Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and why is it important?

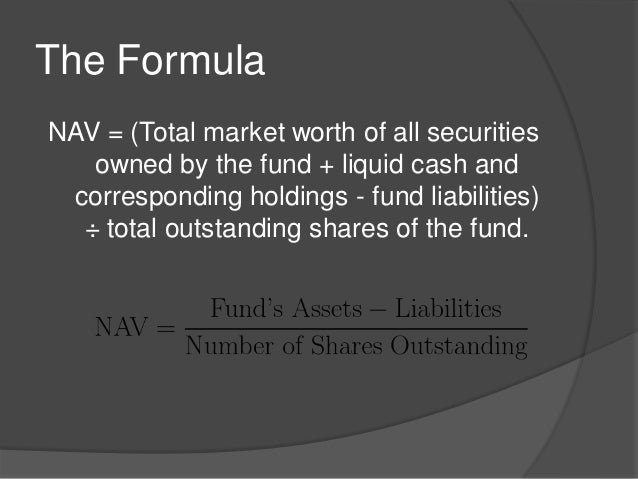

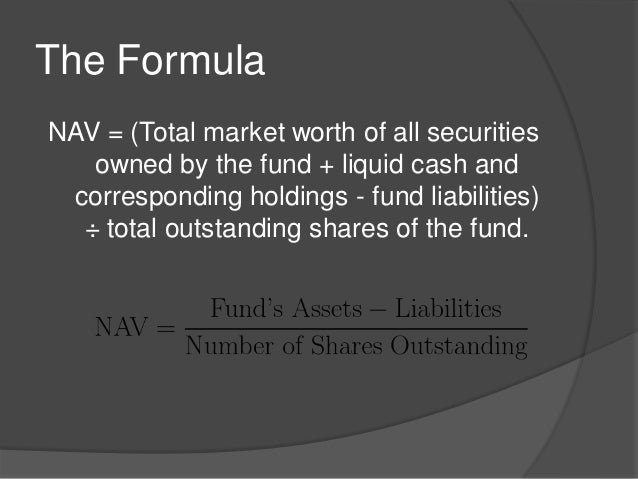

Net Asset Value (NAV) represents the intrinsic value of each share in an ETF. In simple terms, it's the total value of all the ETF's assets (like the stocks it holds) minus its liabilities (like expenses), divided by the total number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the NAV reflects the collective value of the 30 companies that make up the Dow Jones Industrial Average, adjusted for expenses and the number of ETF shares.

Understanding the NAV is paramount for several reasons:

- Performance Benchmark: The NAV serves as a key indicator of the ETF's performance over time. By tracking the NAV, you can see the growth or decline of your investment.

- Fair Price Indicator: The NAV provides a benchmark against which to compare the ETF's market price. While the market price can fluctuate due to supply and demand, the NAV represents the underlying value of the holdings.

- Return Calculation: The NAV is essential for calculating the returns on your investment in the Amundi Dow Jones Industrial Average UCITS ETF.

Here are some key takeaways about the significance of NAV:

- NAV reflects the intrinsic value of the ETF.

- Monitoring NAV helps track investment growth.

- NAV is used to calculate returns.

- Understanding NAV aids in comparing ETFs.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF calculated?

The Amundi Dow Jones Industrial Average UCITS ETF tracks the Dow Jones Industrial Average index. Therefore, its NAV calculation is directly tied to the performance of the index's 30 constituent stocks. Amundi, as the fund manager, undertakes this calculation daily.

The process generally involves:

- Determining the closing market price for each of the 30 Dow Jones Industrial Average stocks.

- Converting these prices to a common currency (usually Euros, as it's a UCITS ETF).

- Summing the total value of all holdings.

- Subtracting the ETF's total liabilities (including management fees and expenses).

- Dividing the result by the total number of outstanding ETF shares.

Amundi employs a transparent methodology, which is typically detailed in the ETF's prospectus. The NAV is usually calculated at the end of each trading day and is readily available to investors.

Here's what to keep in mind about the NAV calculation:

- Daily calculation based on market closing prices.

- Consideration of currency fluctuations.

- Transparent methodology published by Amundi.

- Regularly updated and publicly available information.

Factors influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF.

Several factors can influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF, impacting its value and consequently, your investment:

- Market Fluctuations: The most significant influence is the performance of the 30 companies within the Dow Jones Industrial Average. Individual stock price movements directly impact the overall NAV.

- Economic Indicators: Macroeconomic factors like interest rate changes, inflation rates, and GDP growth can significantly affect the performance of the constituent companies and, therefore, the ETF's NAV.

- Global Events: Geopolitical events, such as wars, political instability, or major economic crises, can create volatility and impact the NAV.

- Dividends: Dividend payments from the underlying companies are usually reinvested back into the ETF, positively affecting the NAV over time.

Here's a summary of the key influences:

- Market performance of the Dow Jones Industrial Average.

- Economic and political factors.

- Currency exchange rates.

- Dividend payouts from underlying stocks.

Where to find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

The NAV for the Amundi Dow Jones Industrial Average UCITS ETF is readily accessible through several channels:

- Amundi's Official Website: The most reliable source is Amundi's official website. Look for their ETF listings, usually within an investor relations section.

- Financial News Websites: Major financial news websites and portals often list ETF NAVs, including this specific ETF.

- Brokerage Platforms: If you hold this ETF through a brokerage account, the NAV will usually be displayed within your portfolio overview.

The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

- Amundi's official website.

- Financial news portals (e.g., Bloomberg, Yahoo Finance).

- Your brokerage account.

- Daily updates are typically available.

