European Stock Markets React To Trump's Tariff Comments; LVMH Shares Plunge

Table of Contents

The Immediate Impact of Trump's Tariff Comments on European Markets

Trump's comments, hinting at further tariffs on European goods, immediately triggered a sell-off across major European indices. The specific comments targeted several sectors, reigniting fears of a protracted trade war. This uncertainty directly impacts investor confidence and fuels market volatility.

- The DAX (Germany) fell by 2.5%.

- The CAC 40 (France) dropped by 3%.

- The FTSE 100 (UK) declined by 1.8%.

Beyond luxury goods, the automotive and technology sectors also experienced significant declines, reflecting the broad-based impact of the news. The market's immediate reaction stemmed from a combination of factors: investors rushing to sell assets to limit potential losses and a general increase in risk aversion. The interconnected nature of global supply chains means that even seemingly minor trade disputes can have far-reaching consequences.

LVMH's Plunging Shares: A Case Study in Tariff Vulnerability

LVMH, the world's largest luxury goods company, saw its shares plummet by 5%, wiping billions off its market capitalization. This dramatic fall highlights the particular vulnerability of luxury goods companies to tariff disputes. LVMH's significant reliance on US consumers and its complex international supply chains make it acutely susceptible to trade barriers.

- Key Markets: The US represents a substantial portion of LVMH's revenue.

- Supply Chain: The company sources materials and manufactures goods globally, making it vulnerable to disruptions caused by tariffs.

- Long-Term Implications: Analysts predict potential impacts on LVMH's growth strategy and profitability, potentially forcing adjustments to pricing and sourcing strategies.

The Broader Implications for European Businesses and the Global Economy

Trump's comments have broader implications, extending beyond individual companies. The interconnectedness of global supply chains means that escalating trade tensions could disrupt economic activity worldwide. Retaliatory measures by the EU could further escalate the situation, leading to a full-blown trade war with unpredictable consequences.

- Geopolitical Context: The current geopolitical climate, already strained by various global issues, exacerbates the negative impact of these trade disputes on market sentiment.

- Expert Opinions: Economists warn of a potential slowdown in European economic growth and a decline in global trade.

The increased uncertainty creates a challenging environment for European businesses and potentially dampens investment and job creation.

Investor Reactions and Trading Strategies in the Wake of Uncertainty

Following Trump's comments, investors exhibited classic signs of risk aversion. This resulted in a "flight to safety," with investors moving capital into safer assets such as government bonds. The increased market volatility requires investors to adopt more cautious strategies.

- Investment Strategies: Diversification of portfolios and hedging strategies become crucial for mitigating risk.

- Analyst Advice: Financial analysts recommend closely monitoring trade policy developments and adjusting investment strategies accordingly.

Conclusion

President Trump's tariff comments triggered significant negative reactions in European stock markets, with LVMH shares experiencing a particularly sharp decline. This underscores the vulnerability of European businesses, and indeed the global economy, to escalating trade tensions. The interconnectedness of global supply chains and the potential for retaliatory measures highlight the need for careful monitoring of trade policy developments. Stay updated on the latest news regarding European stock markets and Trump tariffs to understand the potential impact on your investment portfolio and learn how to mitigate risk in volatile European stock markets.

