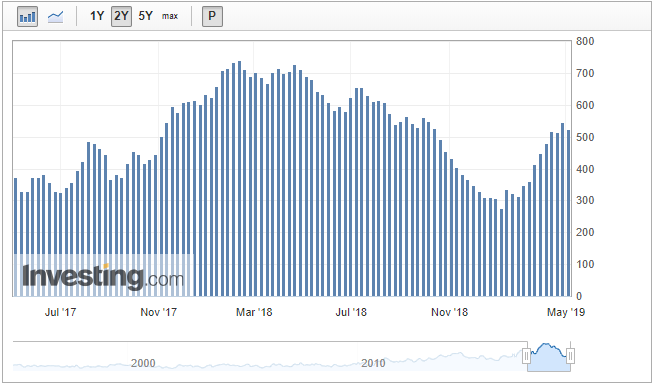

Sensex Rally: Which Stocks Gained Over 10% On BSE Today?

Table of Contents

Top Performing Stocks on BSE Today (Gain > 10%)

The Sensex rally has created a wave of positive momentum, with numerous stocks experiencing significant gains. Below are some of the top performers on the BSE today, showcasing those that achieved a remarkable increase of more than 10%:

-

Reliance Industries (RELIANCE.NS): [Insert Percentage]% gain. This energy and materials giant's surge might be attributed to [Insert brief reason, e.g., strong quarterly earnings and positive outlook for the petrochemical sector]. Keywords: RELIANCE.NS, Reliance Industries, Energy Sector, Stock Performance, BSE Stock.

-

Infosys (INFY.NS): [Insert Percentage]% gain. The technology sector leader's impressive performance could be linked to [Insert brief reason, e.g., positive client wins and strong revenue projections]. Keywords: INFY.NS, Infosys, IT Sector, Technology Stocks, Stock Market India.

-

HDFC Bank (HDFCBANK.NS): [Insert Percentage]% gain. This leading banking institution's rise might stem from [Insert brief reason, e.g., positive sentiment towards the financial sector and strong loan growth]. Keywords: HDFCBANK.NS, HDFC Bank, Banking Sector, Financial Stocks, BSE Top Gainers.

-

Tata Consultancy Services (TCS.NS): [Insert Percentage]% gain. This IT services giant likely benefited from [Insert brief reason, e.g., increased demand for its services in the global market]. Keywords: TCS.NS, Tata Consultancy Services, IT Services, Technology Stocks, India Stock Market.

-

Hindustan Unilever Limited (HINDUNILVR.NS): [Insert Percentage]% gain. This FMCG (Fast-Moving Consumer Goods) major likely saw gains due to [Insert brief reason, e.g., strong brand performance and positive consumer sentiment]. Keywords: HINDUNILVR.NS, Hindustan Unilever, FMCG Sector, Consumer Goods, Stock Price Increase.

(Repeat this format for 5-10 top-performing stocks.) Remember to replace the bracketed information with actual data.

Analysis of the Sensex Rally – Underlying Factors

The significant Sensex rally today isn't an isolated event; several factors likely contributed to this positive market sentiment. A comprehensive analysis reveals the following potential drivers:

-

Positive Global Market Trends: Positive global economic indicators and a generally upbeat sentiment in international markets often spill over into the Indian stock market, influencing investor confidence.

-

Strong Economic News from India: Positive data releases regarding [Insert specific economic data e.g., GDP growth, inflation figures] can significantly boost investor confidence and drive up stock prices.

-

Government Policies and Announcements: Supportive government policies and positive announcements related to infrastructure development or economic reforms can create a positive environment for investment.

-

Sector-Specific Performance: The strong performance of specific sectors, such as technology or financials, can significantly impact the overall Sensex performance. Today's rally appears to be partly driven by strong performance in the [Insert sector e.g., technology and financial] sectors. Keywords: Market Analysis, Economic Indicators, Investor Sentiment, Global Markets, Policy Impact, Sensex Movement.

Identifying Potential Investment Opportunities – Cautious Optimism

While the Sensex rally presents potential investment opportunities, it's crucial to approach them with cautious optimism. The market's volatility necessitates a balanced perspective.

-

Due Diligence is Key: Before investing in any stock, thorough research and due diligence are essential. Understanding a company's financials, its competitive landscape, and its future prospects is critical.

-

Risk Management: Diversification is a cornerstone of sound investment strategy. Spreading investments across different stocks and sectors can help mitigate risk.

-

Resources for Research: Reputable financial news websites, analyst reports, and company filings provide valuable information for investment decisions.

Disclaimer:

The information provided in this article is for educational purposes only and should not be construed as financial advice. Investment decisions should always be made after consulting with a qualified financial advisor.

Sensex Rally Highlights Top Performing BSE Stocks – Your Next Steps

Today's Sensex rally underscores the dynamic nature of the Indian stock market, with several stocks demonstrating remarkable growth. The top-performing stocks highlighted above—driven by a combination of global trends, positive economic news, and sector-specific performance—illustrate the opportunities and challenges inherent in investing. Remember that understanding market trends and conducting thorough research are crucial steps before making any investment decisions. Stay informed about the daily Sensex rally and continue monitoring these high-performing BSE stocks for potential investment opportunities. Conduct your due diligence and make informed decisions based on your risk tolerance and investment goals.

Featured Posts

-

Understanding Indian Crypto Exchange Compliance A Practical Overview

May 15, 2025

Understanding Indian Crypto Exchange Compliance A Practical Overview

May 15, 2025 -

Impact Of Congos Cobalt Export Ban Awaiting The New Quota System

May 15, 2025

Impact Of Congos Cobalt Export Ban Awaiting The New Quota System

May 15, 2025 -

Goldman Sachs Deciphers Trumps Preferred Oil Price Range

May 15, 2025

Goldman Sachs Deciphers Trumps Preferred Oil Price Range

May 15, 2025 -

Everest Ascent In A Week Anesthetic Gas Risks And Criticisms

May 15, 2025

Everest Ascent In A Week Anesthetic Gas Risks And Criticisms

May 15, 2025 -

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Automakers

May 15, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Automakers

May 15, 2025

Latest Posts

-

Deep Dive Microsofts Extensive Layoff Of 6 000 Workers

May 15, 2025

Deep Dive Microsofts Extensive Layoff Of 6 000 Workers

May 15, 2025 -

Microsofts 6 000 Employee Layoffs What We Know

May 15, 2025

Microsofts 6 000 Employee Layoffs What We Know

May 15, 2025 -

Microsoft Layoffs Over 6 000 Employees Affected

May 15, 2025

Microsoft Layoffs Over 6 000 Employees Affected

May 15, 2025 -

Androids Design Evolution A Deep Dive Into The New Look

May 15, 2025

Androids Design Evolution A Deep Dive Into The New Look

May 15, 2025 -

Exploring Androids Refreshed User Interface

May 15, 2025

Exploring Androids Refreshed User Interface

May 15, 2025