Analyzing Elon Musk's Recent Behavior And Its Effect On Tesla

Table of Contents

The Impact of Musk's Twitter Activity on Tesla's Stock Price

Controversial Tweets and Market Volatility

Elon Musk's Twitter activity has repeatedly shown a direct correlation with Tesla's stock price volatility. His impulsive tweets, often concerning Dogecoin, cryptocurrency, or political statements, have caused significant market fluctuations.

- Example 1: Musk's tweets about Dogecoin in early 2021 led to dramatic spikes and drops in the cryptocurrency's price, directly impacting Tesla's stock which is often viewed as correlated with his other ventures. Analysis of this period shows a clear correlation between the tweet volume and Tesla's daily trading range.

- Example 2: Statements regarding Tesla's production targets or future plans, often made via Twitter, have similarly impacted investor confidence and share prices. Data shows significant stock price movements immediately following these announcements.

- SEC Investigations: The SEC's investigations into Musk's tweets highlight the regulatory concerns surrounding his social media usage and the potential for market manipulation. This adds another layer of uncertainty for investors concerned about Elon Musk Tesla Stock.

The psychological impact on investors is significant. Musk's unpredictable tweets fuel fear, uncertainty, and doubt (FUD), leading to rapid changes in investor sentiment and ultimately, stock prices. Social media sentiment analysis tools are increasingly used to gauge the immediate impact of Musk's tweets on market perception.

Brand Image and Reputation Management

Musk's online persona directly impacts Tesla's brand perception. While some admire his outspokenness and innovative spirit, others view it as reckless and unprofessional.

- Positive Associations: Musk's association with innovation and future-forward technology enhances Tesla's brand image among tech-savvy consumers.

- Negative Associations: Controversial tweets and erratic behavior can alienate potential customers and investors, damaging Tesla's carefully cultivated reputation for luxury and sustainability.

The challenge for Tesla lies in maintaining a consistent brand message despite Musk's unpredictable online presence. This requires sophisticated crisis communication strategies to mitigate the negative impact of his actions and protect the Elon Musk Tesla Stock value. Failure to address these issues effectively could lead to significant long-term brand damage.