Conclusion

Understanding the Net Asset Value (NAV) is essential for anyone invested in the Amundi Dow Jones Industrial Average UCITS ETF. By monitoring its daily fluctuations and grasping the various factors that influence its value, investors can gain a clearer understanding of their investment’s performance and make more informed decisions. Remember to consult reliable sources regularly to stay updated on the NAV of your Amundi Dow Jones Industrial Average UCITS ETF holdings. Learn more about Amundi Dow Jones Industrial Average UCITS ETF NAV and make smarter investment choices today!

Featured Posts

-

Indian Wells Triumph Draper Secures Maiden Atp Masters 1000 Victory

May 24, 2025

Indian Wells Triumph Draper Secures Maiden Atp Masters 1000 Victory

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application And Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Application And Information

May 24, 2025 -

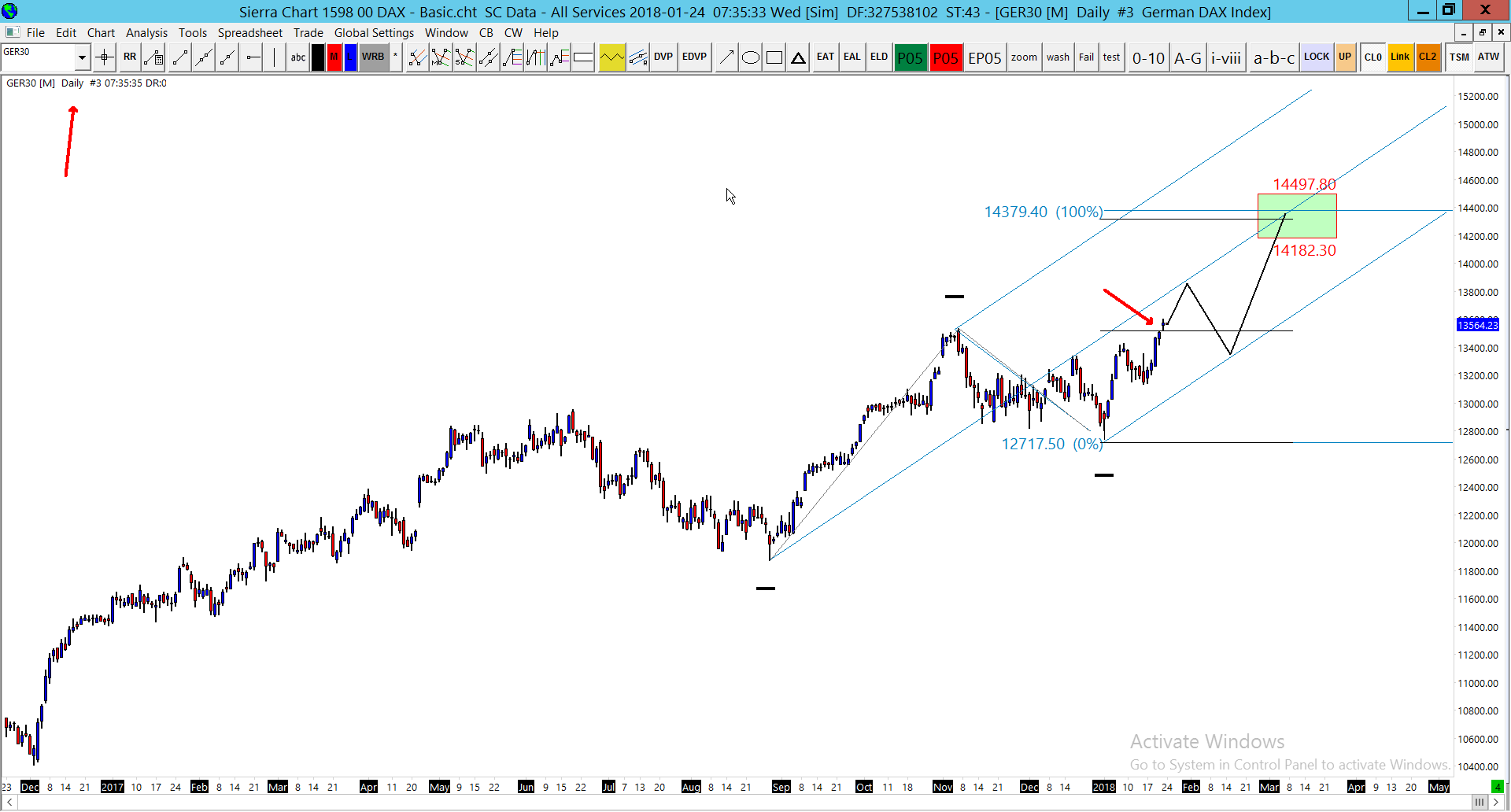

German Daxs Strong Performance A Look At Wall Streets Influence

May 24, 2025

German Daxs Strong Performance A Look At Wall Streets Influence

May 24, 2025 -

Ferrari 296 Speciale Detalhes Do Motor Hibrido De 880 Cv

May 24, 2025

Ferrari 296 Speciale Detalhes Do Motor Hibrido De 880 Cv

May 24, 2025 -

Live Updates M6 Crash Causes Significant Delays For Drivers

May 24, 2025

Live Updates M6 Crash Causes Significant Delays For Drivers

May 24, 2025

Latest Posts

-

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase Impact Of Trumps Tariff Decision

May 24, 2025 -

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025

7 Drop For Amsterdam Stocks As Trade War Fears Rise

May 24, 2025 -

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025 -

Amsterdam Exchange Plunges 7 On Opening Trade War Concerns

May 24, 2025

Amsterdam Exchange Plunges 7 On Opening Trade War Concerns

May 24, 2025 -

Trumps Tariff Relief 8 Stock Market Surge On Euronext Amsterdam

May 24, 2025

Trumps Tariff Relief 8 Stock Market Surge On Euronext Amsterdam

May 24, 2025