Dutch Economy Feels The Heat: Stock Market Decline Linked To US Trade Tensions

Table of Contents

Impact of US Trade Tensions on Dutch Exports

The US is a crucial trading partner for the Netherlands, and the current trade disputes are having a palpable effect on Dutch exports. Increased tariffs and trade disputes directly reduce demand for Dutch goods and services, creating a ripple effect throughout the economy.

Decreased Demand from Key US Markets

The Netherlands exports a wide range of goods to the US, including agricultural products (like flowers and dairy), advanced machinery, and chemicals. The imposition of tariffs and the resulting trade war have significantly dampened US demand for these products.

- Reduced orders from US companies: Many US businesses are reducing their orders of Dutch goods to avoid the higher costs associated with tariffs.

- Increased prices making Dutch goods less competitive: Tariffs increase the price of Dutch products in the US market, making them less competitive against goods from other countries.

- Potential for job losses in export-oriented industries: Reduced demand and decreased competitiveness could lead to job losses in Dutch industries heavily reliant on US exports. This could particularly impact the agricultural and manufacturing sectors.

Supply Chain Disruptions

Beyond direct demand reduction, US trade tensions are disrupting global supply chains, affecting Dutch businesses reliant on timely delivery of goods and materials to and from the US.

- Increased logistical costs and delays: Navigating the complexities of tariffs and trade restrictions adds significant costs and delays to the supply chain.

- Uncertainty in planning for production and distribution: The unpredictable nature of trade disputes makes it difficult for Dutch businesses to plan their production and distribution schedules effectively.

- Pressure on profit margins: Increased costs and decreased efficiency are putting pressure on profit margins for Dutch businesses involved in international trade.

Effect on the Dutch Stock Market

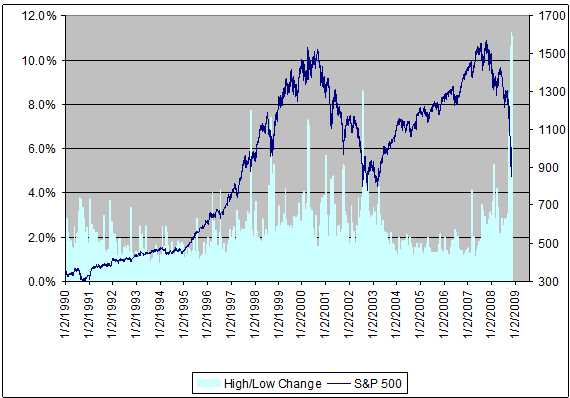

The uncertainty surrounding the US-led trade conflicts is creating a climate of fear and uncertainty in the Dutch stock market, leading to significant volatility and declines.

Investor Sentiment and Volatility

Negative news about trade wars directly impacts investor sentiment. Uncertainty about future trade relations causes investors to become hesitant, leading to capital flight and reduced investment in Dutch companies.

- Flight of foreign investment from Dutch markets: Investors are moving their money away from markets perceived as risky, including the Dutch stock market.

- Increased market volatility, making investing riskier: The fluctuating nature of the market due to trade tensions makes it more challenging and riskier for investors to make sound decisions.

- Negative impact on pension funds and other long-term investments: The decline in the stock market directly impacts the value of pension funds and other long-term investments, jeopardizing the retirement savings of many Dutch citizens.