Featured Posts

-

Faiz Indirimi Sonrasi Avrupa Borsalari Analizi

May 25, 2025

Faiz Indirimi Sonrasi Avrupa Borsalari Analizi

May 25, 2025 -

Nemecke Firmy A Prepustanie Dopady Hospodarskeho Spomalenia Na Pracovny Trh

May 25, 2025

Nemecke Firmy A Prepustanie Dopady Hospodarskeho Spomalenia Na Pracovny Trh

May 25, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025 -

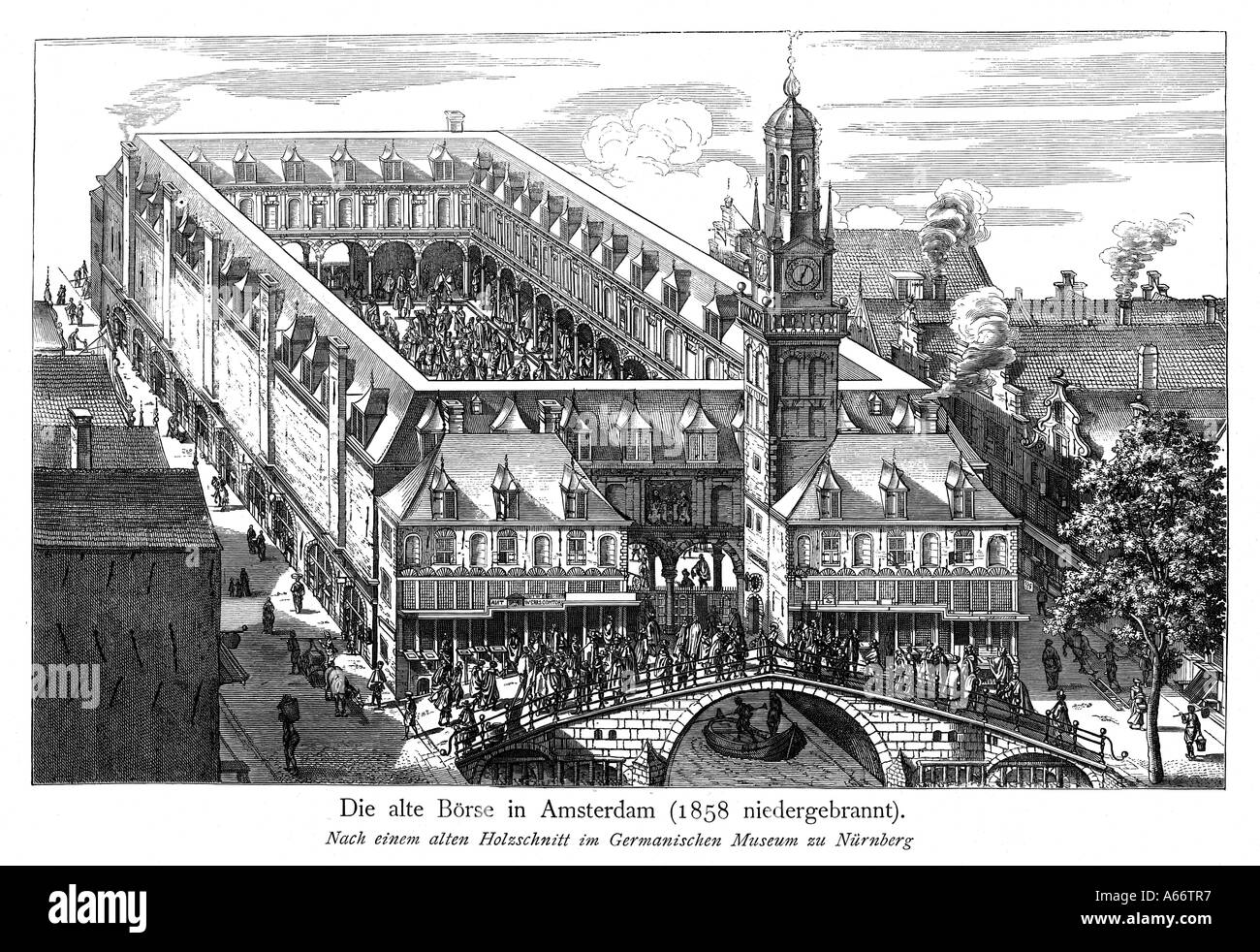

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 25, 2025

Amsterdam Exchange Plunges 11 Since Wednesday Three Days Of Losses

May 25, 2025 -

De Euro En De Kapitaalmarkt Recente Ontwikkelingen En Prognoses

May 25, 2025

De Euro En De Kapitaalmarkt Recente Ontwikkelingen En Prognoses

May 25, 2025

Latest Posts

-

Apple Stock Analysis Q2 Results And Future Outlook

May 25, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 25, 2025 -

Forecasting Apple Stock Aapl Price Key Support And Resistance Levels

May 25, 2025

Forecasting Apple Stock Aapl Price Key Support And Resistance Levels

May 25, 2025 -

Tim Cooks Tariff Announcement Triggers Apple Stock Decline

May 25, 2025

Tim Cooks Tariff Announcement Triggers Apple Stock Decline

May 25, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 25, 2025 -

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 25, 2025

Is Apple Stock Headed To 254 Analyst Prediction And Buying Opportunities

May 25, 2025