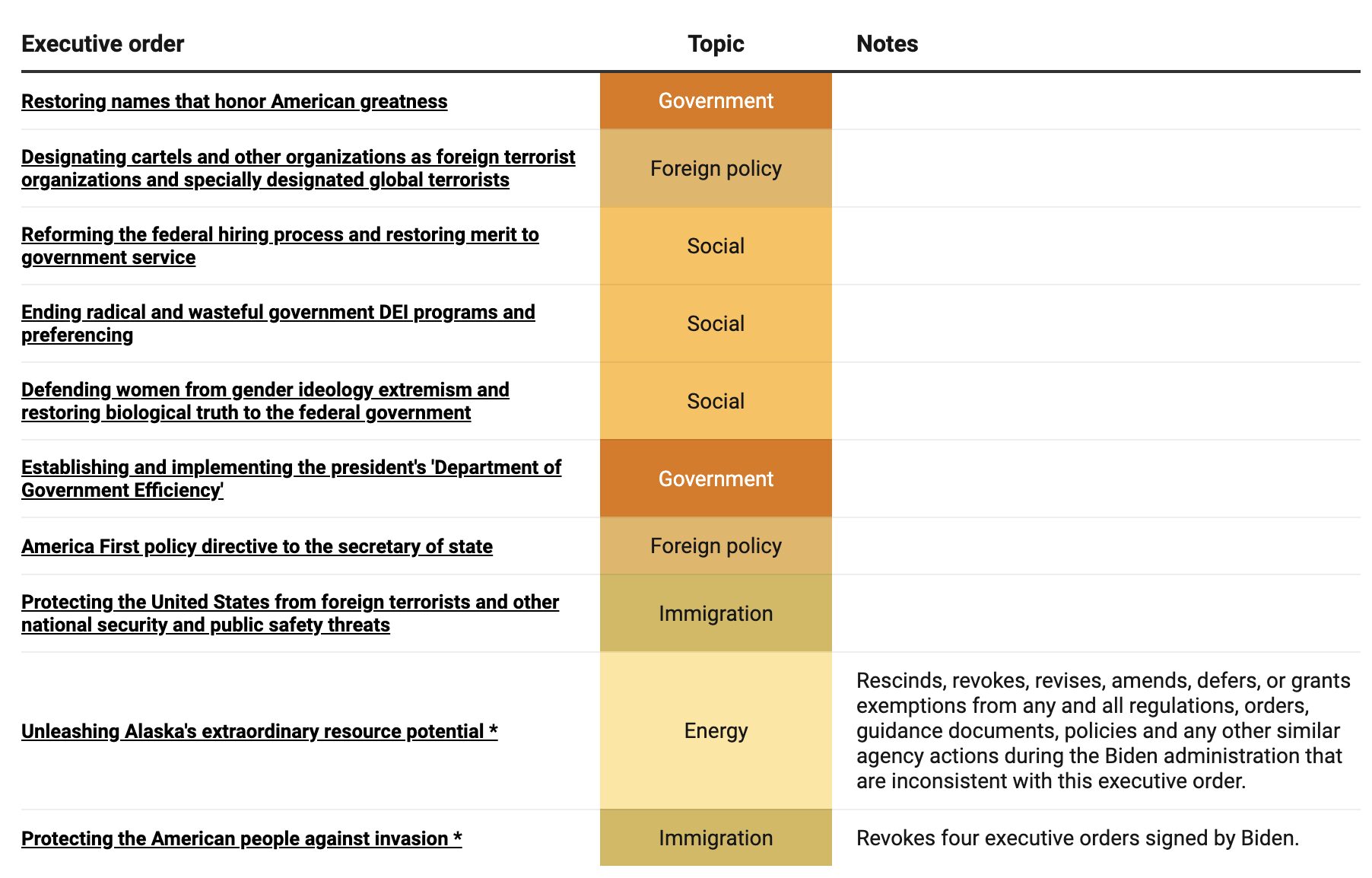

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025 -

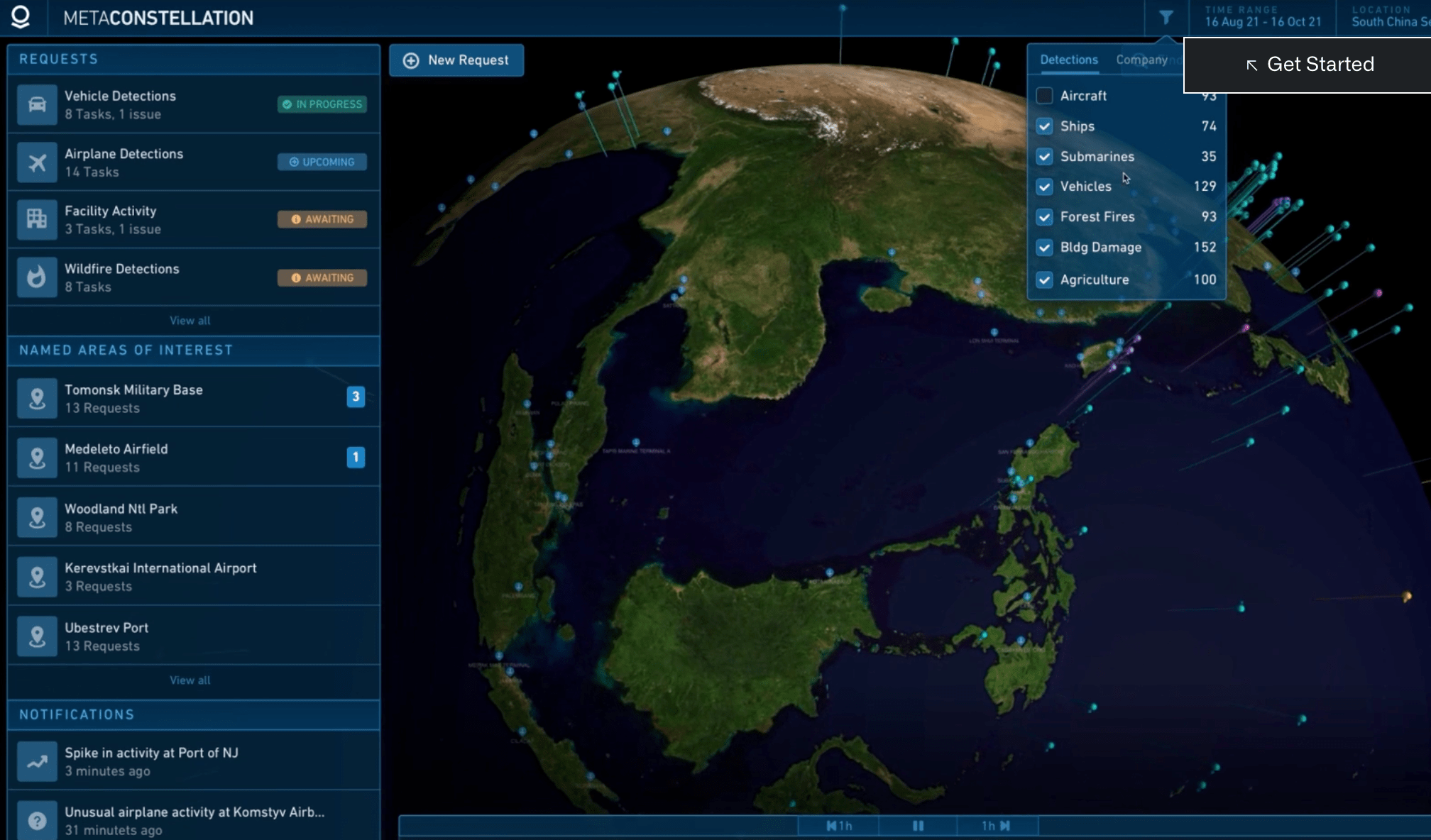

Palantir Stock A Pre May 5th Investment Analysis Based On Wall Streets View

May 10, 2025

Palantir Stock A Pre May 5th Investment Analysis Based On Wall Streets View

May 10, 2025 -

Analyzing Palantir Stock Pltr Before May 5th Risks And Rewards

May 10, 2025

Analyzing Palantir Stock Pltr Before May 5th Risks And Rewards

May 10, 2025