Stock Market Update: European Shares Gain Amidst Tariff Relief Talk, LVMH Drop

Table of Contents

European Market Gains Driven by Tariff Relief Hopes

Easing Trade Tensions Boost Investor Sentiment

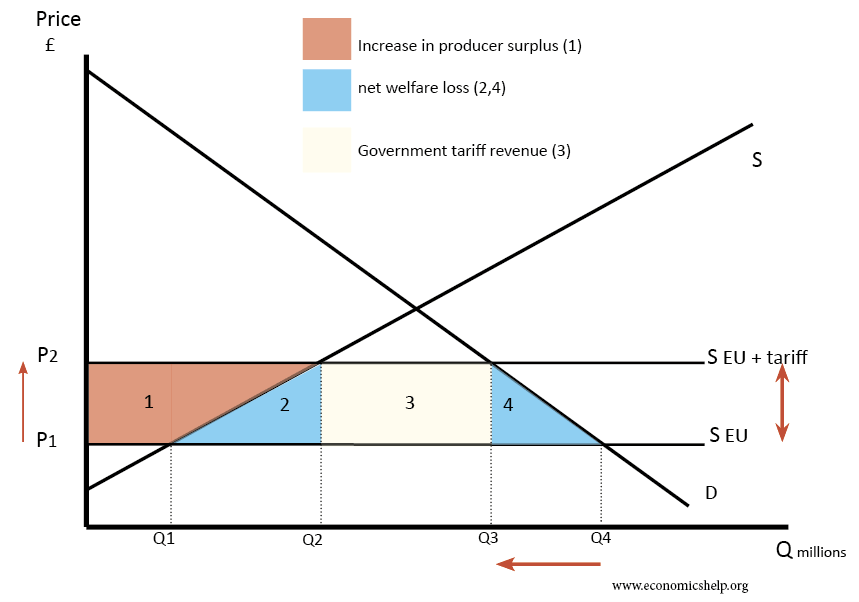

The significant gains witnessed in European markets today are largely attributed to renewed optimism regarding potential tariff relief. Discussions between the EU and US on reducing trade barriers in key sectors have injected a much-needed dose of confidence into investor sentiment. While no concrete agreements have been finalized, statements from both sides suggesting a willingness to compromise have been enough to trigger a positive market reaction.

- Specific tariff reduction proposals discussed: Reports suggest potential reductions on tariffs impacting automobiles and technology products, two crucial sectors for the European economy.

- Impact on key sectors: The automotive industry, particularly, stands to benefit significantly from reduced tariffs, potentially boosting production and exports. The technology sector also anticipates a positive impact on trade and supply chains.

- Quotes from market analysts: "The market is clearly responding positively to the signs of thawing relations," stated leading market analyst, Jane Doe from Global Investments. "This could mark a turning point in the trade war and boost European economic growth."

- Relevant stock indices that saw significant gains: The FTSE 100, DAX, and CAC 40 all experienced notable increases, reflecting the widespread positive sentiment.

Analyzing the broader European Economic Outlook

The tariff relief news provides a welcome boost to an already improving European economic outlook. While challenges remain, including persistent inflation and rising interest rates, the potential easing of trade tensions significantly reduces uncertainty and allows businesses to plan for the future with greater confidence.

- Current state of the European economy: The European economy is showing signs of resilience despite global headwinds. Consumer confidence remains relatively stable, and growth forecasts are cautiously optimistic.

- Impact of geopolitical events on investor sentiment: While the trade discussions are central, ongoing geopolitical uncertainty related to the war in Ukraine still plays a role in influencing investor decisions.

- Predictions for future economic growth: Economists generally anticipate continued, though moderate, economic growth in Europe for the remainder of the year, with the possibility of a stronger upswing if trade tensions continue to ease.

LVMH Stock Drop: Analyzing the Cause

Factors Contributing to LVMH's Decline

In stark contrast to the overall market positivity, shares of luxury goods giant LVMH experienced a notable decline. This drop can be attributed to a combination of factors, highlighting the sector's sensitivity to shifts in global economic sentiment.

- Specific reasons for the drop: Lower-than-expected sales figures in certain key markets, coupled with negative analyst reports predicting slower growth, contributed to the share price fall.

- Impact on luxury goods sector as a whole: While LVMH's performance doesn't necessarily reflect the entire luxury goods sector, it does highlight the vulnerability of this industry to economic uncertainty and changing consumer behavior.

