Amsterdam Stock Market: 7% Plunge At Open Reflects Growing Trade War Anxiety

Table of Contents

The Immediate Impact of the Trade War on the Amsterdam Stock Market

The sharp decline in the Amsterdam Stock Market is directly correlated to escalating trade tensions. Uncertainty surrounding tariffs, trade restrictions, and retaliatory measures creates a climate of fear and instability, prompting investors to sell off assets and seek safer havens. Several sectors, particularly technology companies heavily reliant on global supply chains and export-oriented industries like agriculture and manufacturing, have been disproportionately affected.

- Specific examples of companies experiencing significant stock price drops: [Insert names of specific companies and percentage drops. Use real examples if possible, otherwise use hypothetical but realistic examples]. For instance, a hypothetical major Dutch semiconductor manufacturer might have seen a 10% drop, while a leading agricultural exporter experienced a 8% decline.

- Quantitative data illustrating the extent of the losses: [Insert data on market capitalization loss, trading volume changes, etc. Use actual data if available, otherwise provide plausible estimates]. The total market capitalization loss could be estimated in the billions of Euros.

- Mention any immediate government or central bank responses: [Mention any actual or potential responses from the Dutch government or the European Central Bank, e.g., statements of support, potential stimulus measures]. The Dutch government might be considering fiscal stimulus measures to mitigate the impact.

Underlying Economic Factors Contributing to the Amsterdam Stock Market Decline

While the trade war is a major catalyst, broader economic factors contribute to the Amsterdam Stock Market decline. A global economic slowdown, coupled with rising inflation and subsequent interest rate hikes by central banks, further dampens investor sentiment.

- Analysis of inflation rates and their impact on investor confidence: [Insert data on inflation rates in the Netherlands and the Eurozone. Explain how rising inflation erodes purchasing power and impacts investor confidence]. High inflation reduces the real return on investments, making investors less willing to take risks.

- Discussion of interest rate policies and their effect on market liquidity: [Discuss the impact of interest rate hikes on borrowing costs for businesses and the availability of credit. Explain how higher interest rates can reduce market liquidity and impact investment decisions]. Higher interest rates increase borrowing costs, making it more expensive for businesses to expand and potentially slowing economic growth.

- Mention any relevant economic indicators (GDP growth, unemployment, etc.): [Insert data on relevant economic indicators for the Netherlands. Explain how these indicators influence investor sentiment and market performance]. A slowdown in GDP growth, coupled with rising unemployment, can negatively impact investor confidence.

Investor Sentiment and Market Volatility in the Amsterdam Stock Exchange

The uncertainty surrounding the trade war has significantly impacted investor psychology. Risk aversion is prevalent, leading to a flight to safety and increased market volatility.

- Analysis of investor sentiment indices: [Mention relevant investor sentiment indices and their current levels. Explain how these indices reflect investor confidence and risk appetite]. A decline in investor sentiment indices reflects growing pessimism and a decreased willingness to invest in riskier assets.

- Discussion of increased market volatility and trading volume: [Provide data on increased volatility and trading volume on the Amsterdam Stock Exchange. Explain the relationship between uncertainty, volatility, and trading activity]. Increased volatility indicates a higher degree of uncertainty in the market, leading to more frequent and larger price swings.

- Mention strategies employed by investors to mitigate risks (e.g., hedging): [Discuss various risk mitigation strategies used by investors, such as hedging with derivatives or diversifying their portfolios]. Investors are likely employing hedging strategies to protect themselves against further market declines.

The Global Context: How the Amsterdam Stock Market Plunge Reflects Broader Trends

The Amsterdam Stock Market's decline mirrors broader global trends. Major stock exchanges worldwide are experiencing similar pressure due to trade war anxieties.

