Is News Corp's Stock Price Misrepresenting Its True Worth?

Table of Contents

News Corp's Diversified Portfolio: A Source of Undervaluation?

News Corp's business is segmented into several key areas: News & Information Services (including Dow Jones and the Wall Street Journal), Book Publishing (HarperCollins), and Digital Real Estate (Move Inc.). The performance of each segment significantly impacts the overall valuation. Are some segments undervalued, while others are overvalued, leading to a misrepresentation of the company's true worth in the stock price?

- Revenue and Profit Margins: Analyzing the revenue and profit margins of each segment reveals crucial insights. High-growth segments might be underrepresented in the current stock price, while underperforming segments might be overrepresented. A detailed breakdown of each segment's profitability is necessary to understand the full picture.

- Growth Potential and Emerging Opportunities: News & Information Services faces the challenge of adapting to the digital landscape, while book publishing navigates the evolving reader habits. Digital real estate, however, presents significant growth opportunities within a booming sector. Identifying and evaluating these individual growth potentials is essential.

- Competitive Analysis: Comparing News Corp's performance in each segment against its key competitors is crucial. If News Corp is outperforming competitors yet its stock price lags, it might indeed be undervalued. A direct comparison with similar companies provides a benchmark for evaluating its true value.

Financial Health and Debt Levels: A Factor in Stock Price Suppression?

A thorough examination of News Corp's balance sheet is essential to understanding the stock price. High debt levels or poor cash flow can negatively impact investor sentiment and suppress the stock price, regardless of the underlying value of the business.

- Debt-to-Equity Ratio and Interest Coverage Ratio: Analyzing News Corp's debt-to-equity ratio and interest coverage ratio provides a clear picture of its financial leverage and ability to service its debt obligations. High debt levels can signal increased risk and potentially lower valuation.

- Free Cash Flow and Dividend Payout Ratios: News Corp's free cash flow and dividend payout ratios offer further insights into its financial health. Strong free cash flow demonstrates the company's ability to generate profits and potentially return value to shareholders.

- Financial Risks: Identifying any potential risks associated with News Corp's financial position, such as potential economic downturns or industry-specific challenges, is essential. A transparent assessment of these risks is crucial for investors.

Market Sentiment and External Factors: Influencing Stock Price Perception

Market sentiment and broader economic conditions significantly influence News Corp's stock price. Negative news cycles, macroeconomic factors, and general market volatility can all contribute to undervaluation, irrespective of the company's fundamentals.

- News Coverage and Stock Price Impact: Analyzing recent news coverage and its impact on the stock price is vital. Negative sentiment, even if unwarranted, can significantly influence investor behavior.

- Macroeconomic Factors: Interest rate hikes, inflation, or global economic slowdowns can negatively impact investor confidence and suppress stock prices across the board, including News Corp.

- Investor Sentiment Analysis: Monitoring investor sentiment through surveys, social media analysis, and other sentiment indicators can reveal whether the market's pessimism is justified.

Future Growth Prospects and Strategic Initiatives: A Look Ahead for News Corp

News Corp's future growth potential hinges on its ability to adapt to the ever-changing media landscape and execute its strategic initiatives effectively. The current stock price must account for these future prospects.

- Revenue Projections and Growth Forecasts: Analyzing future revenue projections and growth forecasts based on current trends and future plans offers an indication of potential future value.

- Acquisitions and Divestitures: Planned acquisitions or divestitures can dramatically alter News Corp's trajectory, influencing its overall valuation.

- Digital Transformation Strategy: News Corp's success in navigating the digital transformation will be a major factor in determining its future growth and market share.

Conclusion: Is News Corp Stock Truly Undervalued? A Final Verdict

In conclusion, determining whether News Corp's stock price accurately reflects its intrinsic value requires a nuanced understanding of its diversified portfolio, financial health, market sentiment, and future growth prospects. While certain segments may show strong potential, financial leverage and market perception play a significant role. A thorough analysis suggests that the current stock price may not fully capture the company’s underlying strength in certain areas. However, potential risks and market volatility remain important considerations.

While this article provides valuable insights, remember to conduct your own thorough due diligence before investing in News Corp stock. Carefully evaluate the information presented here and further research to determine if News Corp's stock price accurately represents its true worth. Consider consulting a financial advisor before making any investment decisions related to News Corp or any other stock.

Featured Posts

-

M6 Traffic Chaos Van Overturns Causing Long Delays

May 24, 2025

M6 Traffic Chaos Van Overturns Causing Long Delays

May 24, 2025 -

France Considers Tougher Sentences For Young Criminals

May 24, 2025

France Considers Tougher Sentences For Young Criminals

May 24, 2025 -

Post Record High Frankfurts Dax Shows Stability At Market Open

May 24, 2025

Post Record High Frankfurts Dax Shows Stability At Market Open

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 24, 2025 -

I Phone Ai

May 24, 2025

I Phone Ai

May 24, 2025

Latest Posts

-

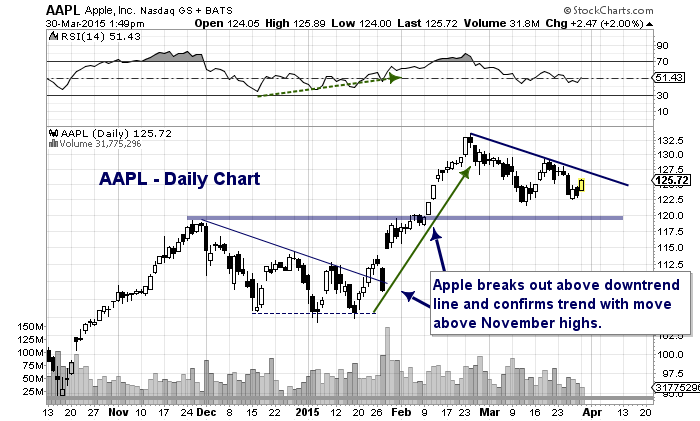

Apple Stock Aapl Price Targets Key Levels To Watch

May 24, 2025

Apple Stock Aapl Price Targets Key Levels To Watch

May 24, 2025 -

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025 -

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 24, 2025

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 24, 2025 -

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025

Berkshire Hathaway And Apple Will Buffetts Succession Impact Apple Stock

May 24, 2025