US-China Trade Deal Boosts Optimism, Leading To Gold Price Decline

Table of Contents

The US-China Trade Deal: A Catalyst for Market Optimism

The "Phase One" US-China trade deal, while not resolving all trade disputes, marked a significant step towards de-escalation. Its positive implications for global trade have been substantial, contributing to a wave of market optimism. This optimism is a key factor driving the decreased demand for gold.

- Reduced Tariffs: The deal led to reduced tariffs on a range of goods, easing trade tensions and boosting global commerce.

- Increased Market Access: US companies gained improved access to the Chinese market, fostering economic growth and collaboration.

- Positive Impact on Supply Chains: Reduced trade friction streamlined global supply chains, reducing uncertainty and improving efficiency.

- Improved Investor Confidence: The deal injected confidence into the global economy, leading investors to believe in a more stable and prosperous future.

This renewed optimism alters investor behavior. With a brighter economic outlook, investors are less inclined to seek the safety of gold, leading to decreased demand and consequently impacting its price.

Safe Haven Asset: Understanding Gold's Role in Uncertain Times

Gold has long held its position as a safe-haven asset, a go-to investment during times of economic uncertainty and geopolitical instability. Its value often increases when investors seek refuge from volatile markets.

- Historical Performance: Historically, gold has demonstrated strong performance during market downturns, acting as a hedge against risk.

- Lack of Correlation: Gold's price typically shows little correlation with traditional assets like stocks and bonds, making it a valuable diversification tool.

- Flight-to-Safety: The "flight-to-safety" phenomenon sees investors flock to gold when facing economic anxieties, driving up demand and price.

However, a positive outlook on trade, as fostered by the US-China Trade Deal, diminishes the perceived need for this safe haven. Investors feel less compelled to seek refuge in gold, reducing its demand.

Impact of Increased Risk Appetite on Gold Prices

Increased risk appetite, fueled by positive economic news like the progress in the US-China Trade Deal, directly impacts gold prices. When investors feel more confident about the economy, they are more willing to take on higher risks.

- Shift to Higher-Yield Assets: Investors shift their investments towards higher-yield assets like stocks and bonds, seeking greater returns.

- Decreased Gold Demand: This shift reduces the demand for gold, a relatively low-yield asset, further impacting its price.

- Higher Interest Rates: Higher interest rates, often a byproduct of economic growth, also tend to negatively impact gold prices, as they increase the opportunity cost of holding non-interest-bearing assets like gold.

This decreased demand, driven by increased risk appetite, creates downward pressure on gold prices, resulting in the decline observed in correlation with the positive developments in the US-China trade negotiations.

Other Factors Contributing to Gold Price Decline (Beyond the Trade Deal)

While the US-China Trade Deal played a significant role, other factors contributed to the decline in gold prices.

- Strengthening US Dollar: A stronger US dollar makes gold more expensive for buyers using other currencies, reducing global demand.

- Central Bank Policies: Changes in central bank policies, including interest rate adjustments, can impact investor sentiment and gold demand.

- Supply and Demand: Basic supply and demand dynamics within the gold market itself also influence price fluctuations independently of geopolitical events.

These factors, while not as impactful as the sentiment shift caused by the US-China Trade Deal, nonetheless contributed to the overall decline in gold prices.

The US-China Trade Deal's Impact on Gold: A Summary and Call to Action

In summary, the positive sentiment generated by the US-China trade deal has significantly impacted gold prices. Reduced uncertainty and increased investor optimism have decreased the demand for this safe-haven asset. The inverse relationship between investor confidence and gold prices is once again demonstrated.

To effectively navigate the gold market, stay informed about the ongoing developments in US-China trade relations and their impact. Monitor the US-China Trade Deal for potential future shifts in gold prices and consider diversifying your investment portfolio to mitigate risk based on your understanding of these market forces. Understanding the interplay between the US-China Trade Deal and gold prices is crucial for making informed investment decisions.

