CAC 40: Weekly Close Down Despite Stability

Table of Contents

Analyzing the CAC 40's Weekly Decline

The CAC 40 experienced a notable 1.5% decrease this week, a significant drop considering the relatively positive economic outlook. This contrasts sharply with last week's 0.8% gain and the year-to-date performance, which had shown modest growth. The magnitude of the decline warrants a closer examination of the contributing factors. Furthermore, trading volume increased by 12%, suggesting a heightened level of activity and potentially increased market volatility.

- The CAC 40 closed down 1.5% this week. This represents a substantial shift from recent positive trends.

- This contrasts with a 0.8% gain last week, highlighting the sudden change in market direction.

- Trading volume increased by 12%, indicating heightened investor activity and potentially heightened uncertainty.

Sector-Specific Performance within the CAC 40

A deeper dive into the CAC 40 constituents reveals a divergence in sector performance. While some sectors thrived, others experienced significant losses, contributing to the overall index decline. Understanding this disparity is crucial for a complete analysis of the weekly downturn. The energy sector, for example, experienced a modest rise due to fluctuating oil prices, while the technology sector suffered a more significant decline possibly due to recent regulatory concerns.

- Top-Performing Sectors: The energy sector showed a 1% increase, driven by global oil price fluctuations. The healthcare sector also performed relatively well, with a 0.5% increase, due to positive pharmaceutical news.

- Underperforming Sectors: The technology sector saw a 2.5% decrease, largely attributed to investor concerns regarding upcoming regulatory changes. The financial sector also underperformed, falling by 1.8%, possibly due to cautious investor sentiment.

- [Link to relevant financial news source on sector performance]