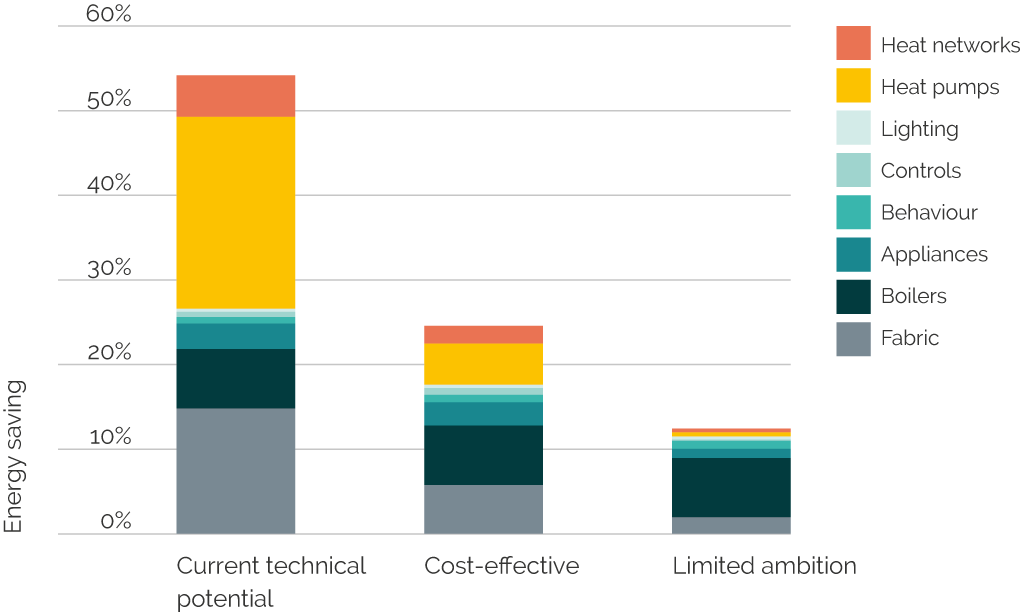

Specific Sectors Hit Hardest

The impact on the Dutch stock market is not uniform. Certain sectors are experiencing more significant declines than others.

- Analysis of specific stock performance within affected sectors: A detailed analysis reveals that the financial sector, export-oriented industries (like agriculture and manufacturing), and companies with significant US operations have experienced the most pronounced stock market declines.

- Examination of sector-specific vulnerabilities to trade disputes: Some sectors are inherently more vulnerable to trade disputes due to their reliance on specific markets or supply chains.

- Comparison with stock market performance in other European countries: Comparing the Dutch stock market performance with that of other European countries allows for a more nuanced understanding of the impact of US trade tensions.

Government Response and Mitigation Strategies

The Dutch government is aware of the challenges posed by US trade tensions and is actively exploring measures to mitigate the negative effects on the Dutch economy.

Policy Adjustments and Economic Support

The government may introduce measures to support affected businesses and stimulate economic activity.

- Potential for government subsidies or tax breaks: Subsidies and tax breaks could help businesses offset the increased costs associated with tariffs and trade restrictions.

- Exploration of new trade partnerships to diversify export markets: Diversifying export markets reduces reliance on the US and minimizes the impact of future trade disputes.

- Initiatives to promote domestic consumption and investment: Stimulating domestic demand can help compensate for decreased export demand.

International Cooperation and Diplomacy

The Netherlands will likely collaborate with its European partners to develop a unified response to US trade actions.

- Collaboration within the European Union on trade policy: A coordinated EU response can provide greater leverage in negotiations with the US.

- Diplomatic efforts to resolve trade disputes with the US: The Netherlands, along with other European nations, will seek diplomatic solutions to resolve the ongoing trade disputes.

- Exploring alternative trade agreements with other countries: Developing new trade agreements with countries outside the US can help diversify export markets and strengthen the Dutch economy.

Conclusion

The escalating US trade tensions are significantly impacting the Dutch economy, leading to a decline in the stock market and negatively affecting key export sectors. The Netherlands needs to respond strategically through policy adjustments, diversification of trade partnerships, and international collaboration. Understanding the intricate link between the Dutch economy and US trade tensions is critical for mitigating future economic risks and ensuring the long-term stability of the Netherlands' financial markets. Further analysis of the impact of US trade tensions on the Dutch economy is necessary to develop robust and effective strategies for future resilience. Staying informed about the evolving situation and the government's response is crucial for businesses and investors navigating this challenging period.

Featured Posts

-

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025 -

Nasledie Nashego Pokoleniya Chto My Ostavim Buduschim Pokoleniyam

May 24, 2025

Nasledie Nashego Pokoleniya Chto My Ostavim Buduschim Pokoleniyam

May 24, 2025 -

Finding A Dream Home In The Countryside 1m Budget And Below

May 24, 2025

Finding A Dream Home In The Countryside 1m Budget And Below

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf How Nav Impacts Your Investment

May 24, 2025 -

Amsterdam City Faces Lawsuit From Residents Due To Tik Tok Influx At Local Snack Bar

May 24, 2025

Amsterdam City Faces Lawsuit From Residents Due To Tik Tok Influx At Local Snack Bar

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025