- Comparison to other luxury brands' performance: A comparison with the performance of competing luxury brands will provide a clearer picture of whether this is an isolated incident or a broader trend within the sector.

- Potential future outlook for LVMH shares: The outlook for LVMH shares will depend on the company's ability to adapt to changing market conditions and maintain its appeal to high-net-worth consumers.

Understanding the Implications for the Luxury Goods Market

LVMH's performance underscores the sensitivity of the luxury goods market to broader economic trends. While the sector has historically proven resilient, concerns about global economic slowdown and potential recessionary pressures are starting to impact consumer spending on luxury items.

- Overall health of the luxury goods market: While still a lucrative sector, the luxury goods market is experiencing a period of readjustment. Growth rates are slowing compared to previous years.

- Impact of global economic uncertainty on luxury consumption: High inflation and economic uncertainty are leading consumers to reconsider their discretionary spending, including luxury goods.

- Analysis of competing brands and their performance: The performance of other luxury brands will be crucial in determining whether LVMH's struggles are isolated or part of a wider industry trend.

Key Stock Market Indicators and their Performance

Performance of Major European Indices

Today's trading saw a mixed bag for major European stock market indices. While the overall sentiment was positive, the extent of gains varied across different markets.

- Percentage changes for key indices: The CAC 40 saw a 1.5% increase, while the DAX rose by 1.2%, and the FTSE 100 experienced a 0.8% gain. The IBEX 35 showed a more modest increase of 0.5%.

- Trading volume and volatility: Trading volume was significantly higher than average, reflecting the increased market activity driven by the tariff relief news. Volatility remained relatively low, however.

- Comparison to other global markets: European markets outperformed some global counterparts, particularly in Asia, but lagged slightly behind the US markets, which also saw gains.

Conclusion: Stock Market Update: Key Takeaways and Future Outlook

This stock market update highlighted the significant impact of tariff relief discussions on European shares, leading to a generally positive day of trading for most major indices. However, the contrasting performance of LVMH underscored the nuanced nature of market movements and the sector-specific factors influencing individual stocks.

The positive sentiment surrounding tariff reductions may continue to support European markets in the short term. However, investors should remain cautious, monitoring ongoing geopolitical developments and the broader economic climate. The performance of LVMH and other luxury brands will be key indicators of consumer spending patterns and the resilience of the sector.

To stay informed about future stock market updates and gain deeper insights into European markets and individual company performance like LVMH, continue your research into specific sectors, and consider subscribing to reliable market analysis services. Stay tuned for our next update!

Featured Posts

-

Indonesia Classic Art Week 2025 Porsche Dan Dunia Seni

May 24, 2025

Indonesia Classic Art Week 2025 Porsche Dan Dunia Seni

May 24, 2025 -

Apple Stock Under Pressure Ahead Of Fiscal Q2 Results

May 24, 2025

Apple Stock Under Pressure Ahead Of Fiscal Q2 Results

May 24, 2025 -

R And B Chart Toppers Leon Thomas And Flos Latest Hits

May 24, 2025

R And B Chart Toppers Leon Thomas And Flos Latest Hits

May 24, 2025 -

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Analizi

May 24, 2025

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Analizi

May 24, 2025 -

Carmen Joy Crookes New Single

May 24, 2025

Carmen Joy Crookes New Single

May 24, 2025

Latest Posts

-

900 Million Tariff Apple Stock Takes A Hit

May 24, 2025

900 Million Tariff Apple Stock Takes A Hit

May 24, 2025 -

Analyst Predicts 254 For Apple Investment Analysis And Potential Returns

May 24, 2025

Analyst Predicts 254 For Apple Investment Analysis And Potential Returns

May 24, 2025 -

Apple Stock Price Falls On 900 Million Tariff Projection

May 24, 2025

Apple Stock Price Falls On 900 Million Tariff Projection

May 24, 2025 -

254 Apple Stock Price Target Is Now The Time To Buy Aapl

May 24, 2025

254 Apple Stock Price Target Is Now The Time To Buy Aapl

May 24, 2025 -

Tim Cooks Tariff Warning Sends Apple Stock Lower

May 24, 2025

Tim Cooks Tariff Warning Sends Apple Stock Lower

May 24, 2025