Moody's Downgrade Triggers Dow Futures Fall And Dollar Weakness

Table of Contents

Deep Dive into Moody's Downgrade

Moody's decision to lower the US government's credit rating from AAA to Aa1 signifies a significant loss of confidence in the nation's fiscal strength. The downgrade was primarily attributed to the ongoing political gridlock surrounding the debt ceiling, persistent budget deficits, and the increasing burden of government debt. This action carries substantial weight, as Moody's ratings influence investor decisions, borrowing costs, and the overall perception of US economic stability.

- Specific rating change: From AAA to Aa1, a significant drop reflecting increased credit risk.

- Key reasons cited by Moody's: Protracted debt ceiling debates, rising government debt, and eroding fiscal strength.

- Comparison to other credit rating agencies' assessments: While Fitch Ratings has a negative outlook, S&P Global Ratings currently maintains an AA+ rating with a negative outlook. Differences in assessment methodologies may account for slight variations in ratings.

- Historical context: This is only the second time the US has been downgraded since receiving a AAA rating. The previous downgrade was by S&P in 2011, which also negatively impacted market sentiment.

Dow Futures React to Moody's Negative Outlook

The announcement of Moody's downgrade immediately impacted Dow futures, causing a significant decline. This reflects the widespread apprehension among investors about the implications of reduced US creditworthiness. The market reacted swiftly, exhibiting a clear negative correlation between the news and investor confidence.

- Percentage drop in Dow Futures: Following the announcement, Dow futures experienced a [Insert Percentage]% drop, indicating significant market volatility.

- Analysis of investor sentiment and trading activity: Increased selling pressure and risk aversion were observed across major market indices. Investor sentiment turned pessimistic, leading to capital flight from riskier assets.

- Specific companies or sectors most affected: Financials and other sectors sensitive to interest rate changes were particularly affected, demonstrating their exposure to shifts in investor sentiment.

- Predictions for short-term and long-term market movements: Short-term volatility is expected, but the long-term effects depend largely on future political and economic developments.

Understanding the Correlation Between Dow Futures and the Dollar

The relationship between Dow futures and the US dollar is complex but often inverse. A weakening dollar typically correlates with a fall in Dow futures because: a weaker dollar makes US exports cheaper, but also makes imports more expensive, potentially harming corporate profits. Furthermore, a weaker dollar can signal uncertainty in the US economy, which in turn negatively impacts investor confidence and causes a sell-off in stocks. This relationship is influenced by various economic factors, including investor sentiment, interest rate differentials, and global economic conditions.

Dollar Weakness: A Consequence of Moody's Action

The Moody's downgrade contributed to a decline in the value of the US dollar. This weakening reflects decreased investor confidence in the US economy and a potential shift in global capital flows.

- Mechanisms linking the downgrade to dollar weakness: Reduced investor confidence leads to capital flight away from the dollar towards perceived safer havens like gold or other currencies.

- Impact on international trade and foreign exchange markets: A weaker dollar makes US exports more competitive but increases the cost of imports, potentially impacting inflation. Foreign exchange markets reacted with increased volatility.

- Potential effects on inflation and interest rates: Increased import costs could contribute to inflationary pressures, potentially leading to adjustments in interest rates by the Federal Reserve.

- Related geopolitical factors: Global geopolitical uncertainties might have amplified the negative impact of the downgrade on the dollar.

Expert Opinions and Market Analysis

Financial experts and market analysts have offered diverse perspectives on the implications of Moody's downgrade. Some express concern about the long-term consequences for US economic stability and global markets, while others view it as a short-term correction.

- Summaries of expert opinions: Many believe this downgrade could signal broader concerns about the long-term sustainability of US debt.

- Different perspectives: Some analysts believe the impact will be limited, focusing on the already high debt levels and previous warnings by other agencies.

- Predictions for future market behavior: Continued market volatility is predicted, with the potential for further downward pressure on the dollar and Dow Futures depending on subsequent economic data and political developments.

Conclusion: Navigating the Aftermath of Moody's Downgrade

Moody's downgrade of the US credit rating, resulting in a significant drop in Dow futures and dollar weakness, underscores the interconnectedness of global financial markets and the importance of fiscal responsibility. The downgrade highlights increasing concerns about the nation's fiscal trajectory and its potential impact on the broader global economy. Understanding the ripple effects of this action is crucial for investors and policymakers alike. Stay informed about future developments regarding the Moody's downgrade and its continuing impact on markets by subscribing to reliable financial news sources, following market updates, and consulting with financial advisors to make informed decisions. Further reading on topics such as fiscal policy and international finance will enhance your understanding of these complex issues.