Major Business Decisions and Their Effect on Tesla's Trajectory

Acquisitions and Investments

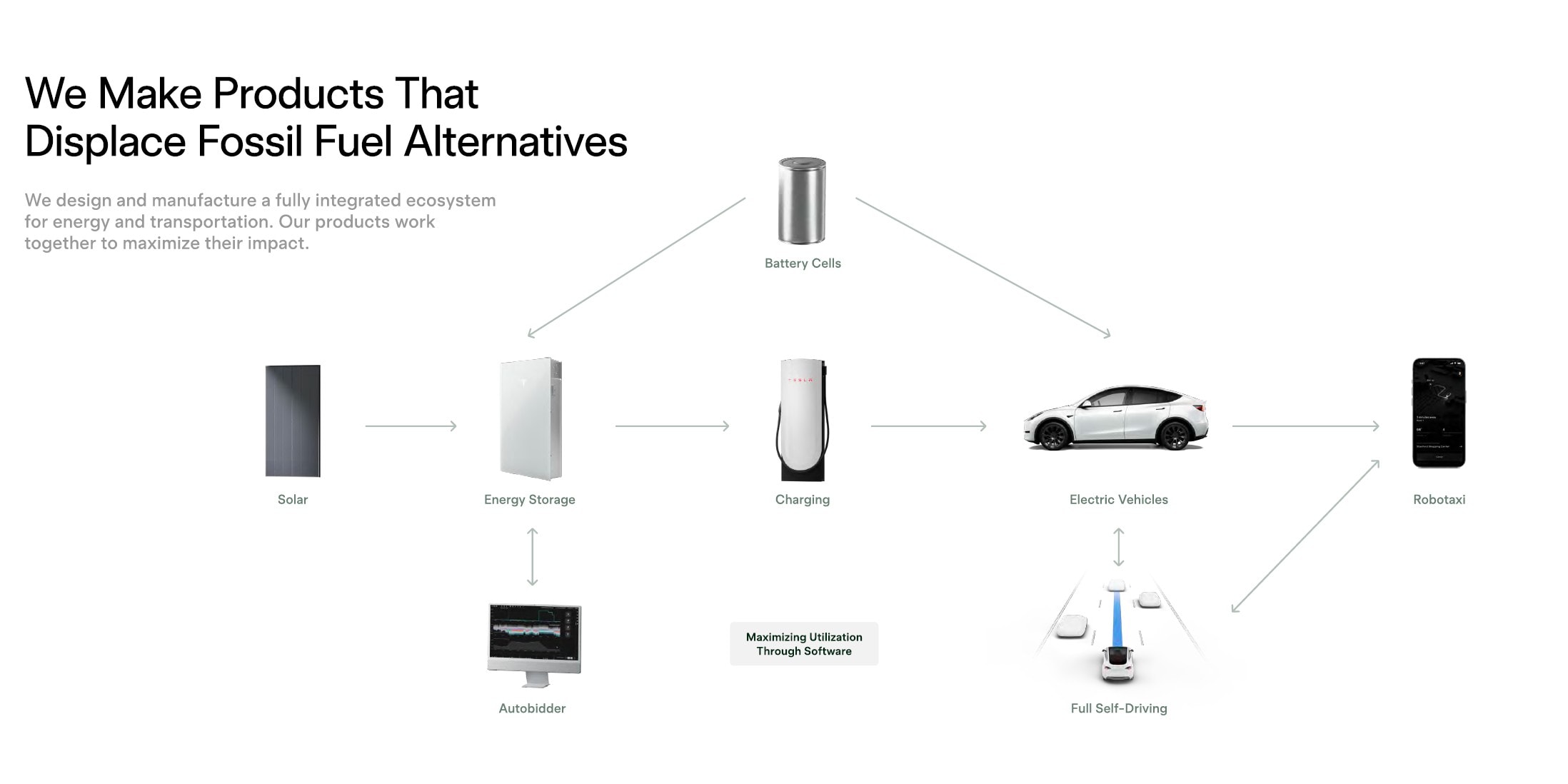

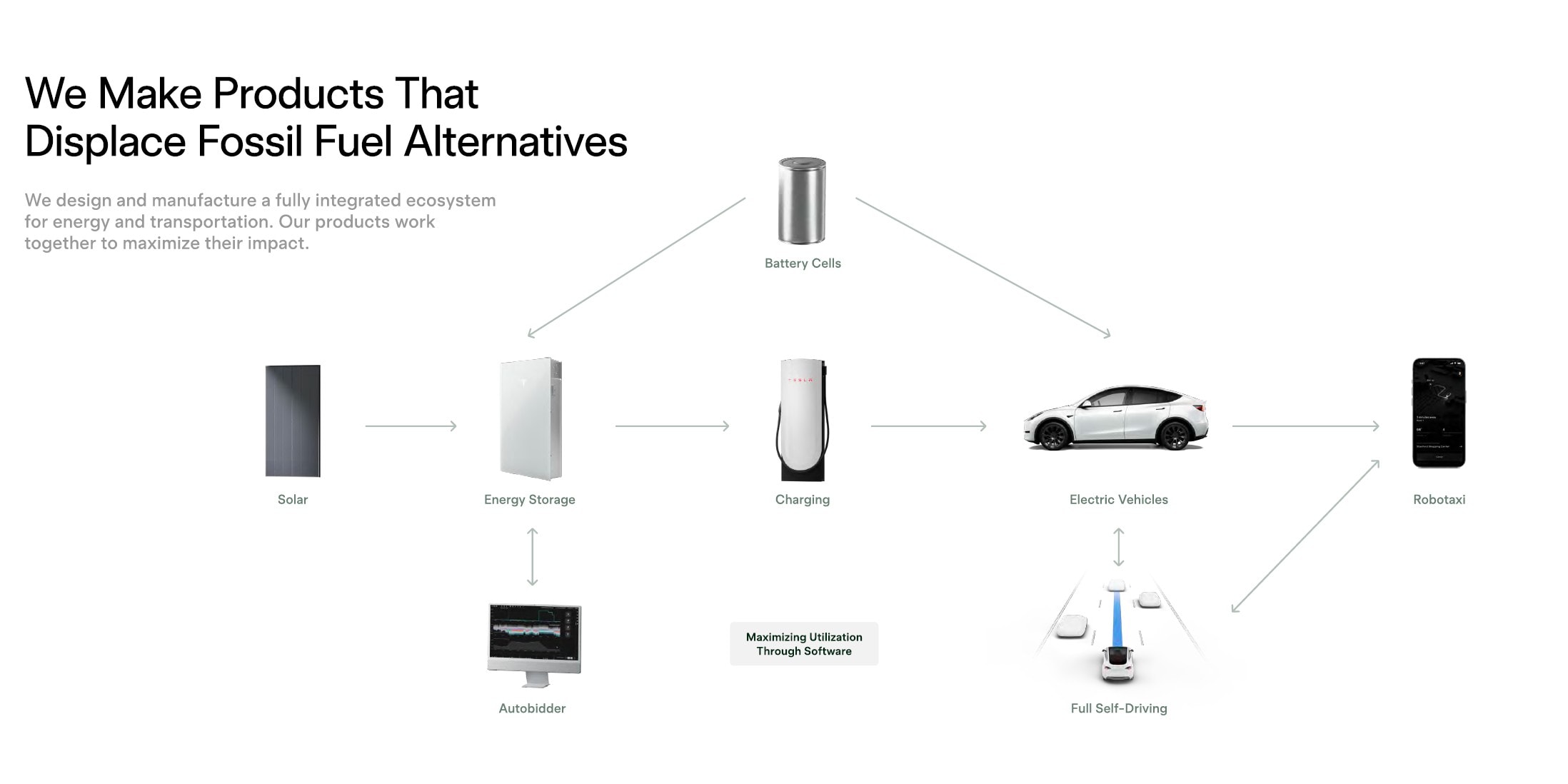

Musk's major business decisions have significantly shaped Tesla's trajectory. Some acquisitions, like SolarCity, have been met with mixed results, impacting the overall Elon Musk Tesla Stock performance.

- SolarCity Acquisition: While aiming to integrate renewable energy solutions into Tesla's ecosystem, the SolarCity acquisition faced criticism for its financial performance and raised concerns about potential conflicts of interest.

- Other Acquisitions and Investments: A detailed analysis of Tesla's other strategic investments and acquisitions is crucial to understand their impact on the company's financial health and long-term vision. Return on investment (ROI) data for these ventures needs to be meticulously assessed.

The strategic rationale behind these decisions, often driven by Musk's personal vision, needs careful scrutiny. Evaluating whether these acquisitions aligned with Tesla's overall goals and long-term sustainability is vital for understanding their impact on Elon Musk Tesla stock.

Leadership Style and its Influence on Employee Morale and Productivity

Musk's demanding leadership style is both praised and criticized. While some see it as essential for driving innovation, others point to reports of demanding work environments and high employee turnover.

- High Turnover Rates: Reports of a demanding and high-pressure work culture have contributed to Tesla's employee turnover rates, potentially impacting productivity and innovation.

- Impact on Innovation: While Musk's demanding style might push employees to achieve extraordinary feats, it could also hinder creativity and collaboration, potentially slowing down innovation.

Analyzing the potential benefits and drawbacks of Musk's leadership style requires comparing it to other successful leadership models in the tech industry. Finding a balance between pushing employees and maintaining a positive and productive work environment is crucial for long-term success.