Global Market Influences on the CAC 40

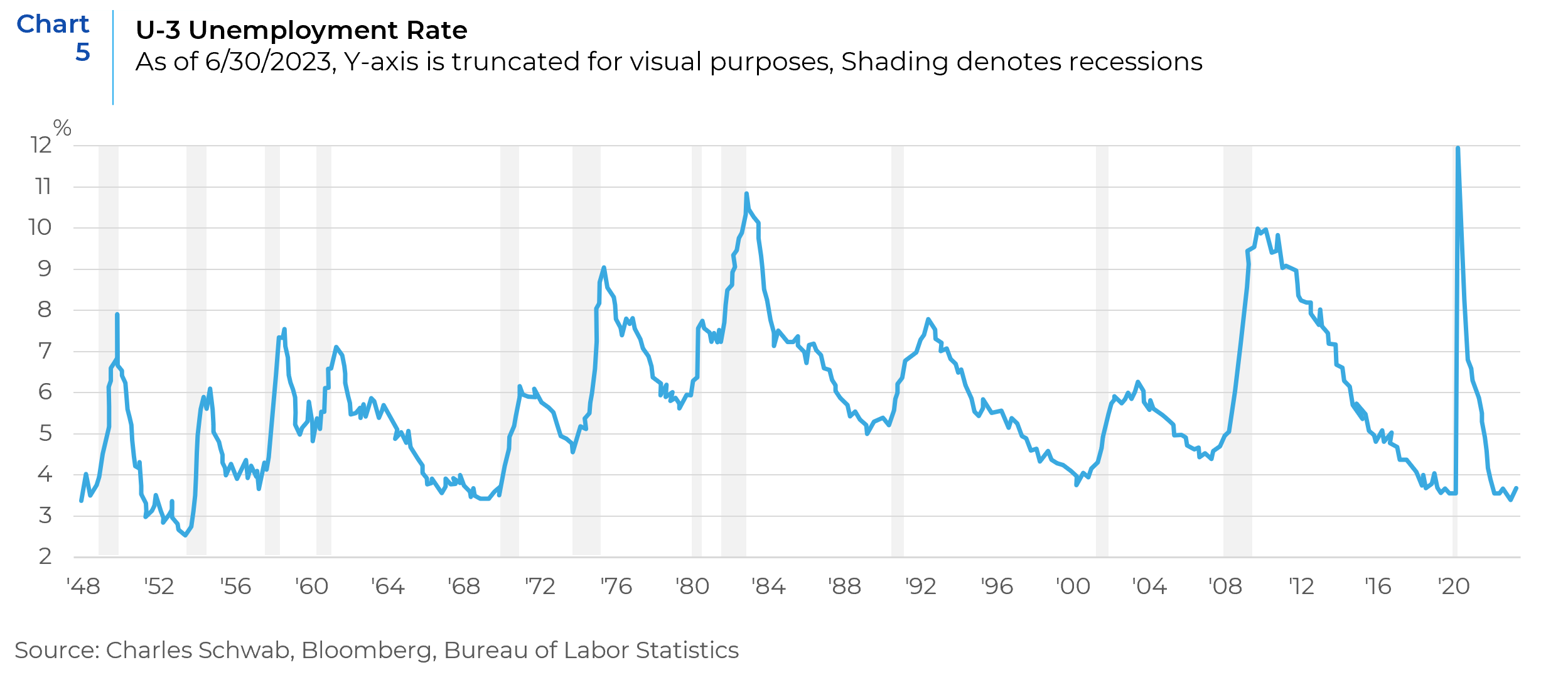

The CAC 40's performance is inextricably linked to global market trends. Geopolitical tensions, interest rate adjustments by central banks, and persistent inflation concerns all play a significant role. Correlations between the CAC 40 and other major indices like the Dow Jones and DAX can offer further insights. For example, a downturn in the US market often has a ripple effect on European markets.

- Geopolitical Tensions: Rising geopolitical instability in Eastern Europe continues to weigh on investor confidence, impacting market sentiment globally.

- Interest Rate Changes: Recent interest rate hikes by the European Central Bank have increased borrowing costs and affected investor risk appetite.

- [Chart showing correlation between CAC 40 and Dow Jones/DAX]

- [Link to expert analysis on global market impacts from a reputable financial publication]

Investor Sentiment and Market Volatility

Gauging investor sentiment is critical to understanding market fluctuations. This week, a noticeable shift towards risk aversion was observed. Market volatility, as measured by indicators such as the VIX index, also increased, indicating heightened uncertainty and potential for further price swings. This suggests that investors are becoming more cautious, leading to a sell-off in certain sectors.

- News Headlines Reflecting Sentiment: Many financial news outlets reported a growing sense of caution among investors due to macroeconomic uncertainties.

- Volatility Indicators: The VIX index, a measure of market volatility, showed a significant increase this week, reflecting heightened uncertainty.

- Analysis of Investor Behavior: The increased trading volume suggests a reactive investor response to news and perceived risks.

Conclusion: Understanding the CAC 40's Unexpected Dip

The CAC 40's weekly decline resulted from a confluence of factors: sector-specific underperformance, particularly in technology and finance; global market influences like geopolitical instability and interest rate hikes; and a shift towards risk-averse investor sentiment. Understanding these interconnected dynamics is crucial for informed investment decisions. While the short-term outlook remains uncertain, continued monitoring of these factors is essential for navigating the complexities of the French stock market. Continue following the CAC 40's performance closely to stay informed about future trends and make well-informed investment decisions. Stay updated on the CAC 40 and monitor the CAC 40 for future trends to make the best decisions for your portfolio.

Featured Posts

-

M56 Traffic Updates Motorway Closure Due To Serious Crash

May 25, 2025

M56 Traffic Updates Motorway Closure Due To Serious Crash

May 25, 2025 -

Memorial Day Travel 2025 Optimal Flight Dates

May 25, 2025

Memorial Day Travel 2025 Optimal Flight Dates

May 25, 2025 -

Amsterdam Stock Market 7 Opening Plunge Reflects Growing Trade Tensions

May 25, 2025

Amsterdam Stock Market 7 Opening Plunge Reflects Growing Trade Tensions

May 25, 2025 -

Kering Stock Takes A Hit 6 Drop After Weak First Quarter Results

May 25, 2025

Kering Stock Takes A Hit 6 Drop After Weak First Quarter Results

May 25, 2025 -

Strong Heineken Revenue Growth Analysis Of Results And Future Predictions

May 25, 2025

Strong Heineken Revenue Growth Analysis Of Results And Future Predictions

May 25, 2025

Latest Posts

-

Should You Follow Wedbushs Bullish Apple Stock Prediction

May 25, 2025

Should You Follow Wedbushs Bullish Apple Stock Prediction

May 25, 2025 -

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 25, 2025

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 25, 2025 -

Investing In Apple Considering Wedbushs Revised Price Target And Long Term View

May 25, 2025

Investing In Apple Considering Wedbushs Revised Price Target And Long Term View

May 25, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 25, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 25, 2025 -

Apple Stock Navigating The Uncertainty Before Q2 Results

May 25, 2025

Apple Stock Navigating The Uncertainty Before Q2 Results

May 25, 2025