Uber Stock Recession Resistance: Why Analysts Remain Bullish

Table of Contents

Uber's Diversified Revenue Streams as a Recession Hedge

One of the primary reasons analysts remain bullish on Uber stock is its diversified revenue streams. This diversification acts as a significant hedge against economic downturns, mitigating the impact of reduced spending in any single sector.

Robust Ridesharing Demand Even During Economic Slowdowns

Even during economic slowdowns, essential travel remains relatively inelastic. This means that people will still need to commute to work, travel for essential appointments, and get to and from airports and other crucial locations, regardless of the overall economic climate.

- Essential travel remains relatively inelastic: Demand for rideshares remains consistent for necessary commutes and trips.

- Cost-conscious consumers may opt for rideshares over car ownership: In times of economic uncertainty, the costs associated with car ownership – including insurance, maintenance, and fuel – can become prohibitive, making rideshares a more attractive, cost-effective alternative.

- Uber's pricing strategies can adapt to changing economic conditions: Uber can adjust its pricing models to remain competitive and attract price-sensitive customers during economic downturns.

Uber's ridesharing business remains vital for essential travel and commutes, even when discretionary spending falls. The flexibility offered by rideshares, compared to owning a car, makes them an appealing choice for many, especially those seeking to reduce expenses.

The Growing Strength of Uber Eats and Delivery Services

The food delivery sector has proven remarkably resilient during economic downturns. People often maintain their dining habits even when cutting back on other expenses. The convenience of food delivery outweighs cost concerns for a significant portion of the population.

- Increased demand for food delivery during economic downturns: People may reduce restaurant visits but still opt for the convenience of delivered meals.

- Convenience factor outweighs cost concerns for many: The ease and comfort of food delivery often outweigh concerns about cost, maintaining demand.

- Potential for expansion into new markets and service offerings: Uber Eats can expand into new markets and add services like grocery delivery, further diversifying its revenue streams and boosting resilience.

Uber Eats benefits significantly from this trend. Its expansion into grocery delivery and other services further enhances its recession-resistant qualities.

Freight and Logistics: A Counter-cyclical Element

Uber Freight, Uber's freight transportation division, offers a counter-cyclical element to the company's overall portfolio. The transportation of essential goods remains largely unaffected by economic slowdowns. In fact, supply chain disruptions during recessions can even increase demand for efficient logistics services.

- Essential goods transportation remains unaffected: The movement of essential goods is not significantly impacted by economic downturns.

- Potential for increased demand during supply chain disruptions: Recessions can sometimes lead to supply chain bottlenecks, increasing the need for reliable transportation.

- Opportunities for growth in this segment: This segment offers considerable growth potential, especially during periods of economic instability.

Uber Freight's role in the transportation of essential goods makes it a valuable asset during uncertain economic times. Its contribution to offsetting potential losses in other sectors is significant.

Cost-Cutting Measures and Operational Efficiency

Uber's commitment to cost-cutting measures and operational efficiency enhances its resilience during economic downturns. Technological advancements and strategic decision-making play a crucial role in this strategy.