Featured Posts

-

Revamping Siri Apples Focus On Large Language Models

May 20, 2025

Revamping Siri Apples Focus On Large Language Models

May 20, 2025 -

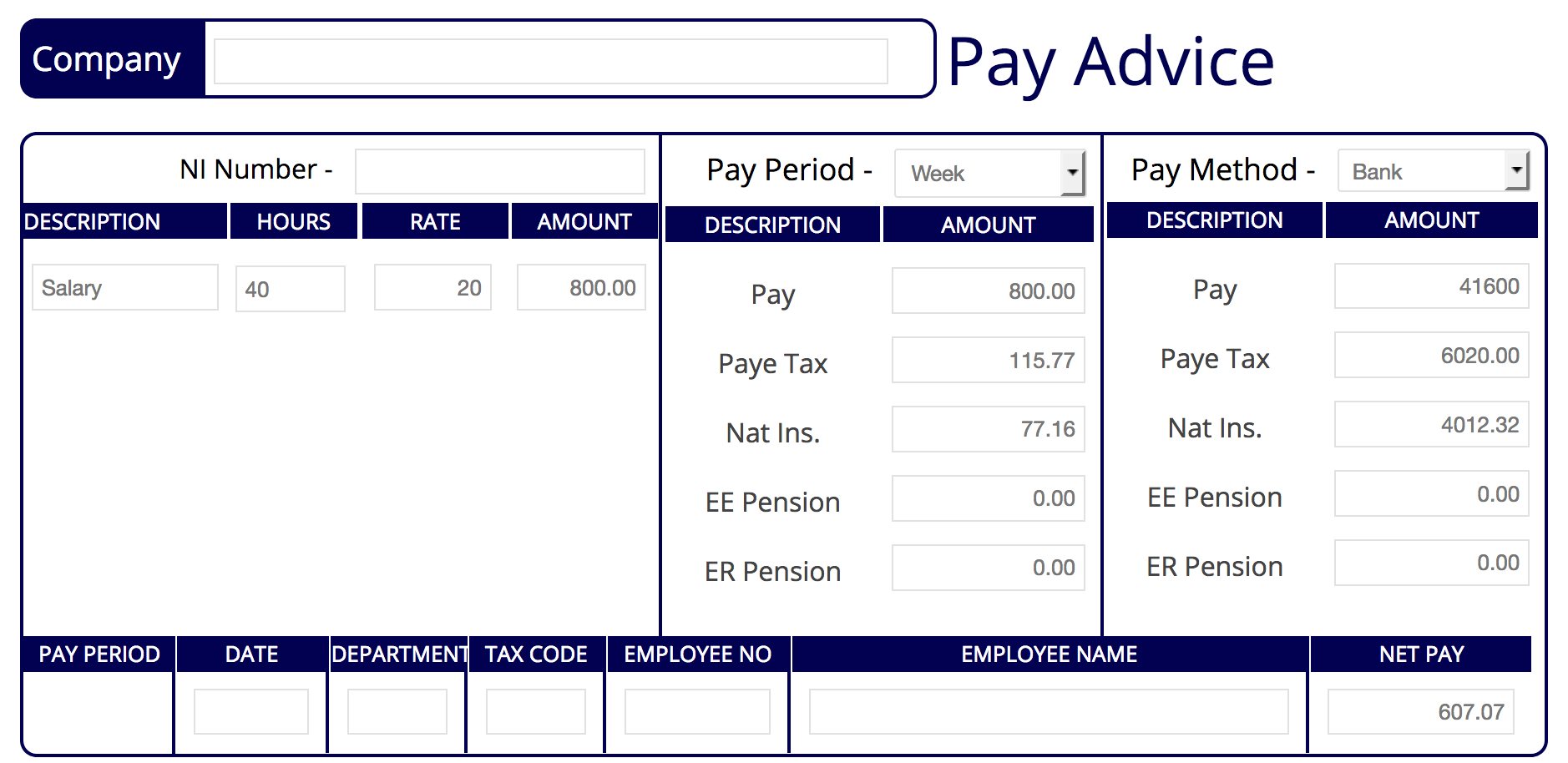

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025 -

Activision Blizzard Acquisition Ftc Challenges Court Ruling

May 20, 2025

Activision Blizzard Acquisition Ftc Challenges Court Ruling

May 20, 2025 -

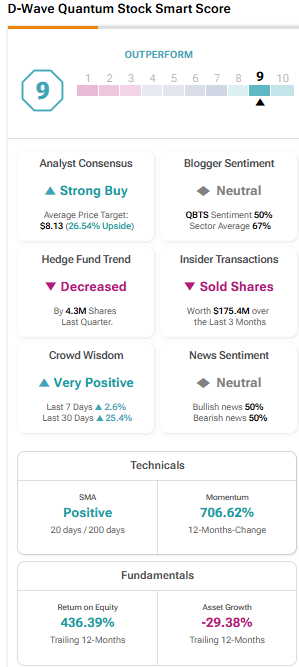

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Explained

May 20, 2025 -

Ferrari Strategists Cautious Hamiltons Priorities Could Cost Leclerc

May 20, 2025

Ferrari Strategists Cautious Hamiltons Priorities Could Cost Leclerc

May 20, 2025

Latest Posts

-

Should You Invest In D Wave Quantum Inc Qbts Now

May 20, 2025

Should You Invest In D Wave Quantum Inc Qbts Now

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Explained

May 20, 2025 -

Understanding The Recent Increase In D Wave Quantum Qbts Share Value

May 20, 2025

Understanding The Recent Increase In D Wave Quantum Qbts Share Value

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunge Kerrisdale Capitals Valuation Concerns

May 20, 2025 -

Is D Wave Quantum Inc Qbts The Best Quantum Computing Stock

May 20, 2025

Is D Wave Quantum Inc Qbts The Best Quantum Computing Stock

May 20, 2025