Apple Stock (AAPL): Where Will The Price Go Next? Key Levels Analysis

Table of Contents

Current Market Conditions and Their Impact on Apple Stock (AAPL)

The trajectory of Apple stock price is heavily influenced by both macroeconomic factors and industry-specific trends. Understanding these forces is crucial for predicting AAPL's potential movements.

Macroeconomic Factors: Navigating the Economic Landscape

Current interest rates, inflation, and the overall economic outlook significantly impact tech stocks like AAPL. The "Apple stock market" performance is directly correlated with investor confidence.

- Recession Fears: The looming threat of a recession casts a shadow on investor sentiment, potentially leading to a sell-off in riskier assets, including Apple shares.

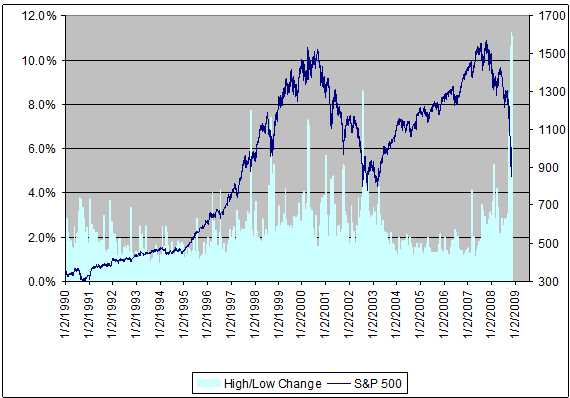

- Bull or Bear Market: A bull market generally favors growth stocks like AAPL, while a bear market can lead to significant price drops. Predicting the direction of the overall market is key to understanding the Apple share price prediction.

- Federal Reserve Influence: The Federal Reserve's monetary policy decisions, particularly interest rate hikes, can impact borrowing costs for companies and investor appetite for risk, thereby influencing the Apple stock price. Analyzing the Fed's moves is crucial for any Apple stock market analysis.

Industry-Specific Trends: Competition and Innovation

The technology sector is fiercely competitive. Apple's stock price is affected by its performance relative to competitors and emerging technologies.

- Competition from Android: The relentless competition from Android-based smartphones and tablets constantly challenges Apple's market share, impacting the AAPL stock price.

- New Technologies (AI, VR/AR): The rise of artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) presents both opportunities and threats for Apple. Successful integration of these technologies could boost Apple stock, while failure to adapt could hinder its growth. Understanding Apple's competitive advantage in this landscape is crucial for accurate Apple stock competitors analysis.

- Supply Chain Disruptions: Global supply chain issues can disrupt Apple's production and sales, affecting the company's financial performance and the Apple stock price.

Technical Analysis of Apple Stock (AAPL): Identifying Key Support and Resistance Levels

Technical analysis of Apple Stock (AAPL) uses chart patterns and indicators to identify potential support and resistance levels, providing clues about future price movements.

Chart Patterns and Indicators: Deciphering the AAPL Stock Chart

Analyzing Apple stock chart patterns using technical indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) helps identify potential turning points.

- Support Levels: These are price levels where buying pressure is expected to overcome selling pressure, potentially preventing further price declines. For example, a significant support level for AAPL might be $150. This means a drop below $150 could signal a further downward trend.

- Resistance Levels: These are price levels where selling pressure is expected to overcome buying pressure, potentially preventing further price increases. A key resistance level for AAPL might be $180. Breaking through this level could suggest further upward momentum. (Note: Specific price points should be replaced with current market data). Visual representations using charts would significantly enhance this analysis.

Trendlines and Breakout Potential: AAPL Stock Trend Analysis

Trendlines help identify the overall direction of the Apple stock price. A breakout above a resistance level indicates a bullish trend, while a breakdown below a support level suggests a bearish trend.

- Upward Trend: A sustained upward trend suggests strong buying pressure and potential for further price increases. A breakout above a significant resistance level would confirm this.

- Downward Trend: A sustained downward trend suggests strong selling pressure and potential for further price declines. A breakdown below a significant support level would confirm this. Illustrations with chart examples would significantly enhance the reader's understanding of AAPL breakout levels. (Note: Specific scenarios should be replaced with current market data and chart illustrations).

Fundamental Analysis of Apple Stock (AAPL): Assessing Intrinsic Value

Fundamental analysis of Apple Stock (AAPL) examines the company's financial health and future growth prospects to determine its intrinsic value.

Financial Performance: Unveiling Apple's Financial Health

Analyzing Apple's financial reports – revenue, earnings, and profit margins – provides a crucial insight into the company's financial strength.

- Key Financial Metrics: Examining metrics like revenue growth, earnings per share (EPS), and profit margins reveals the company's financial health and its ability to generate profits. Strong financial performance would generally support a higher Apple stock valuation.

- Strengths and Weaknesses: Identifying strengths and weaknesses in Apple's financial performance is crucial for evaluating its long-term prospects.

Future Growth Prospects: Peering into Apple's Future

Analyzing Apple's product pipeline, innovation, and market expansion plans offers a glimpse into its future growth potential.

- New Product Releases: The success of new products like the iPhone, Apple Watch, and the recently launched Vision Pro headset significantly impacts Apple's revenue and the Apple stock future growth.

- Market Opportunities: Identifying new markets for Apple's products and services, such as expansion into emerging economies, offers insights into the company's future growth potential.

- Competitive Advantages: Analyzing Apple's competitive advantages, such as its strong brand reputation and loyal customer base, is important for evaluating its long-term sustainability. These factors contribute to any Apple market share prediction.

