U.S. Federal Reserve: Rate Decision And The Mounting Economic Challenges

Table of Contents

The Current Economic Landscape: Inflation and Recessionary Fears

The U.S. economy is currently grappling with a complex interplay of high inflation and recessionary fears. Inflation, measured by the Consumer Price Index (CPI), remains stubbornly elevated, significantly impacting consumer spending and business investment. This persistent inflation, fueled by factors like supply chain disruptions and strong consumer demand post-pandemic, has eroded purchasing power and dampened economic confidence. The Federal Reserve's target inflation rate of 2% is far from being met, forcing the central bank to take decisive action.

The possibility of a recession looms large. While GDP growth has shown some resilience, several indicators point towards a potential slowdown. These include weakening consumer confidence, inverted yield curves (a classic recessionary predictor), and a slowing manufacturing sector. The labor market, while still relatively strong, exhibits mixed signals: unemployment remains low, but job growth is moderating.

- High inflation erodes purchasing power, forcing consumers to cut back on discretionary spending.

- Supply chain disruptions, though easing, continue to impact the prices of many goods and services.

- Consumer confidence is wavering as individuals grapple with higher prices and uncertainty about the future.

- The labor market shows mixed signals; while unemployment remains low, job growth is slowing, indicating potential future weakness.

The Federal Reserve's Rate Hike Decision: Rationale and Implications

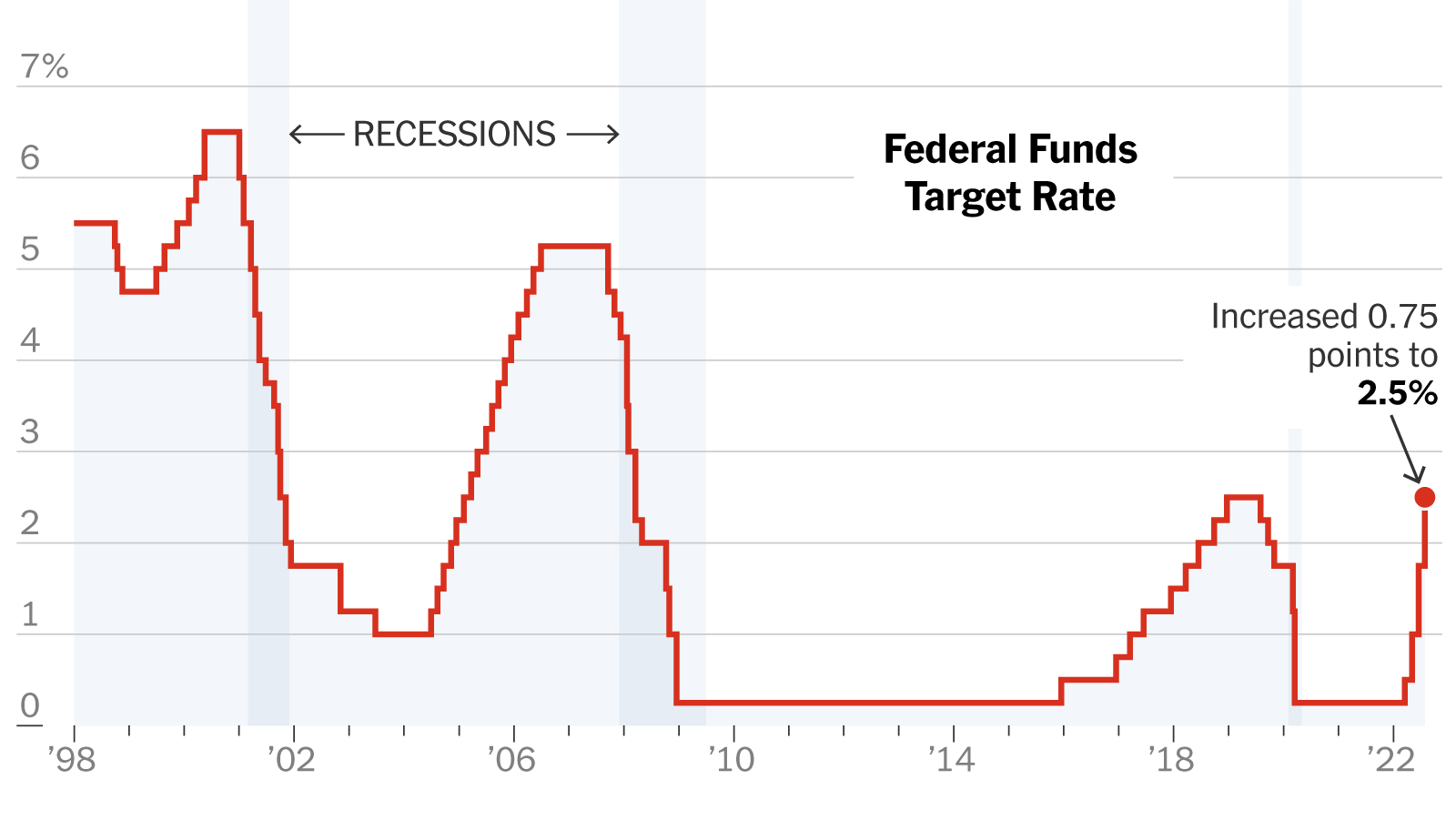

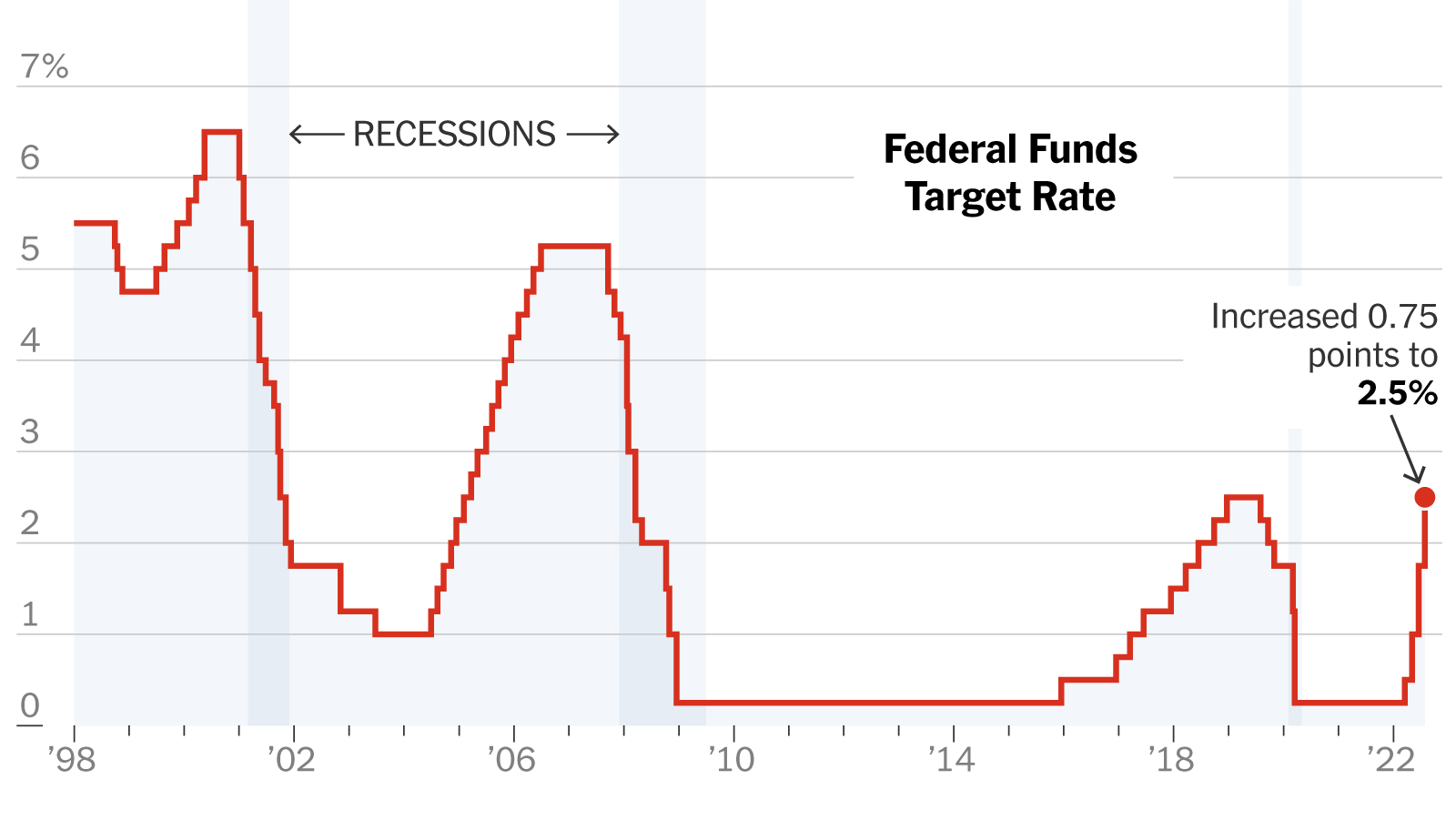

In response to the persistent inflation, the Federal Reserve recently announced another interest rate hike. This decision reflects the Fed's commitment to its dual mandate: controlling inflation and maximizing employment. The rationale behind the rate hike is straightforward: by increasing borrowing costs, the Fed aims to cool down the economy and curb inflation. Higher interest rates make it more expensive for businesses to invest and for consumers to borrow, thus reducing overall demand.

The magnitude of the rate hike and its timing were carefully considered. The Fed's communication strategy, often expressed through press releases and the Chairman's speeches, plays a crucial role in shaping market expectations and influencing investor behavior. However, raising interest rates carries inherent risks. A rate hike too large or too rapid could trigger a recession by significantly dampening economic activity.

- The magnitude of the rate hike reflects the Fed's assessment of the inflation threat and its confidence in the economy's resilience.

- The Fed's communication strategy is designed to manage market expectations and minimize volatility.

- Potential unintended consequences of the rate hike include reduced investment, slower economic growth, and increased unemployment.

- This recent decision must be compared to previous interest rate decisions to understand the evolving approach of the Federal Reserve in managing inflation.

