This SPAC Stock Is Taking On MicroStrategy: A Detailed Investment Analysis

Table of Contents

Understanding the Contender SPAC

H3: The SPAC's Business Model and Bitcoin Strategy:

This analysis focuses on a hypothetical SPAC, "Bitcoin Acquisition Corp" (BAC), for illustrative purposes. BAC, a blank-check company, recently announced its intention to merge with "CryptoMining Solutions" (CMS), a rapidly growing cryptocurrency mining operation. Pre-merger, BAC focused on securing capital for this acquisition. Post-merger, CMS will leverage BAC's financial backing to significantly expand its Bitcoin mining capacity. This strategy differs from MicroStrategy's, which primarily focuses on direct Bitcoin purchases rather than mining.

- Specific details about the target company: CMS boasts state-of-the-art mining facilities, utilizing cutting-edge ASIC technology and renewable energy sources.

- Planned Bitcoin allocation: The merged entity plans to allocate a substantial portion of its resources to acquire and mine Bitcoin, aiming for a significant increase in Bitcoin holdings within the next two years.

- Management team expertise: The combined management team comprises experienced financial professionals from BAC and seasoned engineers and technologists from CMS.

H3: Financial Analysis and Valuation:

BAC's projected financials post-merger show strong revenue growth driven by increased Bitcoin mining output. However, profitability hinges on Bitcoin's price and the efficiency of its mining operations. While precise valuation remains challenging due to Bitcoin's volatility, preliminary estimates suggest BAC's market cap could rival smaller Bitcoin-focused companies within a year.

- Key financial data: Projected revenue growth of 50% year-on-year, based on conservative Bitcoin price predictions.

- Comparisons to industry benchmarks: BAC aims to achieve lower operational costs per Bitcoin mined compared to industry averages.

- Potential upside and downside scenarios: The upside is enormous with sustained Bitcoin growth, but a significant downturn in Bitcoin's price poses substantial downside risks.

H3: Risk Assessment and Due Diligence:

Investing in this SPAC carries inherent risks. Bitcoin's price volatility is a major concern; even with a diversified approach, losses are possible. Regulatory uncertainty surrounding cryptocurrencies also presents a challenge. Additionally, operational challenges, such as equipment malfunctions or regulatory scrutiny, could impact profitability.

- List of specific risks: Bitcoin price volatility, regulatory risks, operational risks, competition, technological obsolescence.

- Potential mitigation strategies: Diversification of mining operations, hedging strategies, meticulous risk management protocols.

- Crucial aspects of due diligence: Thoroughly review the SPAC's merger agreement, conduct independent financial analysis, assess the management team's experience, and research the regulatory environment.

Comparing the Contender to MicroStrategy

H3: Market Capitalization and Bitcoin Holdings:

MicroStrategy currently boasts a significantly larger market capitalization and Bitcoin holdings than the projected post-merger entity. However, BAC's aggressive growth strategy could potentially close this gap over time.

H3: Management Teams and Expertise:

MicroStrategy benefits from a seasoned management team with extensive experience in corporate finance and technology. While BAC's combined team has promising expertise, it lacks the same level of established market recognition.

H3: Long-Term Growth Potential:

Both companies have significant long-term growth potential, contingent on Bitcoin's performance and successful execution of their respective strategies. BAC's focus on mining offers a different approach to Bitcoin accumulation, potentially offering greater scalability in the long term.

- Comparative table summarizing key metrics: A detailed comparison would be included here with market cap, Bitcoin holdings, revenue, and profit margins.

- Strengths and weaknesses analysis of each company: MicroStrategy's established position and brand recognition are strong advantages, while BAC's potential for rapid growth is its key strength.

