Palantir Stock Q1 2024 Earnings: Government And Commercial Business Trends

Table of Contents

Government Contracts: Fueling Palantir's Growth Engine

Increased Spending on National Security

Increased government spending on national security initiatives is a major catalyst for Palantir's growth. The rising geopolitical landscape and the need for advanced data analytics are driving significant investment in technology solutions like Palantir's.

- Examples of significant government contracts awarded: While specific contract details are often confidential, Palantir has publicly announced significant wins with various government agencies, including those focused on intelligence gathering, cybersecurity, and defense modernization. These contracts often involve multi-year agreements, ensuring a steady stream of revenue.

- Projected future spending in this sector: Government forecasts consistently project substantial increases in defense and national security budgets in the coming years, indicating a positive outlook for Palantir's government business. This continued investment is crucial for sustaining Palantir's growth trajectory.

- Analysis of Palantir's market share: Palantir holds a strong position in the government data analytics market, leveraging its proven platform and strong relationships with key agencies. Maintaining and expanding this market share will be key to its continued success. Keyword Focus: Government contracts, National Security, Defense spending, Palantir Government

Expanding Beyond Traditional Defense

Palantir is actively expanding its reach beyond traditional defense contracts, targeting other government sectors where data analytics can deliver significant value.

- Specific examples of contracts outside of traditional defense: Palantir has demonstrated success in securing contracts with agencies focused on healthcare, intelligence, and cybersecurity. These diverse applications showcase the adaptability of Palantir's platform.

- Analysis of market potential in these sectors: The market potential for data analytics within healthcare, intelligence, and cybersecurity is vast. Palantir's ability to leverage its existing platform and expertise across these sectors is a significant competitive advantage.

- Discussion of Palantir's platform adaptability: Palantir Foundry's modular architecture allows for easy integration and adaptation to the unique needs of various government agencies, enabling scalability and efficient deployment across diverse sectors. Keyword Focus: Cybersecurity, Healthcare IT, Intelligence agencies, Palantir Foundry

Commercial Sector: Driving Long-Term Sustainability

Growth in Key Commercial Verticals

Palantir's commercial sector is demonstrating significant growth across key verticals, signifying the increasing adoption of its data analytics platform in the private sector.

- Examples of successful commercial partnerships: Palantir has established partnerships with major players in finance, energy, and healthcare, deploying its platform to address critical data challenges and improve operational efficiency.

- Discussion of revenue growth in these sectors: The commercial sector is contributing increasingly to Palantir's overall revenue, showcasing the expanding market demand for its solutions. Further growth in these sectors is essential for achieving long-term sustainability.

- Challenges faced in the commercial market: Competition in the commercial market is fierce. Palantir needs to continually innovate and adapt its platform to meet evolving customer needs and compete effectively with other data analytics providers. Keyword Focus: Commercial partnerships, Financial services, Energy sector, Healthcare analytics, Palantir Gotham

Platform Adoption and Scalability

The scalability and ease of adoption of Palantir's platforms are key drivers of commercial growth.

- Discuss the ease of integration, cost-effectiveness, and return on investment for commercial clients: Palantir's focus on user-friendly interfaces and efficient data integration helps to reduce implementation time and costs, improving the overall ROI for its commercial clients.

- Highlight successful case studies: Showcasing successful case studies demonstrating the tangible benefits of using Palantir's platforms is critical for attracting new commercial partners. These case studies should highlight cost savings, efficiency improvements, and other measurable results.

- Keyword Focus: Platform adoption, Scalability, ROI, Case studies, Palantir Foundry

Overall Financial Performance and Stock Outlook

Key Financial Metrics

Palantir's Q1 2024 earnings report will provide crucial insights into the company's financial performance.

- Comparison to previous quarters: Analyzing the Q1 2024 results against previous quarters will reveal trends in revenue growth, profitability, and overall financial health.

- Analysis of year-over-year growth: Year-over-year comparisons will highlight the overall growth trajectory and provide a clearer picture of the company's long-term performance.

- Discussion of potential future financial performance: Based on Q1 results and current market trends, analysts will offer projections for future financial performance, providing valuable information for investors. Keyword Focus: Revenue growth, EPS, Profitability, Financial performance, Palantir stock price

Investor Sentiment and Market Predictions

Investor sentiment towards Palantir stock will be significantly impacted by the Q1 2024 earnings report.

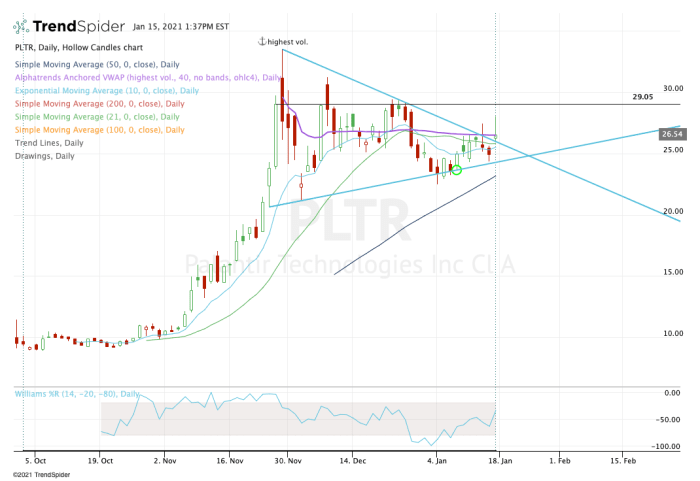

- Mention any recent stock price fluctuations: Recent stock price movements will reflect investor anticipation and reaction to news and market trends leading up to the earnings announcement.

- Discuss potential risks and opportunities: Investors should carefully consider potential risks and opportunities associated with investing in Palantir stock. Analyzing market conditions and the company's competitive landscape is essential.

- Provide an overall outlook based on Q1 results: The Q1 results will shape the overall market outlook for Palantir stock, influencing future investment decisions. Keyword Focus: Investor sentiment, Stock price prediction, Market analysis, Risk assessment, Palantir investment

Conclusion

Palantir's Q1 2024 earnings report is expected to provide valuable insights into the company's performance across both its government and commercial sectors. While the government sector remains a strong driver of revenue, the growth of the commercial segment is crucial for long-term sustainability. The success of Palantir's platform adoption, scalability, and expansion into new sectors will be key indicators of future growth. Analysis of key financial metrics and investor sentiment will ultimately determine the outlook for Palantir stock.

Stay updated on Palantir stock and its future performance by following our analysis and continuing your research into Palantir's Q1 2024 earnings to make informed investment decisions. Learn more about the trends shaping Palantir Technologies and its impact on the market. The future performance of Palantir stock hinges on the continued success of its platform and its ability to capture growth in both the government and commercial sectors.

Featured Posts

-

Investing In Palantir Stock Before May 5th A Comprehensive Guide

May 09, 2025

Investing In Palantir Stock Before May 5th A Comprehensive Guide

May 09, 2025 -

Benson Boone Denies Copying Harry Styles A Detailed Look

May 09, 2025

Benson Boone Denies Copying Harry Styles A Detailed Look

May 09, 2025 -

Oilers Vs Sharks Prediction Picks And Odds For Tonights Nhl Game

May 09, 2025

Oilers Vs Sharks Prediction Picks And Odds For Tonights Nhl Game

May 09, 2025 -

Suncors Record Production Inventory Build Impacts Sales Volumes

May 09, 2025

Suncors Record Production Inventory Build Impacts Sales Volumes

May 09, 2025 -

Young Thugs New Music Hints At Commitment And Regret

May 09, 2025

Young Thugs New Music Hints At Commitment And Regret

May 09, 2025