Analysis: SSE's £3 Billion Spending Cut And The Economic Outlook

Table of Contents

Reasons Behind SSE's Spending Cut

Several interconnected factors have driven SSE's decision to slash its spending by £3 billion. Understanding these factors is crucial to grasping the full implications of this move.

Increased Inflation and Rising Costs

Soaring inflation has significantly impacted the cost of energy projects, rendering some financially unviable. This cost escalation is a multifaceted problem.

- Increased material costs: The price of raw materials, such as steel and copper, used in energy infrastructure projects has skyrocketed.

- Labour shortages: A shortage of skilled workers in the energy sector has driven up labour costs, adding to project expenses.

- Supply chain disruptions: Global supply chain issues have caused delays and increased costs for essential components and equipment.

- Higher interest rates: Increased borrowing costs make financing large-scale energy projects more expensive, further impacting profitability.

These factors combine to create a perfect storm, forcing SSE to reassess its budget and prioritize projects with a higher likelihood of delivering returns in the current economic climate.

Regulatory Uncertainty and Policy Changes

The UK's evolving energy policy landscape adds another layer of complexity. Uncertainty surrounding government regulations and subsidies significantly impacts investment decisions.

- Changes in renewable energy subsidies: Fluctuations in government support for renewable energy projects create instability and make long-term planning difficult.

- Potential alterations to energy market regulations: Uncertainty about future market rules and regulations discourages large-scale investment.

- Uncertainty surrounding future energy policy: The lack of a clear, long-term energy strategy increases the perceived risk associated with significant capital investment.

This regulatory uncertainty makes it challenging for companies like SSE to make confident, long-term investment decisions.

Focus on Profitability and Shareholder Value

SSE's strategic shift towards prioritizing short-term profitability over long-term, high-risk projects reflects the pressure exerted by investors.

- Pressure from investors for higher returns: Investors demand strong financial performance, incentivizing companies to focus on projects with quicker returns.

- Need to improve financial performance: SSE, like many companies, faces pressure to improve its financial results in the face of economic headwinds.

- Focus on core businesses: The company is likely streamlining its operations, focusing on its most profitable and less risky ventures.

This prioritization of shareholder value, while understandable, potentially jeopardizes long-term investments crucial for the UK's energy transition.

Impact of the Spending Cut on the UK Energy Sector

SSE's £3 billion spending cut has far-reaching consequences for the UK energy sector and the wider economy.

Delayed or Cancelled Energy Projects

The reduction in investment will inevitably lead to delays or cancellations of crucial energy projects, hampering the UK's energy transition.

- Examples of specific projects potentially affected: While specific projects haven't been publicly named, delays in wind farm development, grid infrastructure upgrades, and other renewable energy initiatives are likely.

- Delays in renewable energy deployment: Slowed progress on renewable energy projects will delay the UK's transition to a cleaner energy system.

- Impact on the UK's decarbonization targets: The reduced investment directly threatens the UK's ability to meet its ambitious net-zero targets.

These delays will have a significant impact on the UK's efforts to combat climate change and ensure energy security.

Job Losses and Economic Slowdown

The spending cut will likely result in job losses across various sectors linked to energy projects.

- Potential job losses in construction, engineering, and related industries: Reduced investment will lead to fewer job opportunities in the construction, engineering, and manufacturing sectors.

- Reduced economic activity stemming from decreased investment: The decline in energy investment will have a knock-on effect on the wider UK economy, reducing overall economic activity.

These job losses and economic slowdown could disproportionately affect regional economies heavily reliant on the energy sector.

Implications for Energy Security

Reduced investment in domestic energy production poses risks to the UK's energy independence and resilience.

- Increased reliance on imported energy: Decreased domestic energy production may increase the UK's dependence on energy imports, making it vulnerable to global energy price shocks.

- Potential vulnerability to energy price shocks: This increased reliance makes the UK more susceptible to fluctuations in global energy markets.

