Stocks Surge 8% On Euronext Amsterdam: Trump's Tariff Pause Fuels Rally

Table of Contents

Trump's Tariff Pause: The Catalyst for the Euronext Amsterdam Rally

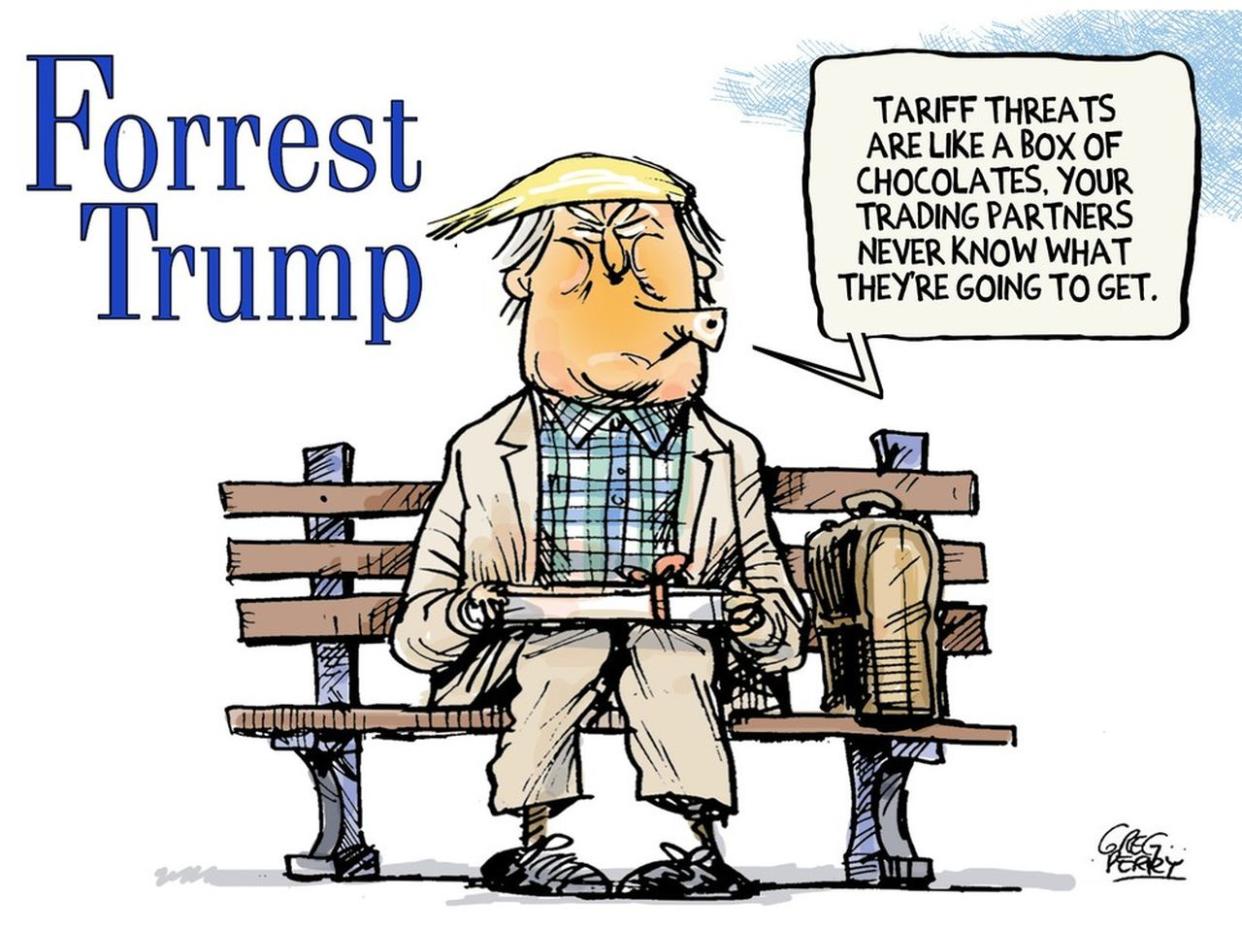

President Trump's decision to temporarily halt the implementation of new tariffs acted as a powerful catalyst for the Euronext Amsterdam rally. The uncertainty surrounding trade wars had weighed heavily on investor sentiment, creating a climate of risk aversion. The pause removed a significant source of this uncertainty, allowing investor confidence to rebound sharply.

This positive news particularly benefited sectors heavily reliant on international trade. European companies exporting goods to the US, many of which are listed on Euronext Amsterdam, experienced a significant boost. The reduced risk of increased tariffs translated directly into higher projected profits and improved stock valuations.

- Decreased uncertainty leading to increased investor confidence in the Euronext Amsterdam Stock Market.

- Positive impact on European export-oriented businesses listed on Euronext Amsterdam.