Apple Stock (AAPL): Final Thoughts and Next Steps

This analysis of Apple Stock (AAPL) highlights the interplay between macroeconomic conditions, industry trends, and the company's intrinsic value. Key support and resistance levels, identified through technical analysis, provide potential price targets. While the fundamental analysis suggests strong growth potential driven by innovation and market expansion, macroeconomic headwinds present potential challenges.

Key Takeaways: The analysis suggests potential support levels (replace with specific current market data) and resistance levels (replace with specific current market data) for Apple Stock (AAPL). Positive factors include strong innovation and brand loyalty; negative factors include macroeconomic uncertainty and competition.

Call to Action: Stay informed on the latest developments in Apple Stock (AAPL) and continue your own in-depth analysis to make informed investment decisions. Remember to conduct thorough research and consider your own risk tolerance before making any investment choices. Understanding the nuances of Apple stock valuation and performing regular AAPL financial analysis are crucial for success.

Featured Posts

-

The Benefits Of An Escape To The Country Health Wellbeing And Lifestyle

May 24, 2025

The Benefits Of An Escape To The Country Health Wellbeing And Lifestyle

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

Apple Stock Performance Implications For Q2 Earnings

May 24, 2025

Apple Stock Performance Implications For Q2 Earnings

May 24, 2025 -

Pavel I I Trillery Refleksiya Fedora Lavrova O Lyudskoy Tyage K Risku

May 24, 2025

Pavel I I Trillery Refleksiya Fedora Lavrova O Lyudskoy Tyage K Risku

May 24, 2025 -

Bbc Radio 1s Big Weekend 2025 Your Guide To Getting Sefton Park Tickets

May 24, 2025

Bbc Radio 1s Big Weekend 2025 Your Guide To Getting Sefton Park Tickets

May 24, 2025

Latest Posts

-

The Nfls War On Butt Slapping Ends The Tush Push Lives On

May 24, 2025

The Nfls War On Butt Slapping Ends The Tush Push Lives On

May 24, 2025 -

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

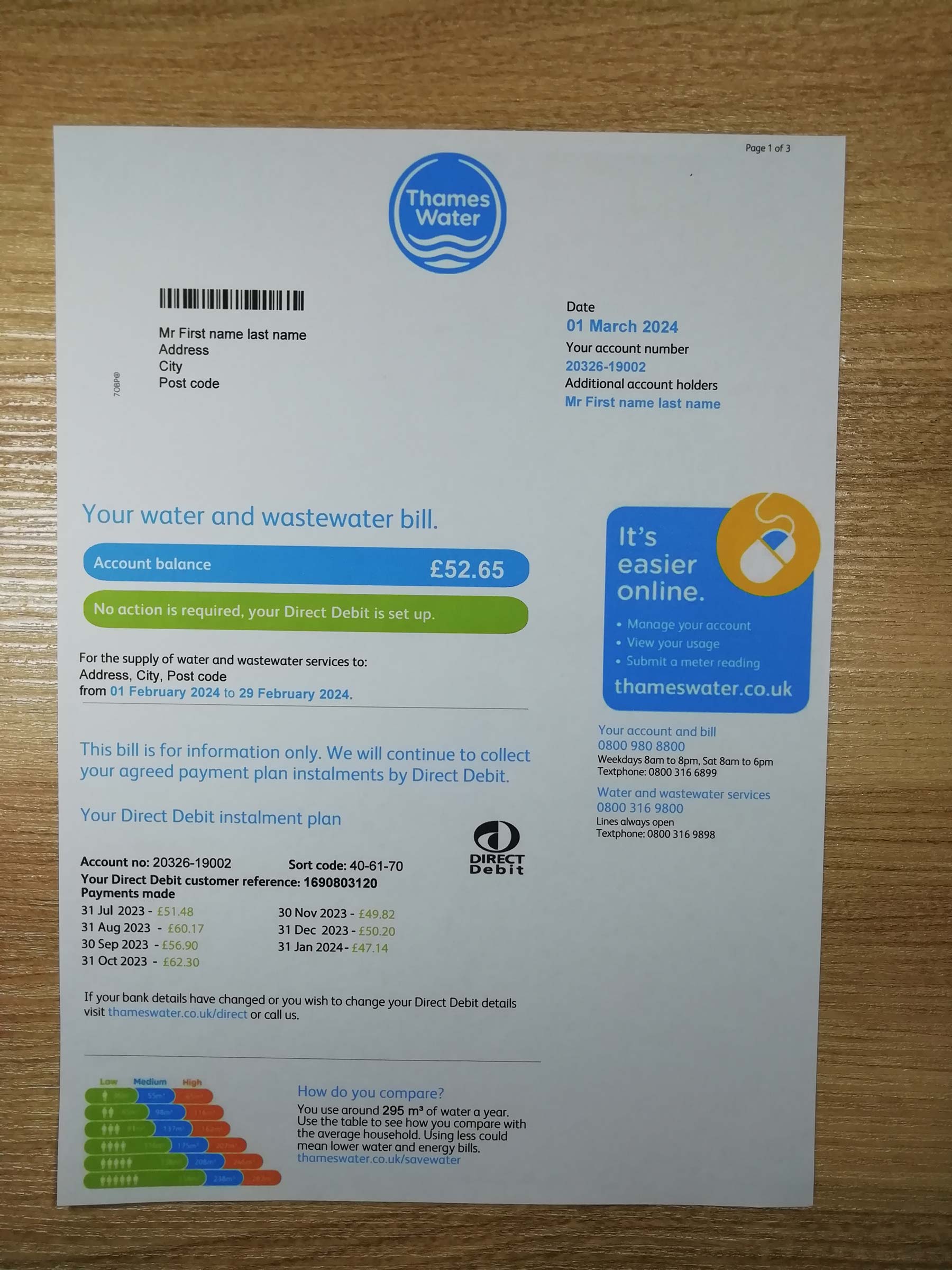

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025