The Future of Elon Musk and Tesla: Predicting the Correlation

Investor Confidence and Long-Term Projections

Investor sentiment towards Tesla is heavily influenced by Musk's actions, creating uncertainty regarding Elon Musk Tesla stock performance.

- Analyst Ratings: Analyst ratings and forecasts for Tesla's stock offer insights into the market's overall perception of the company's future prospects. These projections frequently take into account the risk factor associated with Musk's behavior.

- Future Growth and Challenges: Predictions about Tesla's future growth must consider the potential impact of both positive and negative factors, including the influence of Musk's conduct.

Despite short-term volatility, the long-term prospects for Tesla depend on various factors, including the successful implementation of its strategic plans and the broader electric vehicle market trends. However, Musk's behavior remains a significant wild card.

Strategies for Mitigating Risk Associated with Musk's Behavior

Tesla needs to adopt strategies to mitigate the negative impacts of Musk's behavior.

- Improved Communication Strategies: A more carefully managed communication strategy, potentially with the involvement of a professional PR firm, could help to control the narrative around Musk's actions.

- Enhanced Corporate Governance: Strengthening internal controls and improving corporate governance could reduce the risks associated with impulsive decisions.

A balance must be struck between embracing Musk's visionary leadership and implementing more structured corporate practices. This is critical for maintaining investor confidence and ensuring a sustainable future for Tesla and its Elon Musk Tesla stock.

Conclusion

Elon Musk's actions undeniably have a significant impact on Tesla's performance. While his visionary leadership has propelled Tesla to the forefront of the electric vehicle industry, his unpredictable behavior presents substantial risk. Understanding the correlation between Musk's behavior and Tesla's stock performance is crucial for investors and stakeholders alike. Careful consideration of the points discussed above highlights the need for a strategic approach to manage the risks associated with Musk's influence and ensure a sustainable future for Tesla. Continue researching Elon Musk Tesla Stock to stay informed on future developments and investment strategies.

Featured Posts

-

Naomi Kempbell I Ee Deti Novye Foto I Slukhi O Romane S Millionerom

May 26, 2025

Naomi Kempbell I Ee Deti Novye Foto I Slukhi O Romane S Millionerom

May 26, 2025 -

Naomi Campbell Reportedly Banned From Met Gala 2025 Following Wintour Dispute

May 26, 2025

Naomi Campbell Reportedly Banned From Met Gala 2025 Following Wintour Dispute

May 26, 2025 -

Rio Tinto And Andrew Forrest Clash Over Pilbaras Environmental Impact

May 26, 2025

Rio Tinto And Andrew Forrest Clash Over Pilbaras Environmental Impact

May 26, 2025 -

Jenson Button Remains Overseas Following 250 000 London Robbery

May 26, 2025

Jenson Button Remains Overseas Following 250 000 London Robbery

May 26, 2025 -

Le Palais Des Congres De Liege Apres Le Depart De La Rtbf Reamenagement Et Projets

May 26, 2025

Le Palais Des Congres De Liege Apres Le Depart De La Rtbf Reamenagement Et Projets

May 26, 2025

Latest Posts

-

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025 -

Finding A Direct Lender For Bad Credit Personal Loans Up To 5000

May 28, 2025

Finding A Direct Lender For Bad Credit Personal Loans Up To 5000

May 28, 2025 -

Personal Loans With Guaranteed Approval For Bad Credit Up To 5000

May 28, 2025

Personal Loans With Guaranteed Approval For Bad Credit Up To 5000

May 28, 2025 -

Abd Tueketici Kredileri Mart Ayi Artisinin Sebepleri Ve Sonuclari

May 28, 2025

Abd Tueketici Kredileri Mart Ayi Artisinin Sebepleri Ve Sonuclari

May 28, 2025 -

Secure Personal Loans For Bad Credit Direct Lender Options And Up To 5000

May 28, 2025

Secure Personal Loans For Bad Credit Direct Lender Options And Up To 5000

May 28, 2025