Featured Posts

-

Ego Nwodims Snl Weekend Update Analysis Of Audience Outburst

May 18, 2025

Ego Nwodims Snl Weekend Update Analysis Of Audience Outburst

May 18, 2025 -

Success In Private Credit 5 Essential Dos And Don Ts

May 18, 2025

Success In Private Credit 5 Essential Dos And Don Ts

May 18, 2025 -

Verbod Vuurwerk Toch Nog Veel Kopers In Nederland

May 18, 2025

Verbod Vuurwerk Toch Nog Veel Kopers In Nederland

May 18, 2025 -

Jan 6 Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

May 18, 2025

Jan 6 Hearing Witness Cassidy Hutchinson To Publish Memoir This Fall

May 18, 2025 -

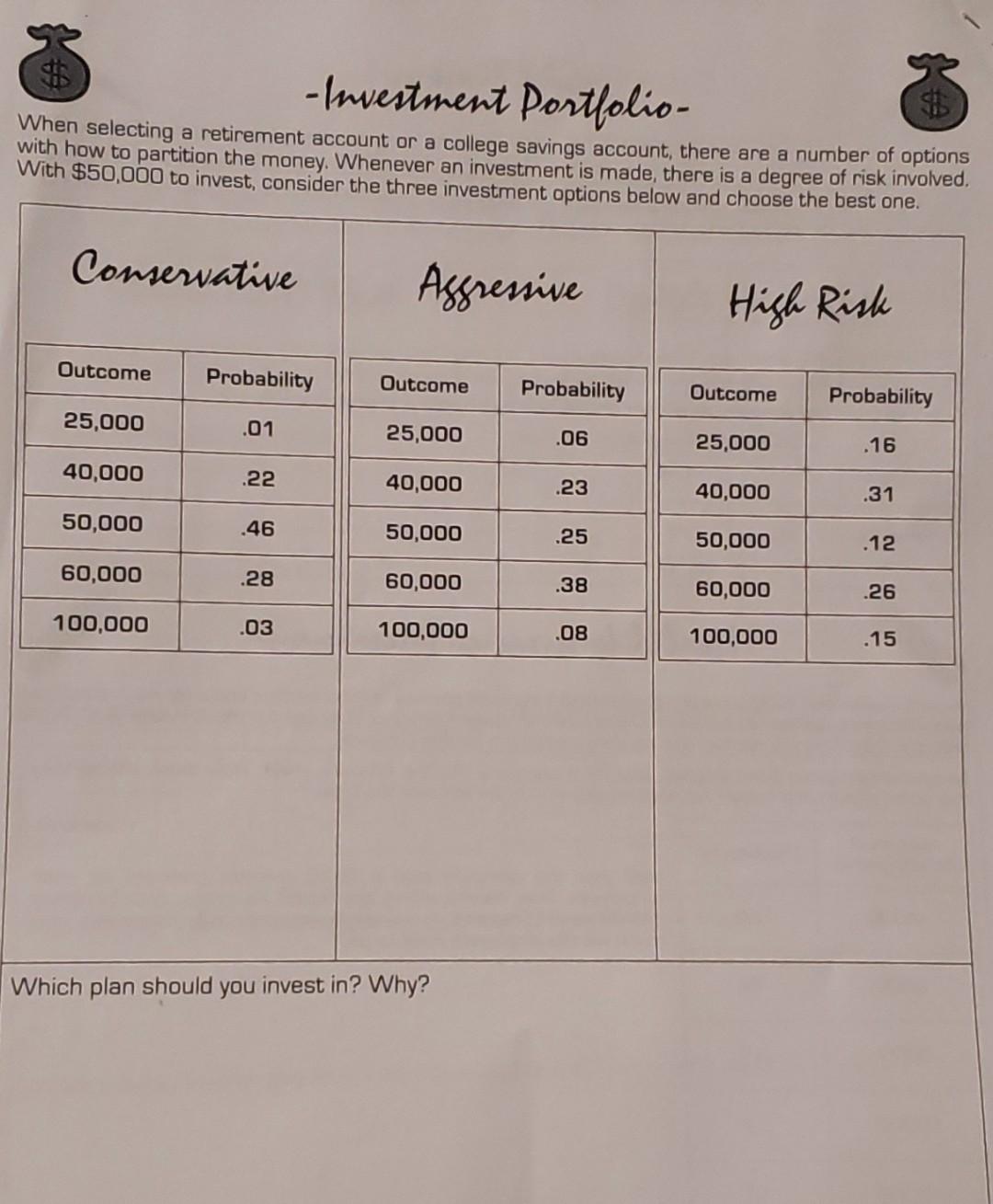

Assessing The Suitability Of This Novel Investment For Retirement

May 18, 2025

Assessing The Suitability Of This Novel Investment For Retirement

May 18, 2025

Latest Posts

-

Snl Controversy Bowen Yang Responds To Shane Gillis Firing Claims

May 18, 2025

Snl Controversy Bowen Yang Responds To Shane Gillis Firing Claims

May 18, 2025 -

Shreks Bbc Three Showing Dates And Times

May 18, 2025

Shreks Bbc Three Showing Dates And Times

May 18, 2025 -

Bowen Yang Addresses Shane Gillis Snl Dismissal

May 18, 2025

Bowen Yang Addresses Shane Gillis Snl Dismissal

May 18, 2025 -

Bowen Yangs Next Project A Blend Of Heart And Comedy

May 18, 2025

Bowen Yangs Next Project A Blend Of Heart And Comedy

May 18, 2025 -

Bowen Yangs Snl Casting Choice He Prefers A Different Jd Vance

May 18, 2025

Bowen Yangs Snl Casting Choice He Prefers A Different Jd Vance

May 18, 2025