Wedbush Remains Bullish On Apple Stock Despite Price Target Reduction: Is It A Good Investment?

Table of Contents

Wedbush's Rationale Behind the Price Target Reduction

Wedbush's decision to lower its Apple price target, while still bullish, stems from a confluence of factors primarily related to the current macroeconomic climate and near-term market dynamics. They aren't necessarily bearish on Apple's long-term potential, but rather are adjusting their expectations in light of current realities.

-

Potential impact of global economic uncertainty on consumer spending for Apple products: Global economic uncertainty, including inflation and potential recessionary pressures, could lead to decreased consumer spending on discretionary items like iPhones and other Apple devices. This impacts short-term sales projections.

-

Expected slowdown in iPhone sales in the short term: While iPhones remain a flagship product, Wedbush anticipates a temporary slowdown in iPhone sales, particularly in emerging markets sensitive to economic fluctuations. This is a significant factor in their revised price target.

-

Competition in the tech market and its influence on Apple's projected growth: Increased competition from other tech giants in various product categories, such as smartphones and wearables, puts some pressure on Apple's projected market share growth in the near future.

-

Analysis of Wedbush's previous price target and the justification for the adjustment: Wedbush's previous price target was likely based on more optimistic economic forecasts. The adjustment reflects a more cautious approach given the current economic headwinds. This demonstrates their responsiveness to market changes.

Why Wedbush Remains Bullish on Apple's Long-Term Prospects

Despite the near-term challenges, Wedbush's continued bullishness on Apple highlights the company's strong long-term growth drivers. Their optimism is founded on several key factors:

-

Strong potential for growth in services revenue (Apple Music, iCloud, etc.): Apple's services segment is a recurring revenue stream with significant growth potential. The increasing adoption of Apple Music, iCloud, and other services contributes to a stable and expanding revenue base.

-

Expansion into new markets and product categories (e.g., augmented reality/virtual reality): Apple's continued investment in research and development, particularly in areas like AR/VR, indicates ambitious plans for future product expansion and market penetration. This diversification mitigates reliance on any single product line.

-

Apple's strong brand loyalty and customer base: Apple boasts a highly loyal customer base, known for its brand affinity and willingness to pay a premium for Apple products and services. This brand loyalty provides a strong foundation for sustainable growth.

-

Continued innovation and technological advancements: Apple's history of innovation and its consistent introduction of groundbreaking products demonstrate its commitment to staying at the forefront of technological advancements. This innovation fuels future growth and market leadership.

-

The potential for future product launches (e.g., new iPhones, Apple Watches): The anticipation of new product launches, like new iPhone models and Apple Watch iterations, continuously generates excitement and demand, driving future sales and impacting the Apple price prediction.

Analyzing Apple Stock Performance and Valuation

Apple's current stock price reflects a blend of positive and negative factors. Analyzing its valuation against market benchmarks and comparing it to competitors is crucial for assessing its investment potential.

-

Comparison of Apple's P/E ratio to competitors: Comparing Apple's price-to-earnings (P/E) ratio to its competitors in the tech sector allows for a relative valuation assessment. A higher P/E ratio might indicate higher growth expectations, while a lower ratio may suggest a more conservative valuation.

-

Analysis of Apple's dividend yield and its attractiveness to investors: Apple's dividend yield, although modest, provides a regular income stream for investors. This dividend income adds to the overall return on investment, making it appealing to income-seeking investors.

-

Assessment of Apple's debt and financial health: Analyzing Apple's debt levels and its overall financial health is vital for assessing its long-term sustainability and risk profile. A strong balance sheet reduces financial risk.

-

Consideration of alternative investment opportunities within the tech sector: Comparing Apple's investment potential against other tech stocks and opportunities provides a broader perspective for investors. Diversification within the sector is often a wise strategy.

Considering the Risks of Investing in Apple Stock

While the long-term prospects for Apple appear strong, potential risks should be acknowledged:

-

Sensitivity to global economic downturns: Apple's performance is often correlated with the overall economic climate. During economic downturns, consumer spending on discretionary items like Apple products may decrease.

-

Competition from other tech giants: Intense competition from established and emerging tech companies poses a threat to Apple's market share and profitability.

-

Dependence on iPhone sales: Although Apple diversifies its revenue streams, iPhone sales still constitute a significant portion of its overall revenue. Any significant decline in iPhone sales can negatively impact the company's financial performance.

-

Potential supply chain disruptions: Global supply chain issues can affect Apple's ability to manufacture and distribute its products, potentially disrupting production and sales.

Conclusion

Wedbush's lowered price target for Apple stock, while reflecting near-term market uncertainties, doesn't diminish their confidence in Apple's long-term potential. The company's strong brand loyalty, innovative products, and expanding services segment provide a solid foundation for future growth. However, investors must consider the risks associated with investing in Apple stock, such as sensitivity to economic downturns and competition. While Apple stock remains a strong contender in many portfolios, the decision to buy, sell, or hold Apple stock ultimately depends on your individual investment goals, risk tolerance, and thorough due diligence. Is Apple stock a good investment for you? Conduct your research and consult with a financial advisor to make an informed decision.