The Bitcoin Market Landscape and Future Outlook

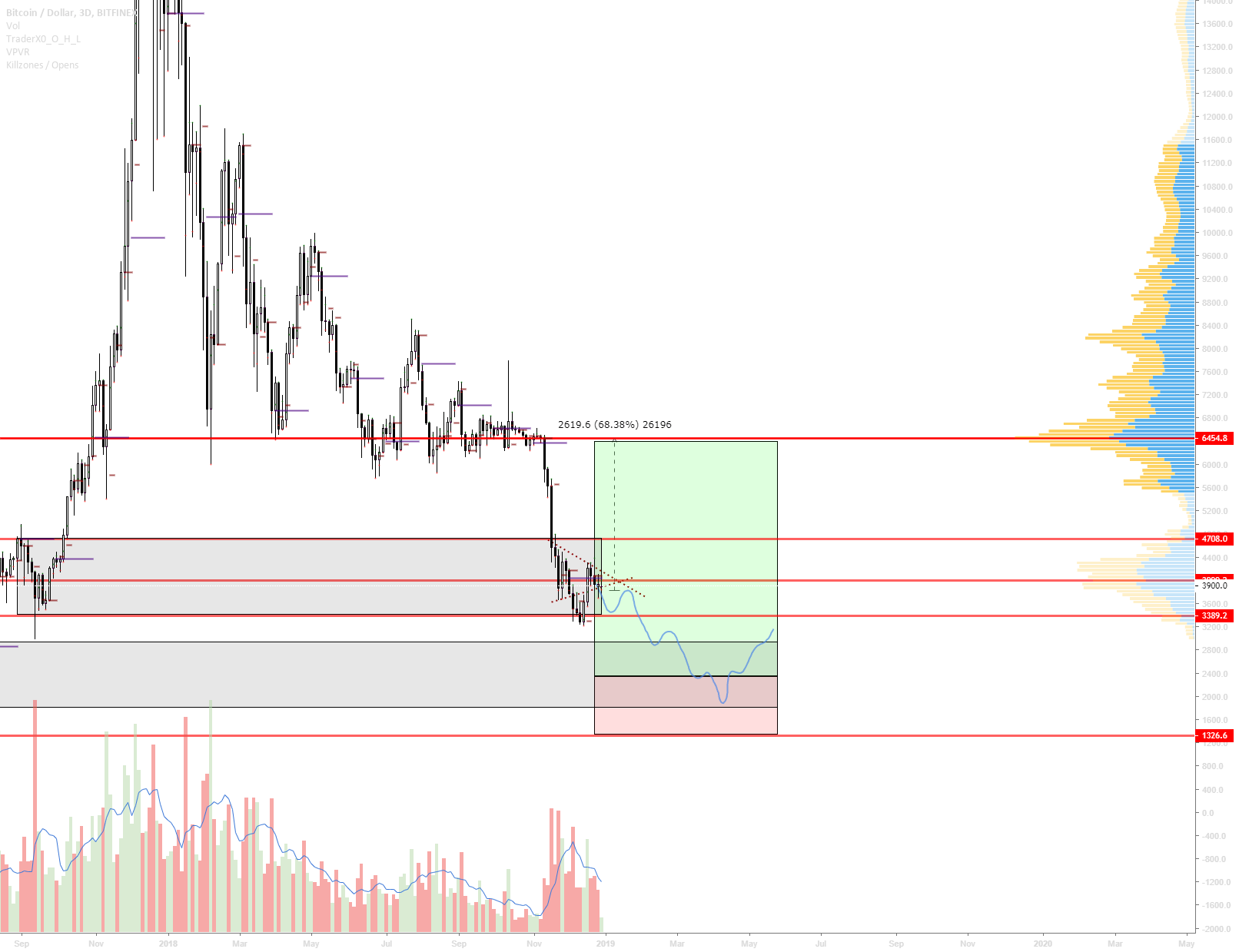

The Bitcoin market is characterized by significant price volatility influenced by regulatory developments, institutional adoption, and broader macroeconomic factors. Predicting future Bitcoin price is inherently speculative, but positive technological developments and growing acceptance could propel its value further. Conversely, tightening regulations or negative market sentiment could lead to price declines.

- Key market indicators: Bitcoin price, trading volume, market capitalization, regulatory announcements, and adoption rates.

- Potential price forecasts: Providing specific forecasts is highly speculative, but consideration of various industry analyses would be included here.

- Influential factors affecting Bitcoin’s price: Government regulations, institutional investor activity, technological advancements, and overall market sentiment.

Conclusion

This investment analysis highlights both the exciting opportunities and considerable risks associated with investing in this emerging SPAC in the Bitcoin market. While the SPAC presents a potentially high-growth strategy, it's vital to remember that returns are not guaranteed and losses are possible.

Investing in this SPAC stock presents both exciting opportunities and considerable risks within the volatile Bitcoin market. Further research and due diligence are crucial before making any investment decisions. Conduct thorough research on this promising SPAC stock and decide if it aligns with your risk tolerance and investment goals. Consider consulting a financial advisor before investing in any Bitcoin investment strategy, especially those involving SPAC mergers. Remember to perform your own comprehensive investment analysis before committing your capital.

Featured Posts

-

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025 -

Greenlands Strategic Importance Evaluating Trumps China Concerns

May 08, 2025

Greenlands Strategic Importance Evaluating Trumps China Concerns

May 08, 2025 -

Has The Bitcoin Rebound Begun Exploring Future Price Predictions

May 08, 2025

Has The Bitcoin Rebound Begun Exploring Future Price Predictions

May 08, 2025 -

Understanding The Uber Uber Investment Landscape

May 08, 2025

Understanding The Uber Uber Investment Landscape

May 08, 2025 -

Thunder Vs Trail Blazers Where To Watch On March 7th

May 08, 2025

Thunder Vs Trail Blazers Where To Watch On March 7th

May 08, 2025