- Reduced risk aversion amongst investors trading on the Amsterdam Stock Exchange.

- Potential for increased trade between the US and Europe, boosting the Euronext Amsterdam Stock Market's performance.

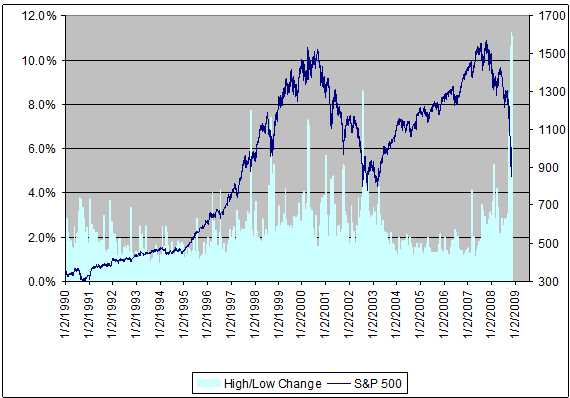

Analyzing the Euronext Amsterdam Market Performance

The Euronext Amsterdam market reacted swiftly and decisively to the tariff news. The AEX index, the benchmark index of the Amsterdam Stock Exchange, saw an impressive surge, closing up over 8%. This positive performance was broad-based, with gains seen across multiple sectors.

The financials and technology sectors were particularly strong performers, reflecting investor optimism about future growth prospects. Energy stocks also saw significant gains, likely fueled by expectations of increased global demand. Specific examples of high-performing stocks included [insert examples of top-performing stocks and their percentage gains here – requires real-time data].

- Percentage increase in the AEX index (Amsterdam Exchange Index) exceeding 8%.

- Strong performance across major sectors like financials, technology, and energy.

- Specific examples of high-performing stocks and their percentage gains (replace with actual data).

- Positive comparison to other European stock market performances, highlighting the Euronext Amsterdam's strong response.

Investor Sentiment and Future Outlook for Euronext Amsterdam

The Euronext Amsterdam rally has significantly improved investor sentiment. Trading volume increased substantially following the news, indicating strong interest in the market. Analysts are largely optimistic about the short-term outlook, with many predicting further gains in the coming weeks. However, the long-term prospects remain dependent on the evolution of US-EU trade relations.

Potential risks still exist, including the possibility of renewed trade tensions and broader economic slowdown. Nevertheless, the current positive momentum offers potential investment opportunities for those willing to navigate the market volatility.

- Increased trading volume on Euronext Amsterdam post-rally.

- Positive analyst predictions for the short-term and long-term performance of the market.

- Potential impact of future trade negotiations on the Euronext Amsterdam exchange.

- Identification of potential investment strategies for the Euronext Amsterdam market, such as focusing on export-oriented businesses.

The Broader Global Impact of the Tariff Pause on Markets

The tariff pause wasn't limited in its impact to Euronext Amsterdam. Other European stock markets, including those in London, Frankfurt, and Paris, also experienced gains, although the magnitude varied. Global markets generally reacted positively, with US and Asian markets also showing improvements.

This demonstrates the interconnectedness of global financial markets and the significant influence of US trade policy on investor sentiment worldwide. The long-term implications of the tariff pause remain to be seen, but it has undeniably injected a shot of confidence into a previously uncertain global economic landscape.

- Positive impact on other European stock markets like London, Frankfurt, and Paris.

- Positive correlation with the performance of US and Asian stock markets.

- Improved global market sentiment and investor confidence following the news.

- Long-term implications for global trade and economic growth remain uncertain but potentially positive.

Conclusion

The 8% surge in the Euronext Amsterdam stock market represents a significant development, driven primarily by President Trump's temporary pause on new tariffs. This pause alleviated market uncertainty, boosted investor confidence, and led to strong gains across various sectors. While opportunities exist, investors should remain aware of potential future risks.

Call to Action: Stay informed about the evolving situation on the Euronext Amsterdam Stock Market and seize potential opportunities presented by this significant market rally. Follow our updates for the latest insights into the Euronext Amsterdam stock market and develop your investment strategy around the fluctuations of the Euronext Amsterdam Stock Market. Understanding the nuances of the Euronext Amsterdam Stock Market is crucial for successful investing.

Featured Posts

-

Apple Stock Analysis I Phone Success Fuels Q2 Growth

May 24, 2025

Apple Stock Analysis I Phone Success Fuels Q2 Growth

May 24, 2025 -

Guccis New Designer Demna Gvasalia And The Future Of The Brand

May 24, 2025

Guccis New Designer Demna Gvasalia And The Future Of The Brand

May 24, 2025 -

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025

Market Report Cac 40 Weekly Performance March 7 2025

May 24, 2025 -

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025

2 Drop In Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025