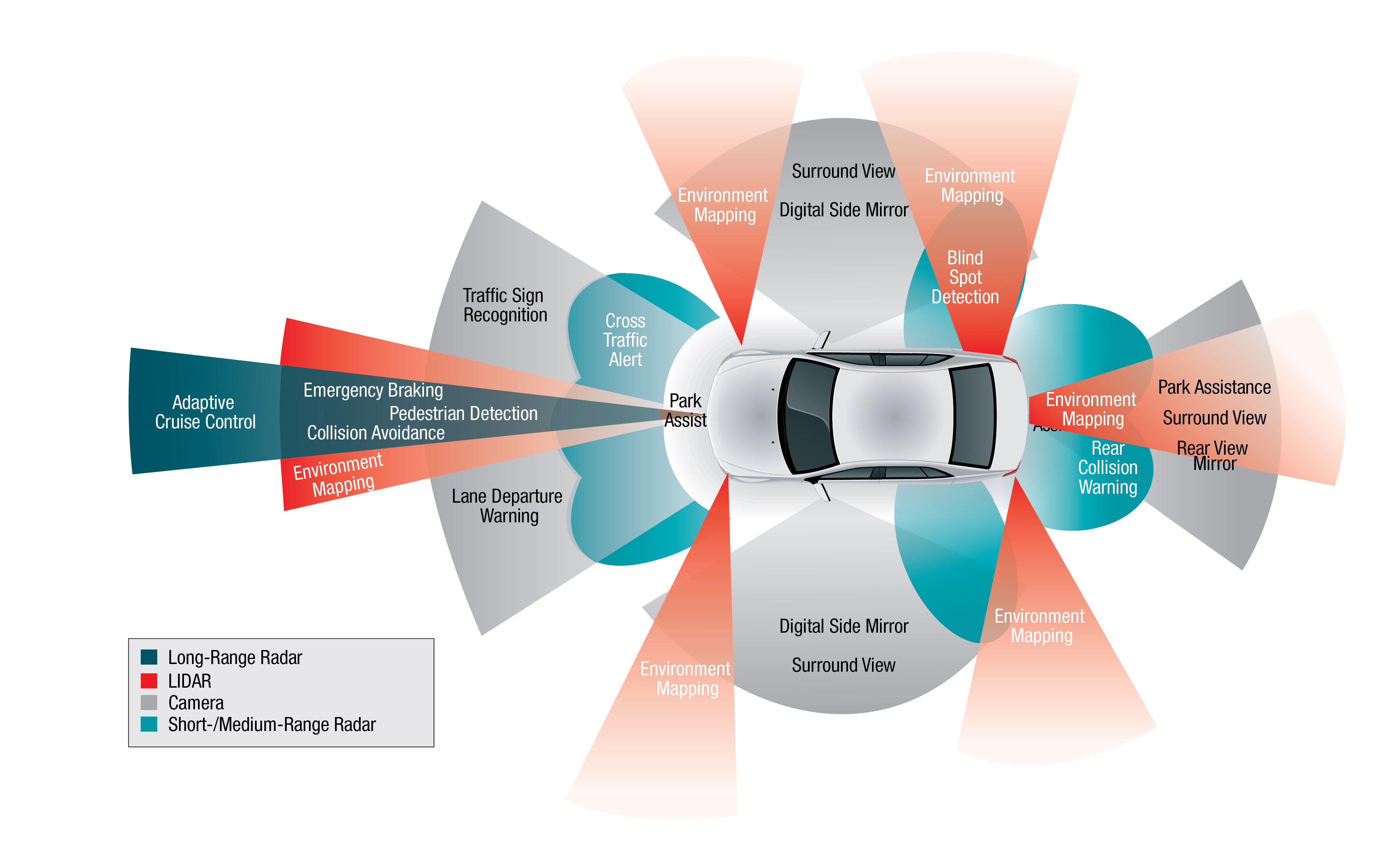

Technological Advancements and Automation

Uber leverages technology to optimize its operations and reduce costs. AI and machine learning are instrumental in streamlining processes, improving efficiency, and lowering expenses.

- Reducing operational costs through AI and machine learning: Algorithms optimize routes, driver assignments, and resource allocation.

- Optimizing routes and driver assignments: AI-powered systems reduce fuel consumption and driver downtime.

- Improved efficiency in logistics: Automation streamlines the delivery process, reducing costs and improving speed.

By embracing technological advancements, Uber significantly enhances its operational efficiency and reduces its vulnerability during economic slowdowns.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions allow Uber to expand its market reach, diversify its services, and leverage synergies to improve overall efficiency and reduce costs.

- Expanding market reach and service offerings: Partnerships broaden Uber's presence and access to new customer bases.

- Leveraging synergies to improve efficiency and reduce costs: Acquisitions can integrate complementary services and technologies, generating cost savings.

