Pakistan Stock Market Crash: Operation Sindoor Triggers KSE 100 Plunge

Table of Contents

What is Operation Sindoor and its Impact on Investor Sentiment?

"Operation Sindoor," a government-led initiative aimed at cracking down on alleged market manipulation and illicit activities within the PSX, is widely considered a primary catalyst for the recent KSE 100 crash. While the operation's objectives were ostensibly to improve market integrity and transparency, its execution significantly impacted investor confidence and fueled market volatility. The abrupt and somewhat opaque nature of the operation instilled uncertainty and fear among investors.

- Increased regulatory scrutiny leading to uncertainty: The intensified scrutiny created an environment of doubt, making investors hesitant to commit further capital.

- Crackdown on specific sectors, impacting their stock performance: Targeted actions against certain sectors led to a disproportionate decline in their respective stock values, triggering a domino effect across the market.

- Rumors and speculation fueled by the operation: The lack of clear communication surrounding the operation's scope and methodology led to widespread speculation and rumors, further exacerbating negative sentiment and driving down the KSE 100. This negative sentiment contributed significantly to the overall market instability.

Analyzing the KSE 100 Plunge: Key Contributing Factors Beyond Operation Sindoor

While Operation Sindoor played a significant role in the KSE 100 plunge, other macroeconomic factors contributed to the severity of the decline. These interwoven issues created a perfect storm that significantly impacted investor confidence and market stability.

- Rising inflation and its impact on consumer spending: Soaring inflation eroded consumer purchasing power, dampening demand and impacting the profitability of many listed companies.

- Political instability and its effect on foreign investment: Political uncertainty often deters foreign investment, a crucial component of Pakistan's economy. This uncertainty further destabilized the market.

- Depreciation of the Pakistani Rupee against the US dollar: The weakening of the Pakistani Rupee against major currencies increased the cost of imports and further strained the economy, impacting business confidence and investor sentiment. This macroeconomic instability played a significant part in the KSE 100 crash.

The Ripple Effects: Impact on Investors and the Pakistani Economy

The KSE 100 crash has had far-reaching consequences, impacting both individual investors and the broader Pakistani economy. The ripple effects are substantial and will likely be felt for some time.

- Impact on retirement savings and investment portfolios: Many individual investors experienced significant losses in their retirement savings and investment portfolios, leading to financial hardship for some.

- Reduced government revenue due to lower market activity: The decline in market activity directly impacted government revenue through reduced taxes and transaction fees.

- Potential impact on foreign direct investment (FDI): The market crash could further deter foreign direct investment, hindering economic growth and development in the long term. The overall market capitalization decline also signals a loss of confidence in the Pakistani economy.

Conclusion: Navigating the Aftermath of the Pakistan Stock Market Crash

The KSE 100 plunge was a multifaceted event, with Operation Sindoor acting as a significant trigger alongside prevailing macroeconomic headwinds. The impact on individual investors and the Pakistani economy is substantial, underscoring the need for careful navigation of the market's volatility. While the future remains uncertain, understanding the contributing factors to this KSE 100 crash is crucial for informed decision-making. The road to recovery will require addressing the underlying economic challenges and restoring investor confidence. Stay informed about the Pakistan stock market outlook, develop robust investment strategies, and monitor the KSE 100 recovery closely. Informed investing, especially in the context of future "Operation Sindoor"-like events, is key to mitigating risk and navigating the complexities of the Pakistan stock market.

Featured Posts

-

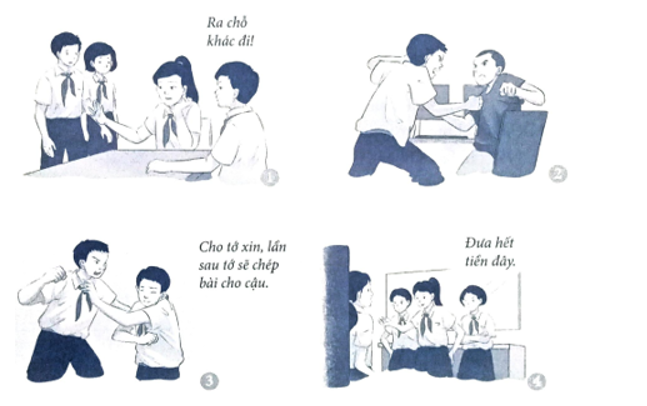

Xu Ly Nghiem Hanh Vi Bao Hanh Tre Em O Cac Co So Giu Tre Tu Nhan Can Nhung Bien Phap Nao

May 09, 2025

Xu Ly Nghiem Hanh Vi Bao Hanh Tre Em O Cac Co So Giu Tre Tu Nhan Can Nhung Bien Phap Nao

May 09, 2025 -

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 09, 2025

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 09, 2025 -

Stock Market Prediction Outperforming Palantir In 3 Years Two Top Picks

May 09, 2025

Stock Market Prediction Outperforming Palantir In 3 Years Two Top Picks

May 09, 2025 -

Nyt Strands Game 366 Hints And Answers For March 4th

May 09, 2025

Nyt Strands Game 366 Hints And Answers For March 4th

May 09, 2025 -

Is Apples Ai Development Keeping Pace A Look At The Competition

May 09, 2025

Is Apples Ai Development Keeping Pace A Look At The Competition

May 09, 2025