- Impact on energy affordability for consumers: Increased reliance on imports could lead to higher energy prices for consumers.

This reduced investment undermines the UK's long-term energy security strategy.

Potential Long-Term Consequences

The long-term implications of SSE's decision are significant and warrant careful consideration.

Impact on the UK's Net-Zero Targets

The spending cut directly threatens the UK's ability to achieve its ambitious net-zero targets by 2050, potentially leading to a slower and more costly transition to a low-carbon economy.

Attractiveness of the UK for Energy Investment

SSE's decision casts a shadow over the UK's attractiveness as a destination for future energy investment, potentially discouraging international investors and hindering the growth of the UK energy sector.

Government Response and Policy Adjustments

The UK government needs to respond proactively with clear policy adjustments to mitigate the negative consequences of SSE's decision, including increased support for renewable energy projects, regulatory clarity, and long-term energy investment strategies.

Conclusion

SSE's £3 billion spending cut is a significant development with potentially far-reaching consequences for the UK economy and its energy sector. The reasons behind the decision – a combination of rising costs, regulatory uncertainty, and a focus on short-term profitability – highlight major challenges facing the energy industry. The potential impact on energy projects, employment, and energy security underscores the urgent need for a comprehensive response. The UK government must implement proactive policies to mitigate the risks and reaffirm its commitment to sustainable energy investment. Understanding the complexities surrounding SSE's decision is vital for navigating the evolving landscape of the UK energy market and ensuring a secure and sustainable energy future. Further analysis of SSE's investment strategy and the broader economic outlook is crucial to fully understand the ramifications of this substantial spending cut.

