Paris Budget Under Pressure: Impact Of Luxury Goods Market Decline

Table of Contents

Decreased Tax Revenue from Luxury Goods

The decline in luxury purchases directly translates to reduced revenue for the city, impacting its ability to fund essential services and infrastructure projects.

Impact on VAT and Sales Taxes

The luxury sector is a significant contributor to Value Added Tax (VAT) and sales tax revenue in Paris. A slowdown in sales of high-end items directly diminishes this crucial income stream.

- Lower sales of high-end fashion, jewelry, and cosmetics: Reduced consumer spending on luxury goods leads to a direct drop in tax revenue.

- Reduced tourist spending on luxury items: Fewer wealthy tourists purchasing luxury items means less tax revenue for the city. This is especially true given the importance of tourism to the Parisian economy.

- Impact on local businesses reliant on luxury sales: Smaller businesses that cater to the luxury market, such as high-end restaurants and artisan workshops, experience reduced revenue, indirectly impacting the city's tax base.

- Decreased property tax revenue from luxury real estate: A softening luxury real estate market can also impact property tax revenues, adding to the city's fiscal challenges.

Effect on Employment and Related Industries

The luxury goods sector is a major employer in Paris, providing jobs across a wide range of roles. The decline in sales inevitably leads to job losses and a ripple effect throughout associated industries.

- Job cuts in luxury boutiques and flagship stores: Reduced sales force luxury brands to cut staff, leading to unemployment.

- Reduced demand for services supporting the luxury sector (e.g., security, transportation): Businesses providing ancillary services to the luxury sector also face reduced demand, leading to further job losses.

- Ripple effect on smaller businesses dependent on luxury consumers: Restaurants, hotels, and other businesses that rely on the spending of luxury consumers experience decreased revenue and may be forced to cut staff.

Reduced Tourism Revenue and its Consequences

Luxury tourism is a cornerstone of the Parisian economy. A decrease in high-spending tourists directly impacts hotel occupancy, overall tourist spending, and related tax revenues.

Impact on Hotel Occupancy and Spending

Fewer wealthy tourists mean lower occupancy rates in luxury hotels and a decrease in spending across the city's high-end services and attractions.

- Fewer bookings in luxury hotels and accommodations: A decline in luxury tourism directly impacts the profitability of high-end hotels.

- Reduced spending in high-end restaurants and entertainment venues: Luxury tourists contribute significantly to the revenue of upscale restaurants, museums, and entertainment venues.

- Decreased revenue from tourism-related taxes: Reduced tourist numbers lead to a decrease in revenue from taxes specifically levied on tourist-related activities and accommodations.

Strain on Public Services Supporting Tourism

The city relies heavily on tourism revenue to fund crucial public services. A downturn in tourism puts a strain on these services, potentially leading to cuts and reduced quality.

- Potential cuts to public transport maintenance and upgrades: Reduced funding may impact the upkeep and modernization of the city's public transportation system.

- Reduced funding for sanitation and waste management in tourist areas: Maintaining cleanliness and hygiene in tourist hotspots requires significant resources, which may be impacted by reduced revenue.

- Potential impact on public safety and security resources in tourist hotspots: Reduced funding could compromise public safety resources in areas frequented by tourists.

City's Response to Budgetary Constraints

Facing these challenges, the city of Paris is actively exploring solutions to mitigate the impact of the Paris Budget Luxury Goods Market Decline.

Exploring Alternative Revenue Streams

To offset the decline in luxury-related revenue, Paris is seeking alternative income sources.

- Increased focus on attracting mid-range and budget tourists: Diversifying the tourism market can help reduce reliance on high-spending tourists.

- Development of new cultural and entertainment attractions: Creating new attractions can boost tourism and generate additional revenue.

- Investment in green initiatives and sustainable tourism: Promoting sustainable tourism can attract environmentally conscious visitors.

Implementing Austerity Measures

Balancing the budget may necessitate painful austerity measures, impacting various aspects of city services.

