Amundi Dow Jones Industrial Average UCITS ETF: How NAV Impacts Your Investment

Table of Contents

What is NAV and How is it Calculated?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, expressed per share. For the Amundi Dow Jones Industrial Average UCITS ETF, understanding its NAV calculation is key to interpreting your investment performance. This ETF aims to track the DJIA, meaning its value is directly tied to the performance of the 30 large, publicly-owned companies that constitute this renowned index.

- NAV represents the value of the ETF's assets minus liabilities per share. This means that any expenses associated with running the fund (e.g., management fees) are deducted from the total asset value before calculating the NAV.

- It is calculated daily by the fund manager, reflecting the closing prices of the DJIA components. This daily calculation ensures that the NAV accurately reflects the current market value of the underlying assets. The closing prices of each of the 30 DJIA stocks are used in this calculation.

- Understanding the calculation helps investors interpret daily price movements. By understanding how the NAV is calculated, investors can better understand why the ETF's price fluctuates from day to day.

- Factors influencing NAV include market movements of the DJIA, dividends received, and management fees. Positive movements in the DJIA will generally result in an increase in the ETF's NAV, while negative movements will lead to a decrease. Dividends received from the underlying companies are added to the NAV, while management fees are subtracted. Accurate Amundi DJIA ETF valuation relies on precise calculations incorporating all these factors.

How NAV Impacts Your Investment Returns

The relationship between NAV changes and your investment returns is direct and proportional. The Amundi DJIA ETF returns are fundamentally linked to the NAV's performance.

- An increase in NAV directly translates to an increase in the value of your investment. If the NAV rises, the value of your shares in the ETF also rises, resulting in a capital gain.

- A decrease in NAV indicates a loss in the value of your holdings. Conversely, a decline in the NAV reflects a decrease in the value of your investment, leading to a capital loss.

- NAV fluctuations reflect the overall market performance of the DJIA. The ETF's NAV will generally track the performance of the DJIA, meaning that positive performance in the index will lead to a rise in the NAV, and vice versa.

- Regular monitoring of NAV allows investors to track their investment performance. By regularly checking the NAV, you can easily monitor the performance of your investment in the Amundi DJIA ETF and make adjustments to your investment strategy as needed.

Using NAV to Make Informed Investment Decisions

Utilizing NAV data effectively can significantly improve your investment strategy. By integrating NAV analysis into your approach, you can enhance your decision-making process.

- Regularly reviewing NAV can help you decide whether to buy more shares when prices are low. This is a core element of dollar-cost averaging, a popular investment strategy that mitigates risk by spreading purchases over time.

- It aids in identifying potential selling opportunities when prices are high, based on your individual risk profile. Understanding NAV trends helps in making informed decisions about when to realize profits, based on your risk tolerance and investment goals.

- Monitoring NAV assists in implementing a disciplined investment approach aligned with your financial goals. Consistent monitoring of NAV enables you to stay on track with your long-term investment strategy.

- Consider combining NAV analysis with other market indicators for a more holistic view. Using NAV in conjunction with other relevant market data, such as economic indicators and company-specific news, provides a more comprehensive understanding of market dynamics.

Comparing NAV to Market Price

While the NAV provides a measure of the intrinsic value of the ETF, the market price reflects the price at which the ETF is currently trading. There can be slight discrepancies due to several factors:

- The market price may differ slightly from the NAV due to supply and demand. This difference is often minimal, especially for liquid ETFs like the Amundi DJIA ETF.

- Bid-ask spreads, the difference between the buying and selling price, also affect the market price. These spreads represent transaction costs incurred during trading.

- In periods of high market volatility, the market price may deviate more significantly from the NAV. This is because investor sentiment and trading activity can temporarily influence the ETF's price. Understanding these discrepancies is crucial for accurate Amundi DJIA ETF trading.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is critical for successful ETF investment. The NAV directly impacts your investment returns, reflecting the performance of the underlying DJIA. By regularly monitoring the NAV and combining this analysis with other market indicators, you can make informed buy and sell decisions, aligning your investment strategy with your risk tolerance and long-term financial goals. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and how NAV impacts your investment today!

Featured Posts

-

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

Understanding Massimo Vians Departure From Guccis Supply Chain Leadership

May 24, 2025

Understanding Massimo Vians Departure From Guccis Supply Chain Leadership

May 24, 2025 -

The Unexpected Twist Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 24, 2025

The Unexpected Twist Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 24, 2025 -

Prognoz Konchity Vurst Kto Pobedit Na Evrovidenii 2025 Chetverka Favoritov

May 24, 2025

Prognoz Konchity Vurst Kto Pobedit Na Evrovidenii 2025 Chetverka Favoritov

May 24, 2025 -

Ferraris 10 Speediest Standard Production Cars A Track Comparison

May 24, 2025

Ferraris 10 Speediest Standard Production Cars A Track Comparison

May 24, 2025

Latest Posts

-

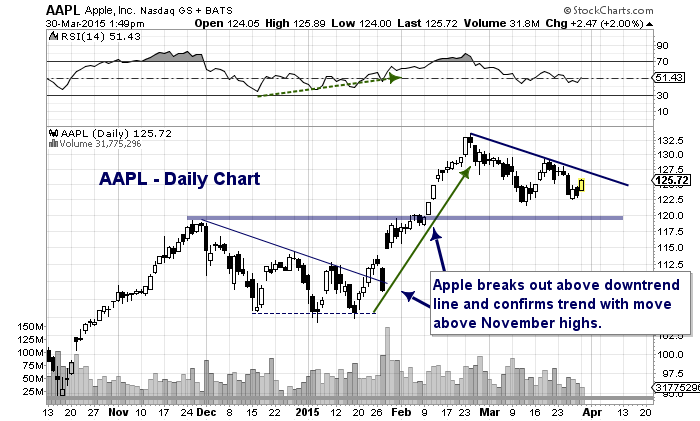

Apple Stock Aapl Where Will The Price Go Next Key Levels Analysis

May 24, 2025

Apple Stock Aapl Where Will The Price Go Next Key Levels Analysis

May 24, 2025 -

Forecasting Apple Stock Aapl Important Price Levels To Consider

May 24, 2025

Forecasting Apple Stock Aapl Important Price Levels To Consider

May 24, 2025 -

Apple Stock Aapl Price Targets Key Levels To Watch

May 24, 2025

Apple Stock Aapl Price Targets Key Levels To Watch

May 24, 2025 -

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025 -

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 24, 2025

Buffetts Retirement What Happens To Berkshire Hathaways Apple Investment

May 24, 2025