Featured Posts

-

Rebuilding Bridges Bangladesh And Europe Collaborate For Mutual Growth

May 24, 2025

Rebuilding Bridges Bangladesh And Europe Collaborate For Mutual Growth

May 24, 2025 -

Is News Corps Stock Price Misrepresenting Its True Worth

May 24, 2025

Is News Corps Stock Price Misrepresenting Its True Worth

May 24, 2025 -

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025 -

The Rise Of Jordan Bardella A Potential French President

May 24, 2025

The Rise Of Jordan Bardella A Potential French President

May 24, 2025

Latest Posts

-

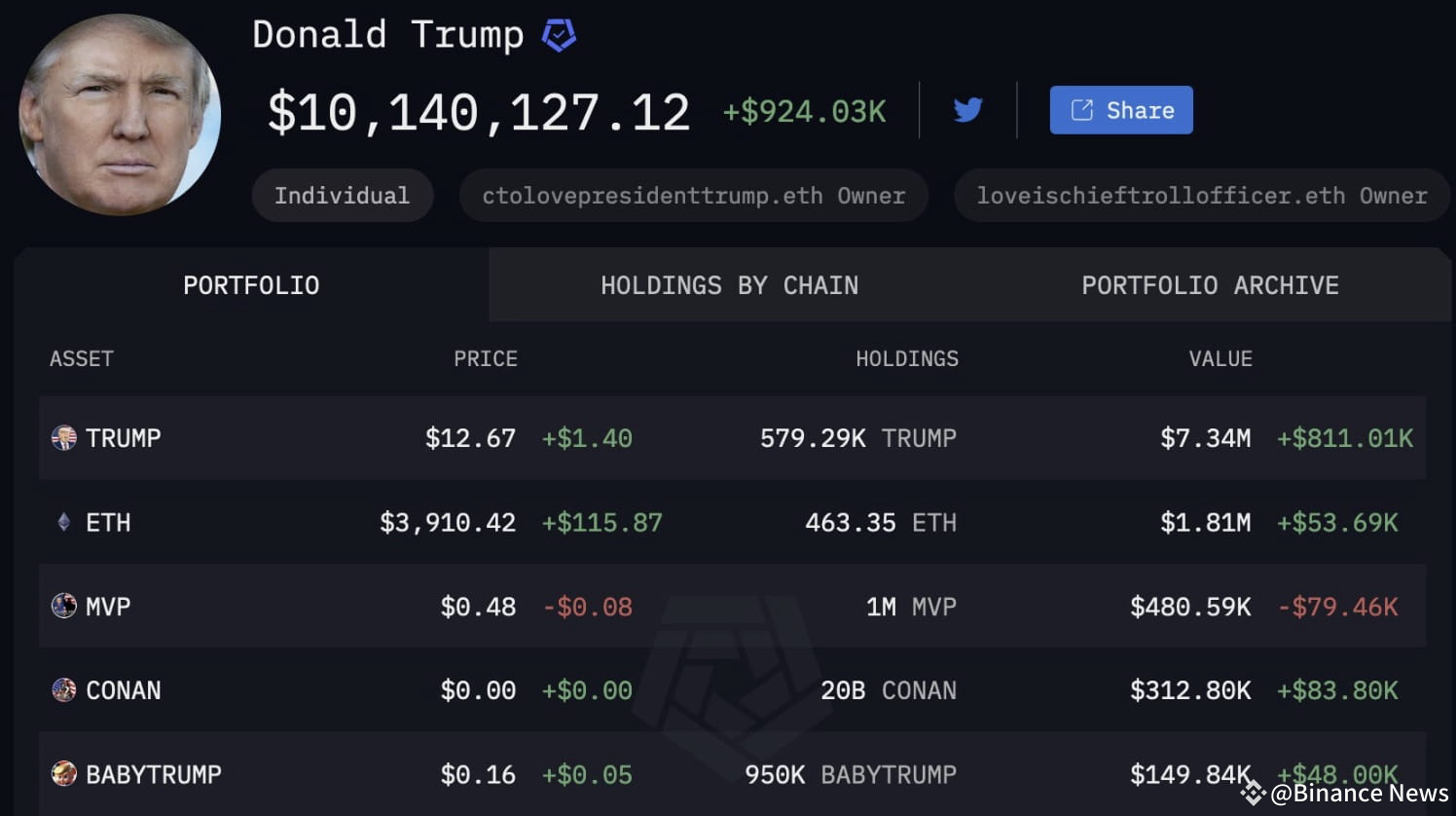

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025 -

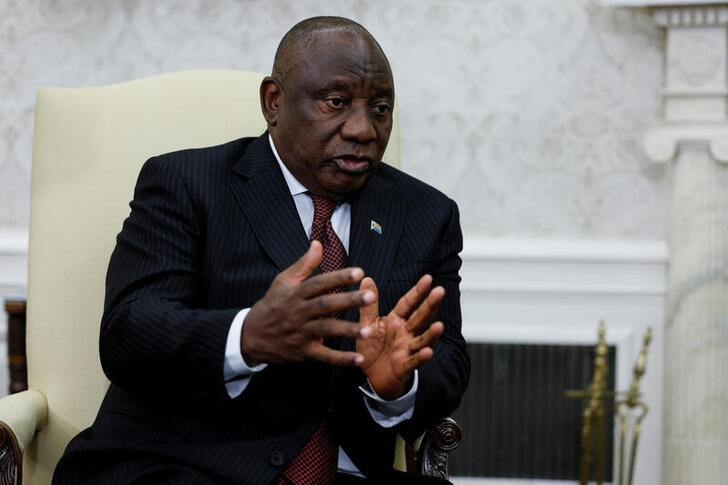