- Potential delays or cancellations of planned infrastructure projects: Budget constraints may lead to the postponement or cancellation of essential infrastructure projects.

- Possible reductions in public services, affecting residents and businesses: Cuts in public services can negatively impact the quality of life for residents and hinder business operations.

- Increased scrutiny of city spending and budget allocation: Greater transparency and efficiency in city spending will be crucial to navigate the current financial challenges.

Conclusion

The decline in the luxury goods market poses a serious threat to Paris's financial stability. The Paris Budget Luxury Goods Market Decline necessitates a multifaceted approach including diversification of tourism, exploration of new revenue streams, and careful management of public spending. Understanding the complexities of this situation is crucial for the future economic health of Paris. It's vital for Parisians and stakeholders to advocate for effective and sustainable solutions to address this challenge and ensure the continued prosperity of the city.

Featured Posts

-

Analyse Hogere Kapitaalmarktrentes En De Sterke Euro

May 24, 2025

Analyse Hogere Kapitaalmarktrentes En De Sterke Euro

May 24, 2025 -

Analyse Krijgt De Recente Markt Draai Bij Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025

Analyse Krijgt De Recente Markt Draai Bij Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025 -

Apple Stock Aapl Where Will The Price Go Next Key Levels Analysis

May 24, 2025

Apple Stock Aapl Where Will The Price Go Next Key Levels Analysis

May 24, 2025 -

Kuda Propali Pobediteli Evrovideniya Za Poslednie 10 Let

May 24, 2025

Kuda Propali Pobediteli Evrovideniya Za Poslednie 10 Let

May 24, 2025 -

Aubrey Wursts Stellar Performance Propels Maryland Softball To Victory

May 24, 2025

Aubrey Wursts Stellar Performance Propels Maryland Softball To Victory

May 24, 2025

Latest Posts

-

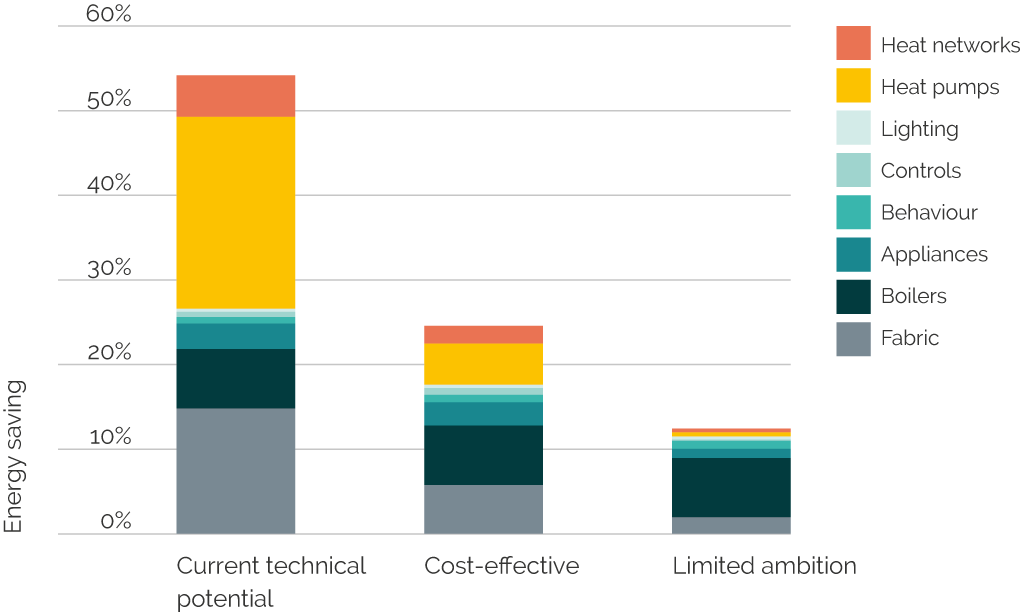

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025