Global Economic Impacts of the U.S. Federal Reserve's Actions

The U.S. Federal Reserve's actions don't stay confined to the U.S. Its decisions have significant global implications through "spillover effects." Higher U.S. interest rates attract foreign investment, increasing demand for the U.S. dollar and strengthening its value. This can make imports cheaper for Americans but more expensive for other countries, impacting their trade balances and potentially slowing their economic growth. Emerging markets, particularly those with high levels of dollar-denominated debt, are particularly vulnerable to these spillover effects.

- Impact on emerging markets: Higher interest rates can lead to capital flight from emerging markets, causing currency depreciation and financial instability.

- Effect on the value of the U.S. dollar: A stronger dollar makes U.S. exports more expensive and imports cheaper, impacting trade balances globally.

- International trade implications: Changes in exchange rates due to U.S. monetary policy can significantly impact international trade flows and global competitiveness.

- Coordination with other central banks: International cooperation among central banks is crucial to mitigate the potential negative spillover effects of U.S. monetary policy.

Alternative Monetary Policy Options Considered by the Fed

The Federal Reserve considered alternative monetary policy options before deciding on the interest rate hike. These options might have included different magnitudes of rate increases, or a continuation of quantitative easing (QE) programs to inject liquidity into the market. However, given the persistence of inflation, the Fed ultimately deemed the interest rate hike the most appropriate course of action to achieve its inflation target while maintaining employment stability.

Conclusion

The U.S. Federal Reserve's interest rate decision is a critical event with far-reaching consequences for the U.S. and global economies. Understanding the current economic challenges, the Fed's rationale for its actions, and the potential ripple effects is crucial for businesses, investors, and individuals alike. The ongoing battle against inflation and the risk of recession necessitate close monitoring of the U.S. Federal Reserve interest rate and its future decisions. Stay informed about further developments concerning the U.S. Federal Reserve interest rate to navigate the complexities of the evolving economic landscape effectively. Regularly check reputable financial news sources for updates on the U.S. Federal Reserve's policy decisions and their impact on the economy. Understanding the implications of the U.S. Federal Reserve interest rate is key to making sound financial decisions in these uncertain times.

Featured Posts

-

The Luis Enrique Era A Winning Strategy For Paris Saint Germain

May 10, 2025

The Luis Enrique Era A Winning Strategy For Paris Saint Germain

May 10, 2025 -

Credit Suisse Whistleblower Reward Up To 150 Million To Be Shared

May 10, 2025

Credit Suisse Whistleblower Reward Up To 150 Million To Be Shared

May 10, 2025 -

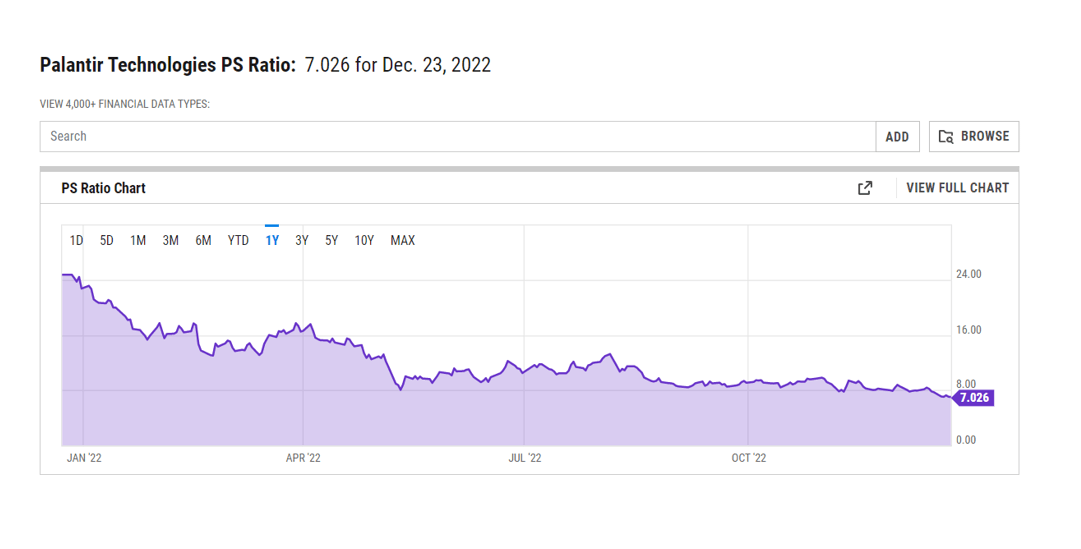

Is A Trillion Dollar Palantir Possible By 2030 An In Depth Analysis

May 10, 2025

Is A Trillion Dollar Palantir Possible By 2030 An In Depth Analysis

May 10, 2025 -

The Effects Of Trumps Policies On The Transgender Population A Call For Voices

May 10, 2025

The Effects Of Trumps Policies On The Transgender Population A Call For Voices

May 10, 2025 -

Should You Invest In Palantir Stock Before May 5th Earnings Report

May 10, 2025

Should You Invest In Palantir Stock Before May 5th Earnings Report

May 10, 2025