Analyzing Ramaphosas White House Encounter What Other Options Were Available

May 24, 2025

Analyzing Ramaphosas White House Encounter What Other Options Were Available

May 24, 2025 -

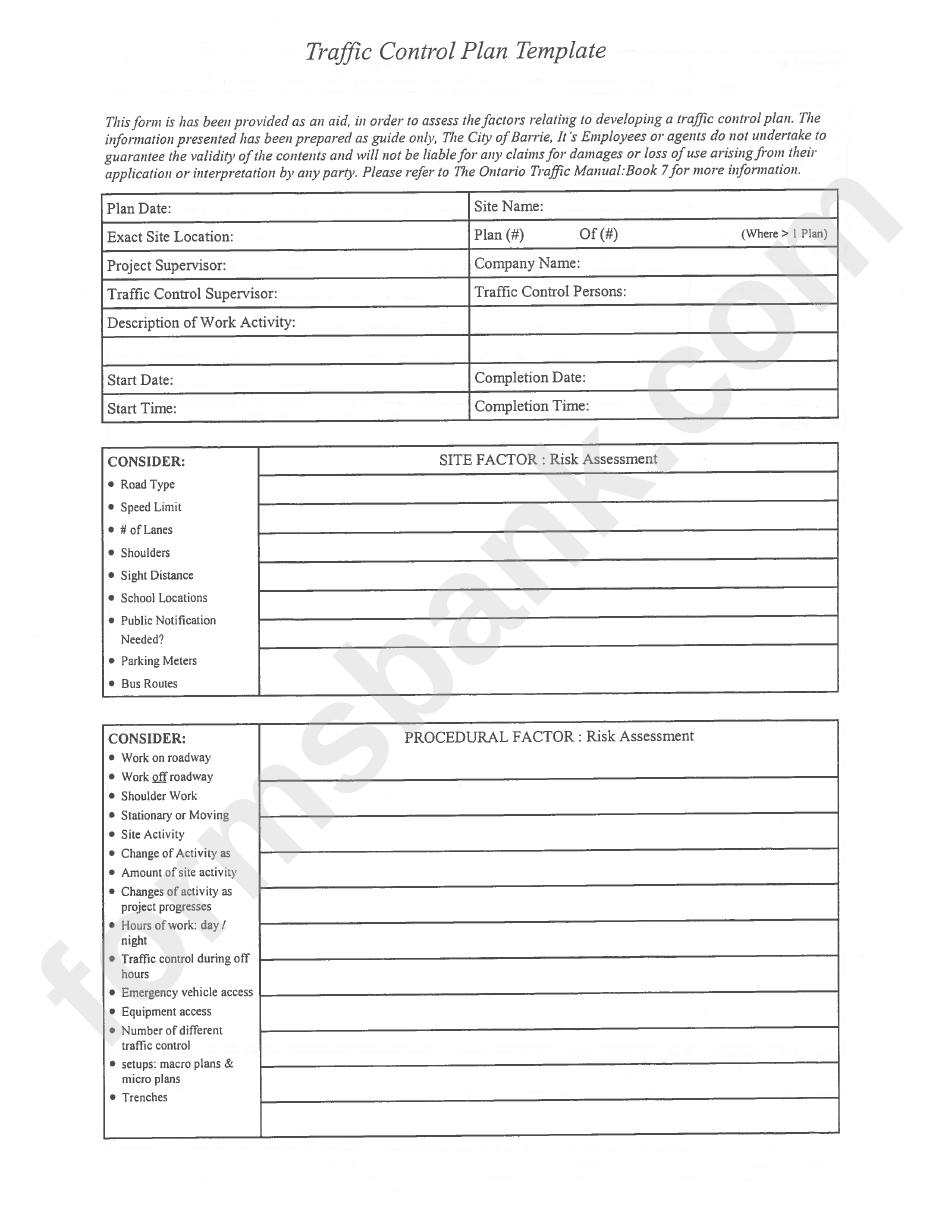

Newark Airport Disruptions A Legacy Of A Controversial Air Traffic Control Plan

May 24, 2025

Newark Airport Disruptions A Legacy Of A Controversial Air Traffic Control Plan

May 24, 2025 -

Last Minute Tweaks House Votes To Approve Trump Tax Legislation

May 24, 2025

Last Minute Tweaks House Votes To Approve Trump Tax Legislation

May 24, 2025 -

Trumps Memecoin Event Paid Guests Enjoy Anonymity

May 24, 2025

Trumps Memecoin Event Paid Guests Enjoy Anonymity

May 24, 2025