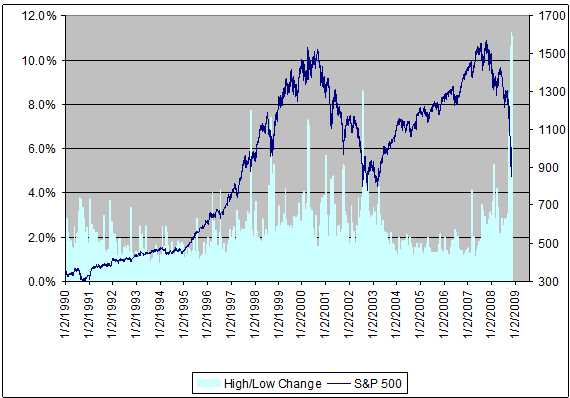

- Comparison with similar market drops in other major European or global stock exchanges: [Compare the Amsterdam Stock Market's performance to other major indices, such as the FTSE 100, DAX, or S&P 500]. The correlation between market movements in different global exchanges highlights the interconnected nature of the global financial system.

- Discussion of interconnectedness of global markets and the ripple effect of trade disputes: [Explain how trade disputes can have a ripple effect across global markets, impacting supply chains, investment decisions, and overall economic activity]. Trade disputes create uncertainty and disrupt global supply chains, leading to negative consequences for businesses and investors worldwide.

- Mention any international organizations' (e.g., IMF, World Bank) responses or predictions: [Mention any statements, reports, or predictions from international organizations regarding the global economic outlook and the impact of trade disputes]. International organizations may issue warnings about the potential negative impact of the trade war on global growth.

Potential Long-Term Implications for the Amsterdam Stock Market and Dutch Economy

The 7% plunge in the Amsterdam Stock Market has significant potential long-term implications for the Dutch economy. Decreased investor confidence can lead to reduced business investment, impacting employment and overall economic growth.

- Potential for decreased foreign investment in the Netherlands: [Discuss the potential impact of the market decline on foreign investment in the Netherlands]. Uncertainty can deter foreign investors from committing capital to the Dutch economy.

- Impact on Dutch export-oriented industries: [Analyze the potential long-term consequences for Dutch export-oriented industries, such as agriculture and manufacturing]. Trade disputes can severely impact export-oriented industries' ability to compete in global markets.

- Potential government intervention measures to stimulate economic growth: [Discuss potential government intervention measures, such as fiscal stimulus or monetary policy adjustments, to mitigate the economic impact of the market decline]. The Dutch government might implement policies to stimulate economic activity and boost investor confidence.

Conclusion: Navigating Uncertainty in the Amsterdam Stock Market

The 7% plunge in the Amsterdam Stock Market is a stark reminder of the significant impact of global trade tensions on national economies. Trade war anxieties, coupled with broader economic factors, have created a climate of uncertainty, leading to decreased investor confidence and market volatility. The potential long-term consequences for the Dutch economy are considerable, highlighting the need for careful monitoring and proactive strategies. To navigate this uncertain environment, staying informed about developments in the Amsterdam Stock Market and global trade relations is crucial. Thorough analysis and informed investment decisions are paramount in this volatile climate. Further research into the Amsterdam Stock Exchange's historical performance and predictions from reputable financial analysts will provide a more comprehensive understanding of its future trajectory.

