Post-Record High: Frankfurt's DAX Shows Stability At Market Open

Table of Contents

Factors Contributing to DAX Stability Post-Record High

Several factors contribute to the Frankfurt DAX's surprising stability following its recent record highs. Let's explore the key elements influencing this market performance.

Resilience of German Corporate Earnings

Strong corporate performance is a cornerstone of the DAX's stability.

- Strong Q3 earnings reports from major DAX companies: Many leading German companies have reported robust earnings for the third quarter of [insert current year], exceeding analysts' expectations. This positive trend demonstrates the underlying strength of the German economy.

- Positive economic outlook for German businesses: Surveys and forecasts indicate continued optimism among German businesses regarding future growth prospects. This confidence translates into increased investment and hiring, further bolstering market stability.

- Increased consumer spending and confidence: Despite inflationary pressures, German consumer spending remains relatively strong, indicating a resilient domestic market. High consumer confidence supports business growth and overall economic stability.

- Robust export performance despite global uncertainties: Germany, as a major exporter, has managed to maintain strong export performance even amidst global economic headwinds. This highlights the competitiveness of German goods and services in the international market.

The financial health of leading DAX companies, such as Volkswagen, Siemens, and BASF, significantly impacts the overall market stability. Their consistent performance and positive growth outlooks provide a strong foundation for the DAX's resilience.

Influence of Global Economic Indicators

Global economic indicators also play a significant role in influencing the DAX's performance.

- Current global interest rate situations: The current interest rate environment, while presenting challenges, hasn't severely impacted the DAX's stability, suggesting a degree of resilience to external pressures. This stability may be partly due to the strength of the German economy.

- Impact of inflation rates on the DAX: While inflation remains a concern globally, its impact on the DAX has been relatively muted, perhaps indicating that investors are confident in the German economy's ability to navigate these challenges.

- Role of geopolitical factors and their impact on the German economy: Geopolitical instability always presents a risk, but the DAX's stability suggests that, for now, the German economy is weathering these external storms. The impact of geopolitical factors needs to be continuously monitored.

- Positive news from global markets: Positive developments in other major global markets can also contribute to a more optimistic outlook, indirectly supporting the DAX's stability. Positive news from the US market, for example, frequently has a positive ripple effect.

Careful analysis of these global economic indicators is crucial to understanding the DAX's performance and predicting its future trajectory.

Investor Sentiment and Market Behavior

Investor sentiment and market behavior are crucial factors influencing the DAX's current position.

- Investor confidence levels and their trading activities: High investor confidence, reflected in sustained trading volumes, suggests a belief in the long-term prospects of the German economy and the DAX.

- Analysis of trading volumes and their significance: Consistent and healthy trading volumes indicate strong market liquidity and investor engagement, contributing to the DAX's stability.

- Notable shifts in investor sentiment: While there might be short-term fluctuations, the overall investor sentiment remains relatively positive, suggesting confidence in the DAX's long-term growth.

- Role of short-term and long-term investments: A balanced mix of short-term and long-term investments in the DAX suggests a sustainable market with a variety of investor approaches.

Expert opinions on market trends generally reflect a cautious optimism, with many analysts acknowledging the potential for volatility while highlighting the underlying strength of the German economy.

Implications for Investors and Future Outlook

The current stability of the DAX, while promising, doesn't guarantee continued smooth sailing. Investors need to consider both opportunities and potential risks.

Investment Strategies in a Stable-Yet-Volatile Market

Navigating a market that's both stable and potentially volatile requires a nuanced investment strategy.

- Diversification: Diversifying your portfolio across various sectors within the DAX and even beyond the German market is crucial to mitigate risk.

- Risk management: Employing effective risk management techniques, such as setting stop-loss orders, is essential to protect your investments from potential market downturns.

- Specific sectors exhibiting strength within the DAX: Identifying sectors showing particular strength (e.g., technology, automotive) can offer targeted investment opportunities.

- Long-term growth versus short-term gains: A long-term investment strategy is generally recommended for the DAX, given its potential for growth, but keeping an eye on short-term market fluctuations is equally important.

- Conservative vs. aggressive strategies: The choice between a conservative or aggressive strategy depends largely on your risk tolerance and investment timeline. Conservative strategies might focus on established, stable companies, while aggressive strategies might involve higher-risk, higher-reward investments.

Careful consideration of these aspects is crucial for developing a successful investment strategy in the current market environment.

Potential Risks and Challenges Ahead

While the current outlook is positive, it's important to acknowledge potential risks.

- Global recession: The possibility of a global recession poses a significant threat to the DAX's stability.

- Energy crisis: The ongoing energy crisis in Europe, particularly impacting Germany, presents a considerable economic challenge.

- Political instability: Geopolitical uncertainties and potential political instability can negatively affect investor sentiment and market performance.

- Impact of potential changes in interest rates: Future interest rate hikes could impact investor behavior and market performance.

- Vulnerabilities within the German economy: While the German economy is robust, it's not immune to economic vulnerabilities.

- Impact of technological disruptions: Rapid technological advancements and disruptions could impact specific sectors within the DAX.

A balanced perspective that acknowledges these risks is essential for making informed investment decisions.

