Investing In Amundi MSCI All Country World UCITS ETF USD Acc: NAV And Performance

Table of Contents

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc

This section delves into the core features of the Amundi MSCI All Country World UCITS ETF USD Acc, providing a foundational understanding for potential investors.

What is a UCITS ETF?

UCITS stands for Undertakings for Collective Investment in Transferable Securities. A UCITS ETF is an exchange-traded fund regulated under the UCITS Directive, a European Union regulatory framework. This framework ensures a high level of investor protection and allows for cross-border investment within the EU and beyond.

- Regulatory Oversight: UCITS ETFs are subject to stringent regulatory oversight, ensuring transparency and compliance with established investment guidelines.

- Investor Protection: Robust regulations protect investors' assets and ensure the fund's stability and proper management.

- Cross-border Investment: The UCITS structure simplifies investment across borders, making global diversification easier for investors.

Investment Strategy and Holdings

The Amundi MSCI All Country World UCITS ETF USD Acc aims to track the performance of the MSCI All Country World Index. This index represents a broad range of large and mid-cap equities from developed and emerging markets worldwide, providing extensive global diversification.

- Market Capitalization Weighting: The ETF's holdings are weighted according to the market capitalization of each company in the index, reflecting the relative size and importance of each constituent.

- Global Diversification: By tracking the MSCI All Country World Index, the ETF offers exposure to a wide range of countries and sectors, reducing geographic and sector-specific risk.

- Sector Allocation: The ETF's sector allocation mirrors that of the MSCI All Country World Index, providing a natural diversification across various economic sectors.

Expense Ratio and Fees

The ETF's expense ratio is a crucial factor influencing long-term returns. A lower expense ratio means more of your investment is working for you. The Amundi MSCI All Country World UCITS ETF USD Acc boasts a competitive expense ratio compared to similar global ETFs, making it a cost-effective option for long-term passive investing.

- Competitive Expense Ratio: The low expense ratio contributes to potentially higher returns compared to funds with higher fees.

- Impact on Long-Term Returns: Even small differences in expense ratios can significantly impact returns over the long term, compounding the benefits of a lower cost structure.

Analyzing NAV and Performance Data

Understanding the NAV (Net Asset Value) and performance history of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial before investing.

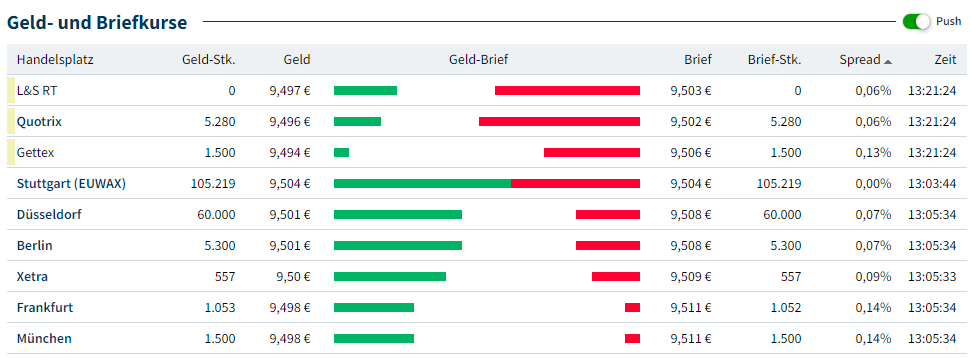

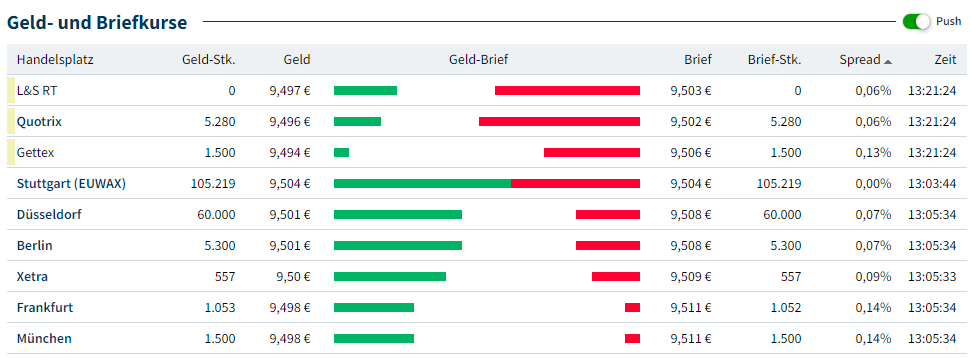

NAV Fluctuations and Their Causes

The NAV of the ETF fluctuates based on the underlying asset prices within the index it tracks. These fluctuations are primarily driven by market forces.

- Market Movements: Changes in global stock markets directly impact the ETF's NAV. Bull markets generally lead to increased NAV, while bear markets result in decreases.

