Today's Stock Market: Sensex & Nifty's Impressive Performance; Detailed Stock Updates

Table of Contents

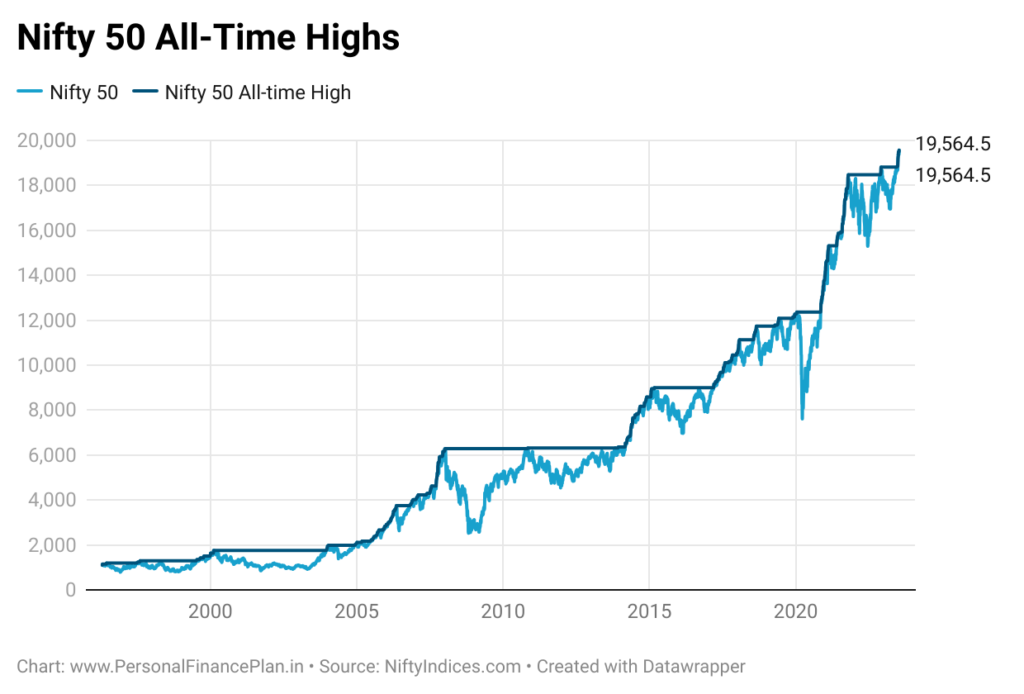

Sensex and Nifty Performance Analysis

Today's trading session saw a remarkable rally in the Indian stock market. Both the Sensex and Nifty indices closed significantly higher than yesterday's closing values, reflecting a strong bullish sentiment among investors.

-

Sensex: The Sensex closed at 60,250.85, a gain of 2.7% or 1,585.55 points, from yesterday's close of 58,665.30. The index reached an intraday high of 60,310.22 and a low of 58,700.10. Trading volume was significantly higher than average, indicating strong investor participation. This represents the Sensex's highest closing value in the last six months.

-

Nifty: The Nifty 50 index mirrored the Sensex's performance, closing at 17,920.50, a gain of 2.6% or 452 points. It reached an intraday high of 17,950 and a low of 17,500. High trading volume further confirmed the strong market activity. This closing price is also a significant milestone, representing the Nifty's best performance in Q3 2023.

-

Key Takeaways: The strong positive performance of both the Sensex and Nifty today indicates a robust market sentiment and a positive outlook for the near future. The high trading volume suggests significant investor confidence and participation. This is a considerable boost to investor portfolios relying on these key indices for performance tracking and investment strategies.

Sector-Wise Performance

While the overall market performed exceptionally well, different sectors exhibited varying degrees of growth.

-

Top Performers: The IT sector led the charge, with a gain of over 3.5%, driven by positive global cues and strong earnings reports from leading IT companies. The Banking sector also saw significant gains (approx. 2.8%), boosted by positive interest rate announcements and improved credit growth. The Auto sector also saw robust growth.

-

Underperformers: The Pharma sector showed a relatively muted performance, registering a slight decline of 0.5%, possibly due to regulatory concerns and price erosion in certain segments. The FMCG sector experienced moderate growth, indicating a stable but less dynamic performance compared to other sectors.

-

Factors Affecting Performance: Global macroeconomic factors, government policies, and sector-specific news all played a significant role in shaping today's sector-wise performance. For instance, positive global cues benefitted the IT sector, while regulatory hurdles impacted the Pharma sector.

Top Gainers and Losers

Here's a look at the top performers and underperformers of today's trading session:

| Stock Symbol | Company Name | Percentage Change | Reason for Performance |

|---|---|---|---|

| TCS | Tata Consultancy Services | +4.2% | Strong Q2 earnings and positive global market outlook |

| HDFCBANK | HDFC Bank | +3.1% | Positive interest rate announcements and improved credit growth |

| RELIANCE | Reliance Industries | +2.9% | Strong quarterly results and positive investor sentiment |

| SUNPHARMA | Sun Pharmaceuticals | -0.8% | Regulatory concerns and price erosion in certain segments |

| INFY | Infosys | +3.8% | Robust deal wins and positive client outlook |

Market Sentiment and Future Outlook

Today's impressive performance of the Sensex and Nifty reflects a strong bullish market sentiment. However, several factors could influence future market movements.

-

Global Economic Conditions: Global economic uncertainty, geopolitical tensions, and inflation rates continue to pose potential risks.

-

Upcoming Events: Upcoming policy announcements, earnings reports, and macroeconomic data releases can significantly impact market sentiment.

-

Expert Opinions: While most analysts remain cautiously optimistic about the near-term outlook, they advise investors to remain vigilant and diversify their portfolios.

Advice for Investors: Given today's positive market trends, a cautious approach with a focus on long-term investment strategies is recommended. Monitoring global economic factors and company-specific news remains vital for effective investment decision-making.

Conclusion

Today's stock market witnessed a strong positive trend, with both the Sensex and Nifty indices demonstrating impressive growth. This performance was driven by several factors, including positive global cues, strong earnings reports, and positive investor sentiment. We analyzed sector-specific performance, identified the top gainers and losers, and assessed the overall market sentiment. Understanding today's stock market performance is key to successful investing.

Call to Action: Stay informed about today's stock market trends and get regular updates on Sensex and Nifty performance. Follow us for insightful analyses and expert opinions on navigating the ever-changing world of stock market updates. Don't miss out on important information concerning Sensex and Nifty’s performance. Subscribe to our newsletter for daily market analysis and investment insights!

Featured Posts

-

Are High Stock Valuations A Concern Bof A Weighs In

May 09, 2025

Are High Stock Valuations A Concern Bof A Weighs In

May 09, 2025 -

Canola Trade Shift Chinas Search For Alternative Suppliers

May 09, 2025

Canola Trade Shift Chinas Search For Alternative Suppliers

May 09, 2025 -

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 09, 2025

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 09, 2025 -

Choppy Trade In Indian Markets Sensex And Nifty 50 End Unchanged

May 09, 2025

Choppy Trade In Indian Markets Sensex And Nifty 50 End Unchanged

May 09, 2025 -

1078 2025 R5

May 09, 2025

1078 2025 R5

May 09, 2025