Conclusion

The Frankfurt DAX's stability following its record highs is a complex phenomenon influenced by strong corporate earnings, global economic indicators, and investor sentiment. While the current outlook seems positive, investors should adopt a well-diversified investment strategy incorporating effective risk management techniques. Understanding the potential risks alongside the opportunities is crucial for navigating this dynamic market.

Call to Action: Stay informed about the fluctuating Frankfurt DAX and its implications for your investment strategy. Regularly monitor market trends, analyze economic indicators, and consult with financial advisors to make informed decisions regarding your investments in the German stock market and the DAX. Understand the intricacies of the DAX index and its performance to maximize your returns. Don't hesitate to deepen your understanding of the Frankfurt DAX and its influence on global markets.

Featured Posts

-

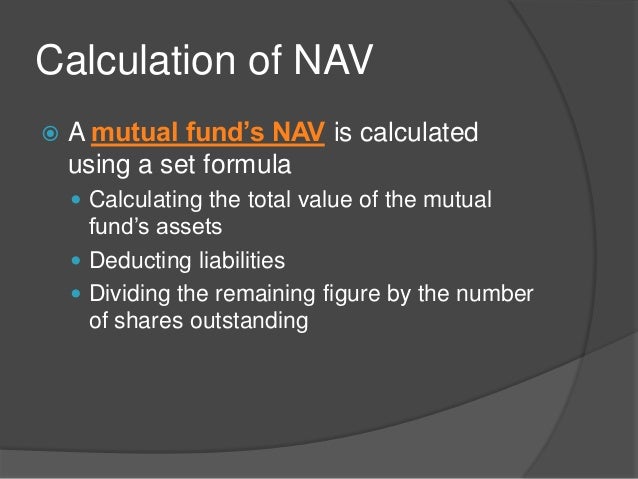

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value

May 24, 2025 -

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 24, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 24, 2025 -

A Realistic Look At Escaping To The Country Pros And Cons

May 24, 2025

A Realistic Look At Escaping To The Country Pros And Cons

May 24, 2025 -

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Annie Kilner Runs Errands After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Runs Errands After Kyle Walkers Night Out

May 24, 2025

Latest Posts

-

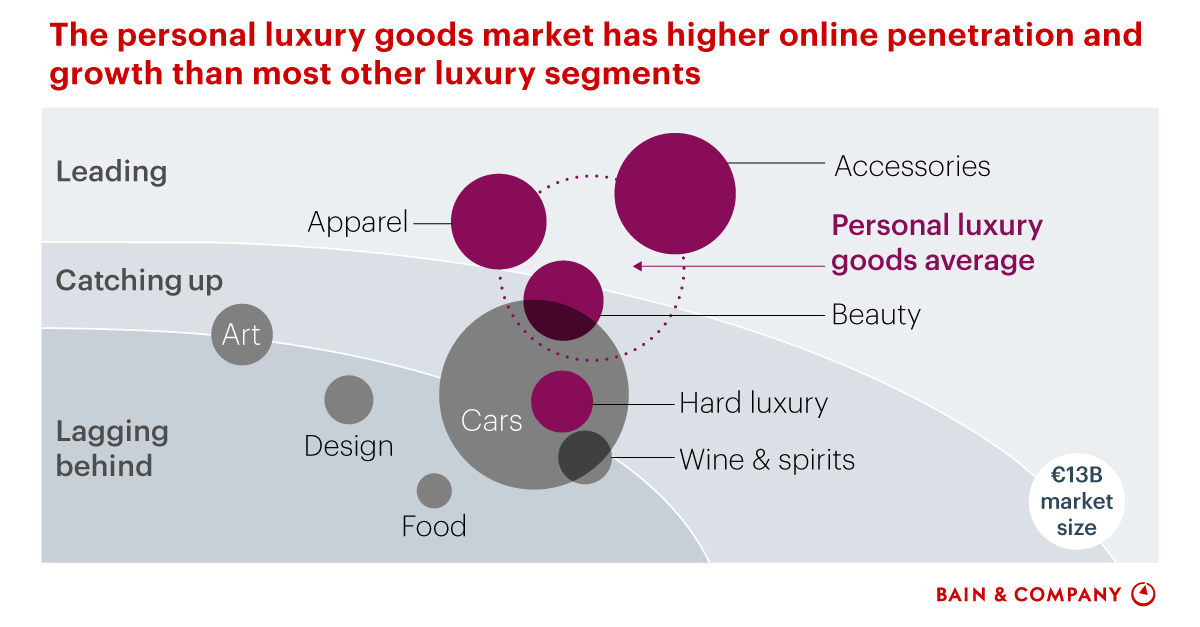

Analysis How The Luxury Goods Recession Affects Paris

May 24, 2025

Analysis How The Luxury Goods Recession Affects Paris

May 24, 2025 -

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025

Pariss Economy Suffers As Luxury Sector Contracts

May 24, 2025 -

The Impact Of The Luxury Goods Crisis On Pariss Economy

May 24, 2025

The Impact Of The Luxury Goods Crisis On Pariss Economy

May 24, 2025 -

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025 -

Luxury Sector Slump The Economic Repercussions For Paris

May 24, 2025

Luxury Sector Slump The Economic Repercussions For Paris

May 24, 2025