Featured Posts

-

The Woody Allen Controversy Sean Penns Backing And The Public Reaction

May 24, 2025

The Woody Allen Controversy Sean Penns Backing And The Public Reaction

May 24, 2025 -

Crystal Palace Target Kyle Walker Peters On A Free

May 24, 2025

Crystal Palace Target Kyle Walker Peters On A Free

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Tracking And Analysis

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Nav Tracking And Analysis

May 24, 2025 -

Finding Bbc Radio 1 Big Weekend 2025 Tickets Sefton Park

May 24, 2025

Finding Bbc Radio 1 Big Weekend 2025 Tickets Sefton Park

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

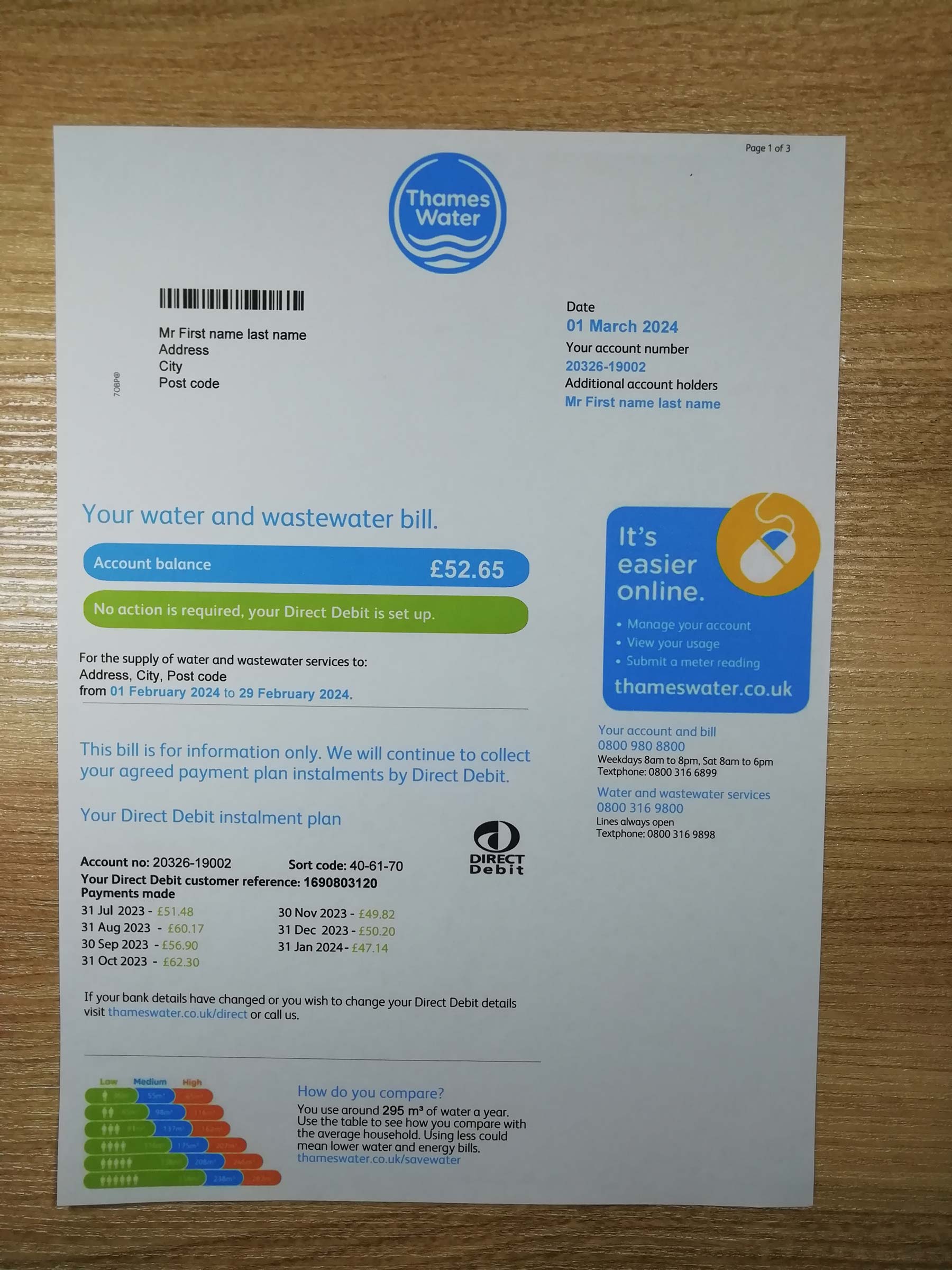

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025