Featured Posts

-

Gold Investment Soars Impact Of Trumps Latest Trade Actions

May 25, 2025

Gold Investment Soars Impact Of Trumps Latest Trade Actions

May 25, 2025 -

Memorial Day 2025 Air Travel Avoid These Busy Dates

May 25, 2025

Memorial Day 2025 Air Travel Avoid These Busy Dates

May 25, 2025 -

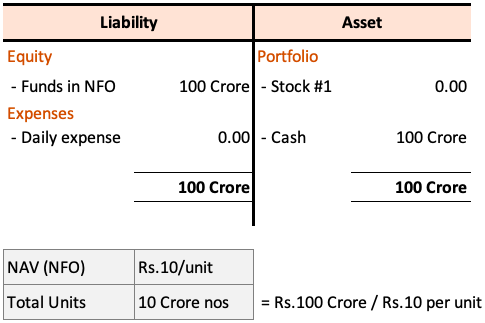

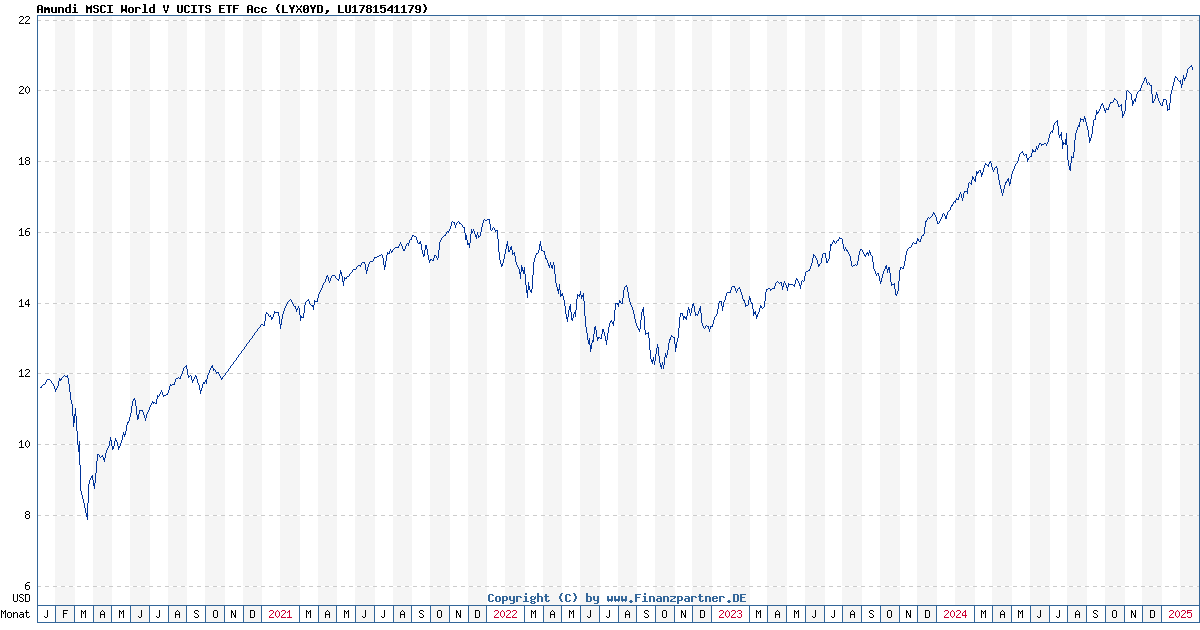

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 25, 2025

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 25, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf

May 25, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf

May 25, 2025 -

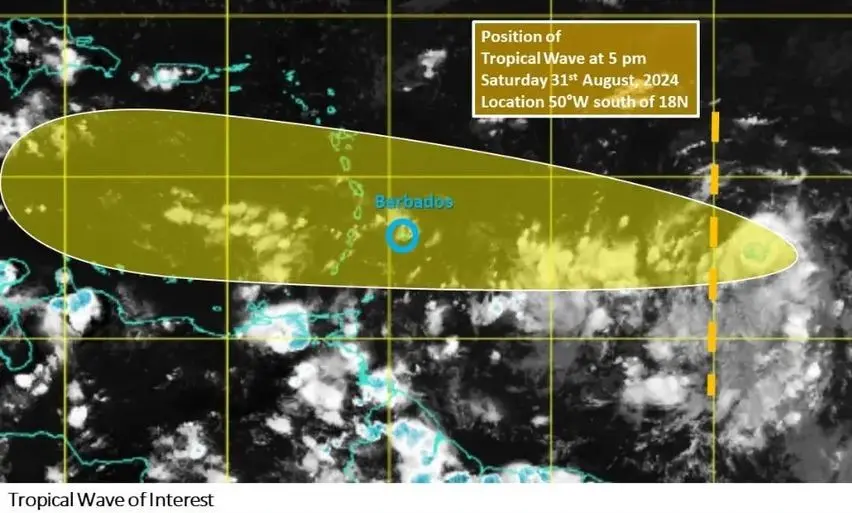

Bradford And Wyoming Counties Under Flash Flood Warning Due To Thunderstorms

May 25, 2025

Bradford And Wyoming Counties Under Flash Flood Warning Due To Thunderstorms

May 25, 2025

Latest Posts

-

Flash Flood Emergency Response Protecting Yourself And Your Family

May 25, 2025

Flash Flood Emergency Response Protecting Yourself And Your Family

May 25, 2025 -

Flood Warning Your Action Plan With Nws Safety Tips

May 25, 2025

Flood Warning Your Action Plan With Nws Safety Tips

May 25, 2025 -

Nws Issues Flash Flood Warning For South Florida Due To Intense Rainfall

May 25, 2025

Nws Issues Flash Flood Warning For South Florida Due To Intense Rainfall

May 25, 2025 -

South Florida Flash Flood Warning Heavy Rainfall Prompts Urgent Alert

May 25, 2025

South Florida Flash Flood Warning Heavy Rainfall Prompts Urgent Alert

May 25, 2025 -

Understanding Flood Warnings Your Guide From The Nws

May 25, 2025

Understanding Flood Warnings Your Guide From The Nws

May 25, 2025