- Currency Fluctuations: As the ETF is denominated in USD (USD Acc), fluctuations in exchange rates can impact the NAV for investors holding the ETF in other currencies.

- Dividend Distributions: Dividend payments from the underlying companies are typically reinvested, impacting the NAV positively, while some ETFs may choose to distribute dividends directly to shareholders.

Historical Performance and Benchmark Comparison

While past performance isn't indicative of future results, reviewing the historical performance of the Amundi MSCI All Country World UCITS ETF USD Acc against its benchmark (the MSCI All Country World Index) provides valuable insights. (Note: This section would ideally include charts and graphs comparing the ETF's performance to the benchmark index. This is limited within this text-based format.) Key metrics to analyze include:

- Past Performance Data: Historical performance data, visualized using charts and graphs, helps illustrate the ETF's growth trajectory and volatility over time.

- Risk-Adjusted Returns: Metrics like the Sharpe ratio and Sortino ratio help assess the risk-adjusted returns, demonstrating the return generated per unit of risk.

- Comparison with Competitors: Comparing the Amundi ETF's performance with other similar global ETFs allows for a comparative assessment.

Performance Drivers

The ETF's performance is influenced by several factors beyond simply tracking the index.

- Market Trends: Broad market trends, such as economic growth or recession, significantly influence the ETF's performance.

- Sector Performance: The relative performance of different sectors within the index also impacts the overall ETF returns.

- Economic Conditions: Global economic conditions, including inflation and interest rates, affect the valuations of the underlying companies and thus the ETF's NAV.

Amundi MSCI All Country World UCITS ETF USD Acc: Risks and Considerations

Like all investments, the Amundi MSCI All Country World UCITS ETF USD Acc carries inherent risks. Understanding these is crucial before making any investment decisions.

Market Risk and Volatility

Investing in equities involves market risk and volatility.

- Potential for Losses: The ETF's value can decrease, potentially resulting in investment losses.

- Impact of Global Events: Global events, geopolitical instability, or economic crises can negatively affect the market and, consequently, the ETF's NAV.

- Market Corrections: Periodic market corrections are normal, and the ETF's value is likely to experience temporary downturns.

Currency Risk

The USD Acc designation means the ETF is denominated in US dollars.

- Exchange Rate Fluctuations: Investors holding the ETF in a currency other than USD are exposed to currency exchange rate risk. Fluctuations can impact their returns when converting back to their local currency.

- Impact on Returns for Non-USD Investors: Unfavorable exchange rate movements can reduce the overall return for investors who aren't invested in USD.

Suitable Investor Profile

The Amundi MSCI All Country World UCITS ETF USD Acc is generally suitable for:

- Long-Term Investors: This ETF is most suitable for investors with a long-term investment horizon who can withstand short-term market fluctuations.

- Diversified Portfolio Seekers: The ETF is an excellent choice for investors aiming to diversify their portfolio globally, reducing concentration risk.

- Risk-Tolerant Investors: Given the potential for market volatility, the ETF is more appropriate for investors comfortable with moderate to higher risk.

Conclusion

The Amundi MSCI All Country World UCITS ETF USD Acc offers exposure to a globally diversified portfolio of equities, tracking the MSCI All Country World Index. Understanding its NAV fluctuations, historical performance, and associated risks is crucial before investing. Its competitive expense ratio and broad diversification make it an attractive option for long-term investors seeking global market exposure. However, remember that past performance doesn't guarantee future results, and market volatility is inherent.

Call to Action: Consider investing in the Amundi MSCI All Country World UCITS ETF USD Acc as part of a well-diversified investment strategy. However, thorough research and potentially seeking advice from a financial advisor are recommended before making any investment decisions. Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its performance today! Remember to consult a financial professional for personalized advice tailored to your specific financial situation and risk tolerance.

Featured Posts

-

Ferrari 296 Speciale Detalhes Do Motor Hibrido De 880 Cv

May 24, 2025

Ferrari 296 Speciale Detalhes Do Motor Hibrido De 880 Cv

May 24, 2025 -

Mengupas Sejarah Porsche 356 Dari Zuffenhausen Ke Dunia

May 24, 2025

Mengupas Sejarah Porsche 356 Dari Zuffenhausen Ke Dunia

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Relationship

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Relationship

May 24, 2025 -

Nimi Muistiin Ferrarin Uusi 13 Vuotias Taehti

May 24, 2025

Nimi Muistiin Ferrarin Uusi 13 Vuotias Taehti

May 24, 2025 -

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Latest Posts

-

Analyzing The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Investment Analysis Net Asset Value Nav Of Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Investment Analysis Net Asset Value Nav Of Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Amundi Djia Ucits Etf Net Asset Value Nav Explained

May 24, 2025

Amundi Djia Ucits Etf Net Asset Value Nav Explained

May 24, 2025 -

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025