By strategically partnering with or acquiring other companies, Uber reinforces its competitive position and improves its ability to navigate challenging economic conditions.

Long-Term Growth Potential and Market Dominance

Uber's long-term growth potential and its position as a market leader are further reasons for analysts' bullish outlook. Its expansion into new markets and services, coupled with strong brand recognition and network effects, solidify its competitive advantage.

Expanding into New Markets and Services

Uber continues to aggressively expand into new markets and develop innovative services, creating additional revenue streams and reducing reliance on any single sector.

- Untapped global potential: Significant growth opportunities exist in many underpenetrated markets globally.

- Diversification into new transportation modes (e.g., micromobility): Expanding into areas like e-scooters and e-bikes adds to service offerings.

- Expanding into new geographic regions: Uber continues to penetrate new markets, building upon its already vast reach.

Uber's ambitious expansion plans contribute to its overall growth potential and resilience.

Brand Recognition and Network Effects

Uber boasts strong brand recognition and benefits significantly from network effects. Its large and loyal customer base, coupled with a massive network of drivers, creates a significant barrier to entry for competitors.

- Strong brand recognition: Uber is a globally recognized brand, benefiting from high consumer awareness and trust.

- Large and loyal customer base: A substantial user base provides a stable foundation for revenue generation.

- Network effects creating a barrier to entry for competitors: The size and scope of Uber's network make it difficult for competitors to challenge its dominance.

The strength of Uber's brand and network effects contributes substantially to its long-term sustainability and resilience.

Conclusion

While economic uncertainty always presents challenges, Uber's diversified revenue streams, cost-cutting measures, and substantial growth potential contribute to its perceived recession resistance. Analysts' continued bullishness on Uber stock highlights the company's adaptability and long-term prospects. Consider carefully researching Uber's financial performance and market trends before making any investment decisions, but the evidence suggests Uber stock may be a worthwhile consideration in your recession-proof portfolio strategy. Learn more about the factors driving the continued bullish sentiment surrounding Uber stock recession resistance and its potential for future growth.

Featured Posts

-

Analyzing Marcello Hernandezs Snl Suitcase Dog Performance

May 18, 2025

Analyzing Marcello Hernandezs Snl Suitcase Dog Performance

May 18, 2025 -

Rune Pobeduje Alkarasa U Finalu Barselone Uprkos Povrede

May 18, 2025

Rune Pobeduje Alkarasa U Finalu Barselone Uprkos Povrede

May 18, 2025 -

Dissecting The Spring Breakout Rosters 2025

May 18, 2025

Dissecting The Spring Breakout Rosters 2025

May 18, 2025 -

Watch Easy A On Bbc Three Hd Your Guide To Airtimes

May 18, 2025

Watch Easy A On Bbc Three Hd Your Guide To Airtimes

May 18, 2025 -

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025

2025 The Year Of Pedro Pascal Begins Next Week

May 18, 2025

Latest Posts

-

Ubers Autonomous Vehicle Push Investing In The Future With Etfs

May 19, 2025

Ubers Autonomous Vehicle Push Investing In The Future With Etfs

May 19, 2025 -

Could Driverless Cars Make These Uber Etfs A Smart Investment

May 19, 2025

Could Driverless Cars Make These Uber Etfs A Smart Investment

May 19, 2025 -

Ubers Foodpanda Taiwan Acquisition Fails Amid Regulatory Challenges

May 19, 2025

Ubers Foodpanda Taiwan Acquisition Fails Amid Regulatory Challenges

May 19, 2025 -

Regulatory Issues Halt Ubers Acquisition Of Foodpanda In Taiwan

May 19, 2025

Regulatory Issues Halt Ubers Acquisition Of Foodpanda In Taiwan

May 19, 2025 -

Investing In Uber A Detailed Look At Uber Stock

May 19, 2025

Investing In Uber A Detailed Look At Uber Stock

May 19, 2025